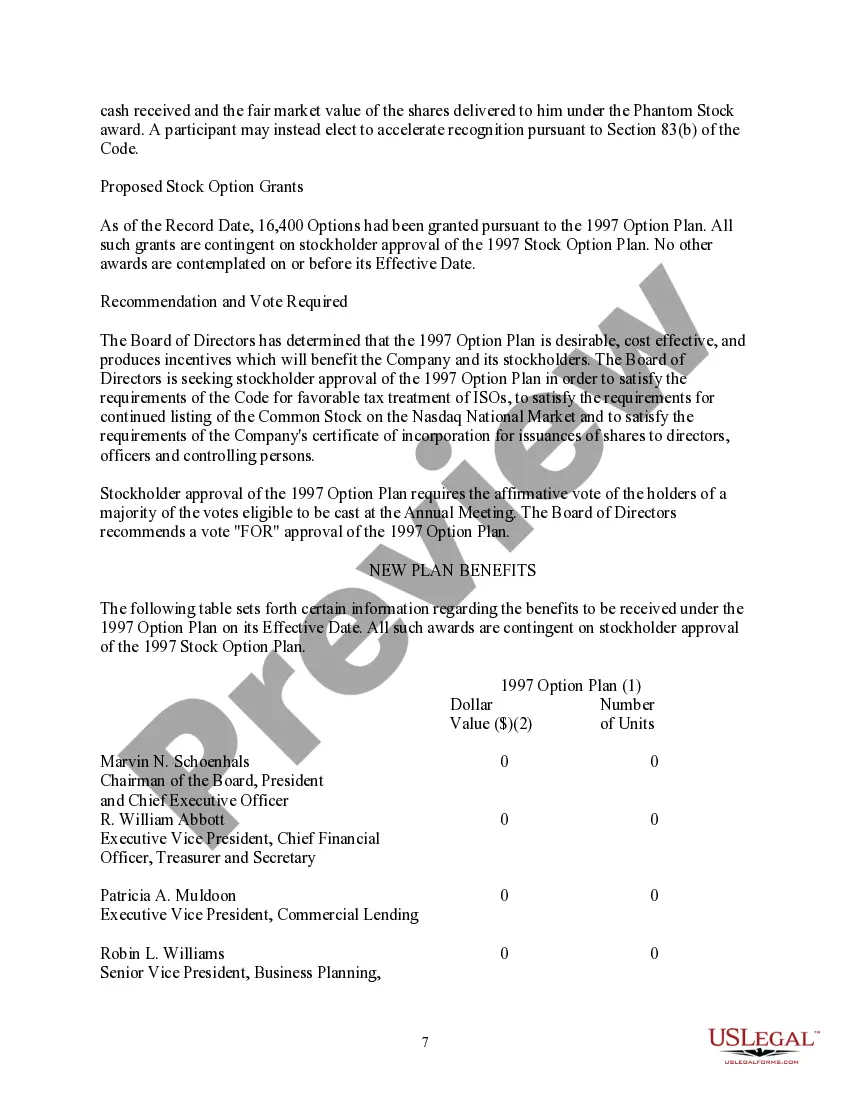

Middlesex Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation The Middlesex Massachusetts Adoption of Stock Option Plan is a comprehensive employee benefit plan introduced by WSFS Financial Corporation for its Middlesex, Massachusetts-based employees. This plan is designed to incentivize and reward employees for their contributions to the company's success by offering stock options as a form of compensation. With the Middlesex Massachusetts Adoption of Stock Option Plan, eligible employees are granted the opportunity to purchase a specific number of shares at a predetermined price, known as the exercise price. These stock options provide employees with the chance to participate in the appreciation of WSFS Financial Corporation's stock over time, potentially leading to financial gains. WSFS Financial Corporation, a reputed financial services company, recognizes the importance of attracting and retaining top talent in the highly competitive market. The Middlesex Massachusetts Adoption of Stock Option Plan is one of the strategies employed by the company to provide its employees with a sense of ownership and to align their interests with the long-term success of the organization. The Middlesex Massachusetts Adoption of Stock Option Plan comes with various key features and benefits: 1. Eligibility: Employees who meet certain criteria, such as tenure, job position, or performance milestones, are eligible to participate in the plan. 2. Stock Option Grant: The plan enables the granting of stock options to eligible employees, typically accompanied by a vesting schedule that outlines the gradual accumulation of ownership rights over a specified time period. 3. Exercise Price: The exercise price is determined at the time of granting the stock options and is set at a level that reflects the current market value of WSFS Financial Corporation's stock. 4. Vesting Schedule: The vesting schedule defines the timeframe within which an employee can exercise their stock options. It often involves a graded approach, ensuring employee retention and aligning long-term commitment with the company's success. 5. Tax Implications: The plan may have tax implications for employees upon exercising their stock options or selling the acquired shares. Employees should consult professional tax advisors to understand the potential tax consequences. It is essential to note that various types of stock option plans can exist within the Middlesex Massachusetts Adoption of Stock Option Plan. These may include: 1. Incentive Stock Options (SOS): Designed to meet specific tax requirements, SOS provide potential tax advantages to employees if certain holding period and employment criteria are met. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not offer the same tax advantages but provide more flexibility in terms of granting options to a broader range of employees. In conclusion, the Middlesex Massachusetts Adoption of Stock Option Plan implemented by WSFS Financial Corporation serves as an enticing employee benefit designed to attract, retain, and motivate employees while aligning their interests with the company's long-term success. The plan offers eligible employees the opportunity to purchase company stock at a predetermined price, potentially leading to financial gains and fostering a sense of ownership within the organization.

