The Middlesex Massachusetts Stock Incentive Plan is a structured program established by Abase Corp. to offer incentives and rewards to its employees through the issuance of company stock. This plan is primarily designed to attract and retain talented professionals while aligning their interests with the long-term growth and success of Abase Corp. The Middlesex Massachusetts Stock Incentive Plan consists of various types or components, each serving a unique purpose within Abase Corp.'s overall compensation and retention strategy. Some named types may include: 1. Restricted Stock Units (RSS): RSS are a popular component of stock incentive plans, where employees are granted units of company stock that will be converted into shares after a predetermined vesting period. These units serve as a powerful motivation for employees to contribute to the company's performance and value creation. 2. Stock Options: Stock options grant employees the right to purchase a specific number of company shares at a predetermined price, known as the exercise price or strike price. These options typically have a vesting period, encouraging employees to remain with the company and contribute to its growth. 3. Performance Shares: Performance shares are granted to employees based on preset performance conditions. These conditions may include financial goals, revenue targets, or individual performance metrics. Once achieved, shares are issued, providing employees with a direct stake in the company's accomplishments. 4. Employee Stock Purchase Plan (ESPN): An ESPN allows employees to purchase shares of the company's stock at a discounted price, frequently through payroll deductions. This helps foster a sense of ownership and alignment between employees and Abase Corp., encouraging long-term commitment and enhanced performance. 5. Stock Awards: Stock awards are given to employees in the form of fully vested shares of the company's stock. These awards recognize outstanding performance or significant contributions to Abase Corp. The Middlesex Massachusetts Stock Incentive Plan serves as a valuable tool for Abase Corp. to motivate, reward, and retain its employees. By offering various types of incentives, the company aims to reinforce employee loyalty, promote teamwork, and stimulate sustained growth in Middlesex, Massachusetts, and beyond.

Middlesex Massachusetts Stock Incentive Plan of Ambase Corp.

Description

How to fill out Middlesex Massachusetts Stock Incentive Plan Of Ambase Corp.?

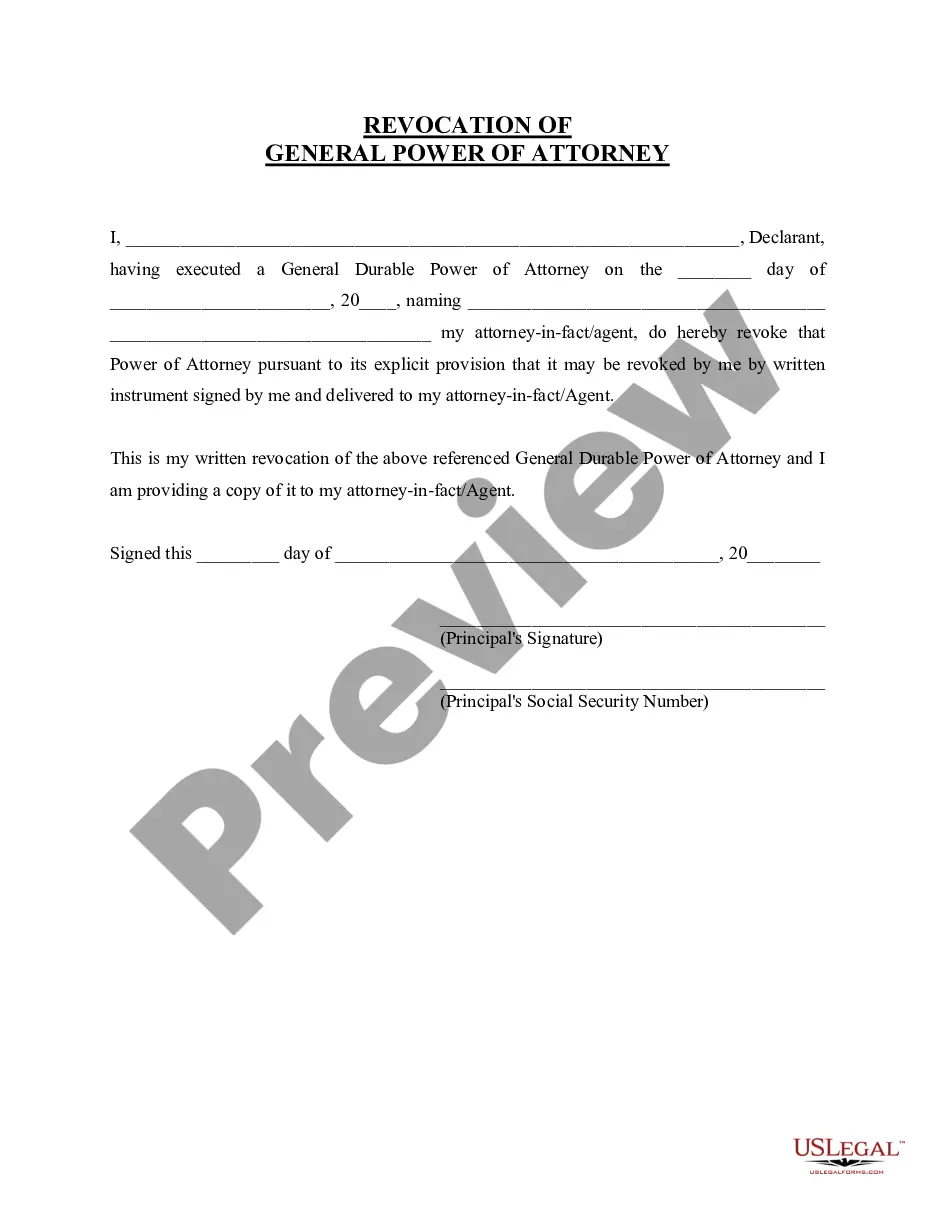

Preparing documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Middlesex Stock Incentive Plan of Ambase Corp. without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Middlesex Stock Incentive Plan of Ambase Corp. by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Middlesex Stock Incentive Plan of Ambase Corp.:

- Examine the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

Steps to Setting Up an ESOP (1) Determine Whether Other Owners Are Amenable.(2) Conduct a Feasibility Study.(3) Conduct a Valuation.(4) Hire an ESOP Attorney.(5) Obtain Funding for the Plan.(6) Establish a Process to Operate the Plan.

To create an equity incentive plan, the founders must make provisions right at the start of business operations. In the initial stages, all company shares are distributed among the founders. Thus to create equity incentive plans, founders must set aside a percentage of their shares in an 'option pool'.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

At its core, an equity-based incentive plan is used to attract, retain, and incentivize employees. Companies often reward employees, partners, directors, contractors, or others by granting them shares or units (these terms are used interchangeably herein) in an equity plan.

An ESOP will probably cost $80,000 to $250,000 to set up and run the first year and, for most companies with fewer than a few hundred employees, $20,000 to $30,000 annually.

ESOPs are costly to set up ($80,000 to a few hundred thousand dollars), but less costly than the sale of the company to another buyer. Their ongoing costs are not a significant factor for the large majority of companies.

An equity incentive plan allows the company to issue restricted and grant stock options to employees, advisors and consultants. The company will need to decide how many of the company's shares are in the equity incentive plan.

Stock-based compensation, sometimes known as equity or share-based compensation, is a practice in which companies supplement employees' cash compensation (salary and bonuses) with shares of ownership in the business. It's most commonly awarded to employees in the form of stock options or restricted stock.