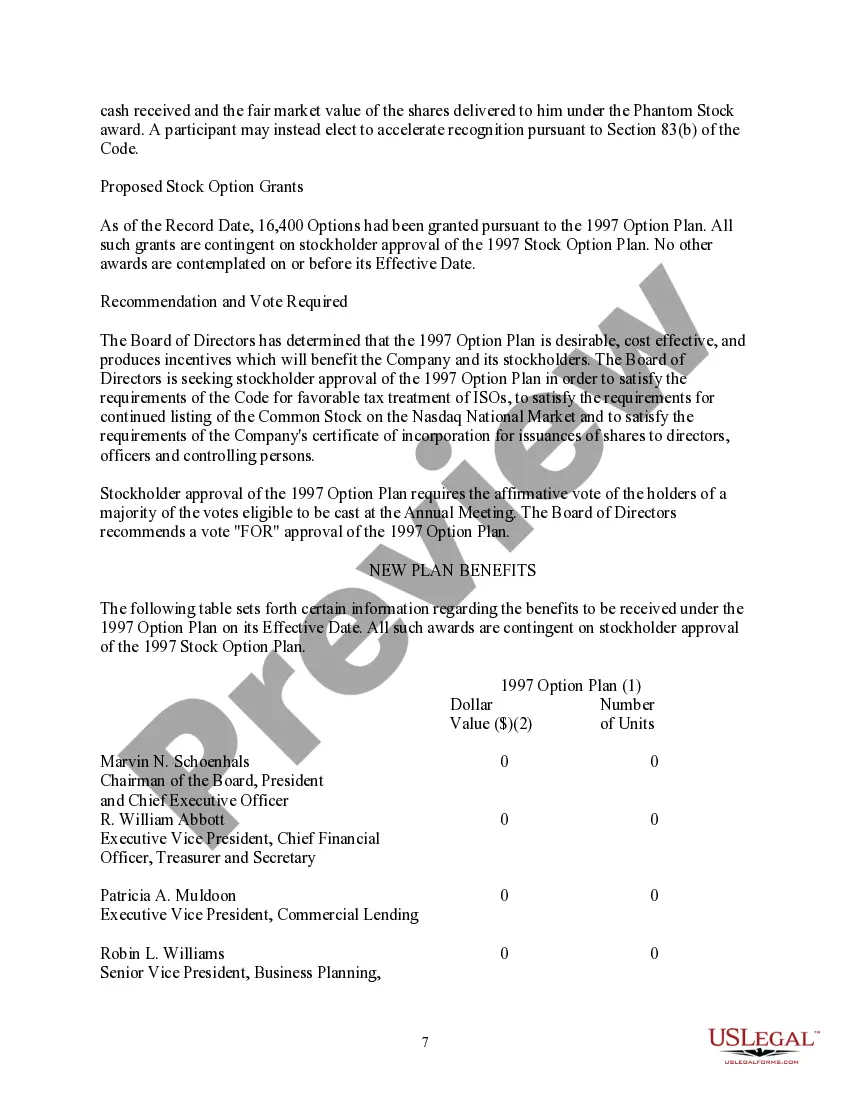

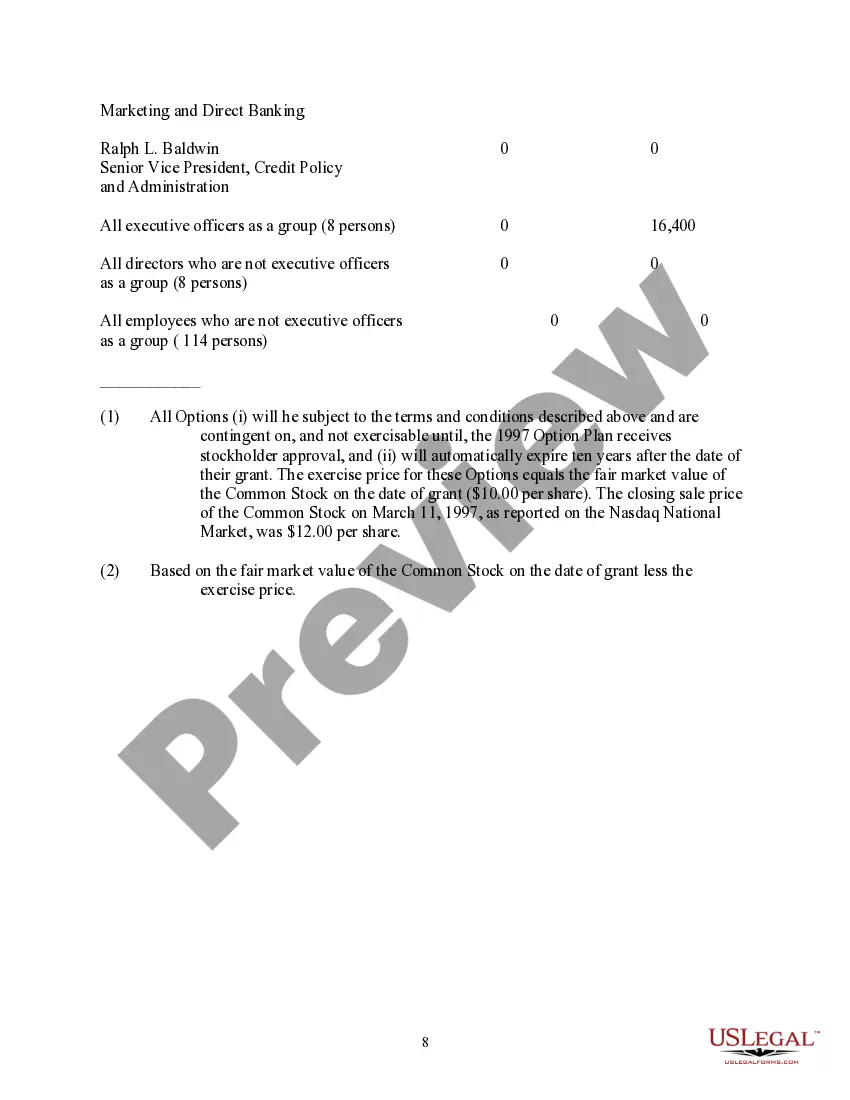

The Chicago adoption of the Stock Option Plan of WSFS Financial Corporation is an important development that encompasses various aspects of corporate finance and employee compensation. This article will provide a detailed description of what the Stock Option Plan entails, its significance for WSFS Financial Corporation in Chicago, and the different types of options included in the plan. WSFS Financial Corporation is a reputable financial services company based in Chicago, Illinois. As part of its overall strategy to attract and retain top talent, the corporation has established a Stock Option Plan for its employees. This plan offers eligible employees the right to purchase a specified number of company stocks, known as stock options, at a predetermined price within a particular time frame. The Stock Option Plan serves several essential purposes. First and foremost, it incentivizes employees by providing them with the opportunity to share in the company's financial success and growth. As the stock price increases over time, employees can exercise their stock options, purchase shares at a lower predetermined price, and potentially earn a considerable profit if the stock's value rises. This aligns the interests of employees with those of the company's shareholders, fostering a sense of ownership and encouraging long-term commitment. Additionally, the Stock Option Plan offers tax advantages for both employees and the company. Employees enjoy potential tax savings by being able to defer the recognition of income until the stock options are exercised. For WSFS Financial Corporation, the plan allows them to attract and retain talented individuals by offering a competitive compensation package without immediately incurring substantial cash expenses. Thus, the Stock Option Plan can effectively optimize the allocation of resources while ensuring employee satisfaction. Regarding the types of stock options offered under the plan, there are two common variations — non-qualified stock optionsSOSOs) and incentive stock