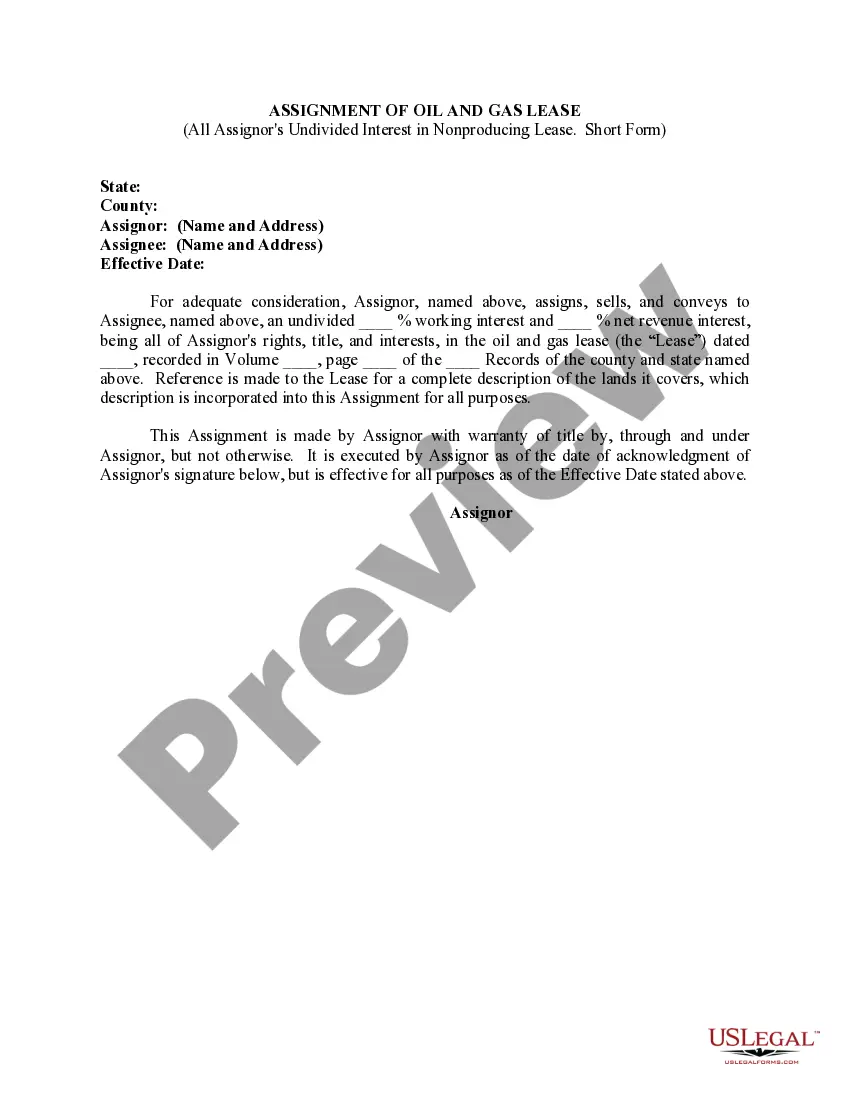

The Orange California Stock Incentive Plan of Abase Corp. is a comprehensive program designed to reward and incentivize employees through stock-based compensation. This plan plays a crucial role in attracting and retaining top talent by aligning their interests with the success of the company. It offers various types of stock-based awards that provide employees with an opportunity to acquire shares of Abase Corp. One of the primary objectives of the Orange California Stock Incentive Plan is to motivate employees to contribute to the long-term growth and success of the company. By tying employee compensation to the performance and value of Abase Corp.'s stock, this plan encourages employees to take an active role in maximizing shareholder value. This plan encompasses different types of stock-based awards, including stock options, restricted stock units (RSS), and performance-based stock awards. Each award has its own unique terms and conditions, empowering employees with flexibility in how they participate in the program. Stock options allow employees to purchase a specific number of Abase Corp.'s shares at a predetermined price, known as the exercise price. The options typically have a vesting period before they can be exercised, after which employees have the choice to exercise their options and potentially benefit from any appreciation in the company's stock price. Restricted stock units (RSS) are another form of stock-based award included in the Orange California Stock Incentive Plan. RSS grant employees a right to receive shares of Abase Corp.'s stock at a future date. Unlike stock options, RSS are usually subject to vesting conditions. Once the RSS vest, employees receive the shares of stock outright. Additionally, the Orange California Stock Incentive Plan may include performance-based stock awards, which link the granting of shares to specific performance goals or milestones set by Abase Corp. This type of award ensures that employees are rewarded for achieving predetermined targets, such as meeting financial objectives, increasing market share, or driving innovation. The plan is meticulously designed to comply with all applicable laws and regulations governing stock-based compensation, ensuring fairness and transparency for participating employees. It also includes provisions for adjusting awards in the event of stock splits, mergers, or other corporate events to maintain the integrity of the program. Overall, the Orange California Stock Incentive Plan of Abase Corp. serves as a powerful tool to motivate, retain, and reward employees, fostering a strong sense of ownership and commitment to the company's success. By linking employee compensation to the performance of Abase Corp.'s stock, this plan aligns the interests of employees with those of shareholders, ultimately driving long-term value creation.