Middlesex Massachusetts Adoption of Stock Option Plan of WSFS Financial Corporation

Description

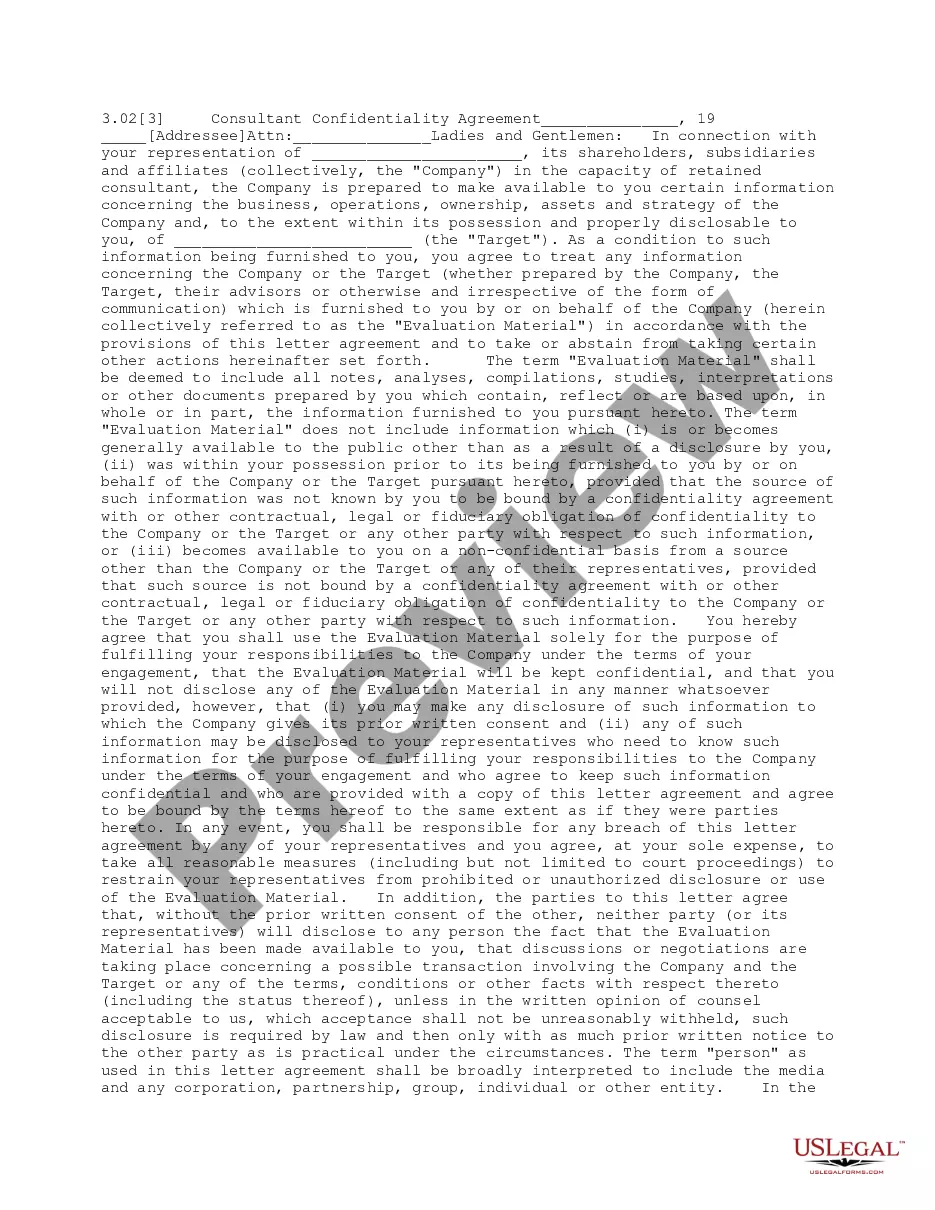

How to fill out Middlesex Massachusetts Adoption Of Stock Option Plan Of WSFS Financial Corporation?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Middlesex Adoption of Stock Option Plan of WSFS Financial Corporation is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Middlesex Adoption of Stock Option Plan of WSFS Financial Corporation. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Middlesex Adoption of Stock Option Plan of WSFS Financial Corporation in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!