options (SOS). Non-qualified stock options are more flexible and can be granted to employees, directors, consultants, and other service providers. These options typically have a lower exercise price than the fair market value of the stock on the grant date, resulting in immediate taxable income for the recipient upon exercising the options. Incentive stock options, on the other hand, are exclusively available to employees and have distinct tax advantages. When recipients exercise these options, the difference between the fair market value of the stock and the exercise price is not immediately taxable. Instead, taxes are deferred until the stock is sold. To qualify for these tax advantages, SOS must meet certain requirements set by the Internal Revenue Service (IRS), including specific holding periods. In conclusion, the Chicago adoption of the Stock Option Plan of WSFS Financial Corporation offers a valuable compensation tool for attracting and retaining talented employees. By implementing this plan, the company motivates its workforce, aligns their interests with those of shareholders, and maximizes tax benefits for both parties. The inclusion of non-qualified stock options and incentive stock options in the plan allows for flexibility in granting options to various individuals while considering distinct tax implications.

Chicago Illinois Adoption of Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Chicago Illinois Adoption Of Stock Option Plan Of WSFS Financial Corporation?

If you need to get a reliable legal paperwork supplier to find the Chicago Adoption of Stock Option Plan of WSFS Financial Corporation, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply type to search or browse Chicago Adoption of Stock Option Plan of WSFS Financial Corporation, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Chicago Adoption of Stock Option Plan of WSFS Financial Corporation template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or complete the Chicago Adoption of Stock Option Plan of WSFS Financial Corporation - all from the comfort of your home.

Join US Legal Forms now!