Orange California Stock Incentive Plan of Ambase Corp.

Description

How to fill out Orange California Stock Incentive Plan Of Ambase Corp.?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life situation, locating a Orange Stock Incentive Plan of Ambase Corp. suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Orange Stock Incentive Plan of Ambase Corp., here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Orange Stock Incentive Plan of Ambase Corp.:

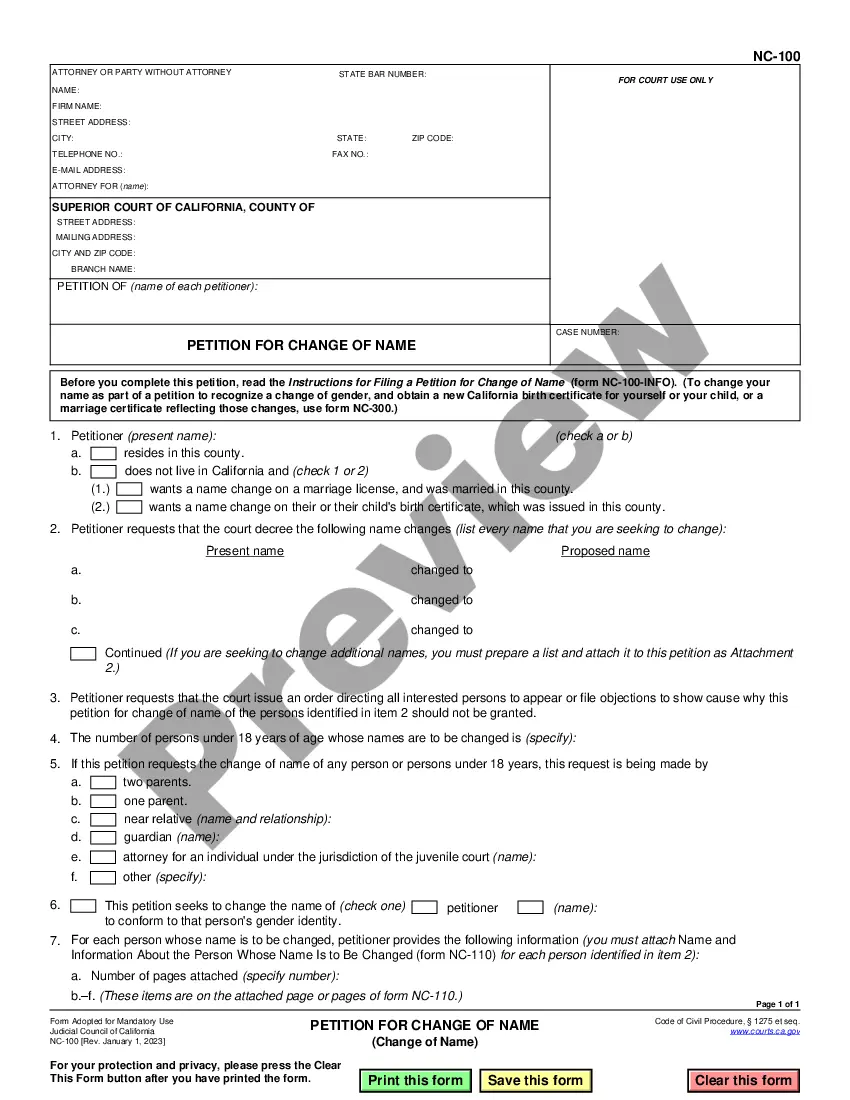

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Orange Stock Incentive Plan of Ambase Corp..

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!