The Houston Texas Stock Option Plan of WSFS Financial Corporation is a comprehensive program designed to attract and retain top talent within the organization. This plan is specifically tailored for employees based in the Houston, Texas area. As an integral part of WSFS Financial Corporation's compensation package, the Houston Texas Stock Option Plan offers employees the opportunity to purchase company stock at a predetermined price, known as the exercise or strike price. This plan is an excellent method to motivate and incentivize employees by aligning their actions and interests with the performance and success of the company. There are several key features and benefits associated with the Houston Texas Stock Option Plan. Firstly, it provides employees with the option to purchase company stock at a discounted price, which can be a significant advantage as the stock value appreciates over time. This opportunity allows employees to participate in the company's growth and profitability. Moreover, this plan promotes employee retention and loyalty by including vesting schedules. Vesting refers to the process by which employees gain ownership rights to their stock options over a defined period. The vesting period serves as an incentive for employees to remain with the company, thereby creating a long-term commitment to their roles and contributing to the overall success of WSFS Financial Corporation. The Houston Texas Stock Option Plan of WSFS Financial Corporation may consist of various types, each tailored to specific employee groups or levels within the organization. These types may include: 1. Employee Stock Purchase Plans (ESPN): ESPN generally offer all employees the opportunity to purchase company stock at a discounted price through regular payroll deductions. This inclusive plan encourages broad-based employee participation. 2. Incentive Stock Options (ISO): SOS are typically offered to key employees and executives, providing them with the right to purchase company stock at a favorable price. These options often come with specific tax advantages. 3. Non-Qualified Stock Options (NO): Nests are available to a broader employee base and offer them the ability to purchase company stock without the same tax advantages as SOS. However, they still provide compelling incentive opportunities. 4. Restricted Stock Units (RSS): RSS represent a promise to grant employees a specific number of company shares at a predetermined future date, usually tied to performance milestones or continued employment. RSS is similar to stock options but don't require an upfront purchase. In conclusion, the Houston Texas Stock Option Plan of WSFS Financial Corporation is a strategic initiative aimed at attracting and retaining talent within the Houston, Texas area. This comprehensive plan offers employees various types of stock options, providing them with opportunities to participate in the company's growth and success. Vesting schedules and discounts on stock prices further enhance the plan's appeal, ensuring a committed and motivated workforce.

Houston Texas Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Houston Texas Stock Option Plan Of WSFS Financial Corporation?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Houston Stock Option Plan of WSFS Financial Corporation, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Houston Stock Option Plan of WSFS Financial Corporation, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Stock Option Plan of WSFS Financial Corporation:

- Glance through the page and verify there is a sample for your area.

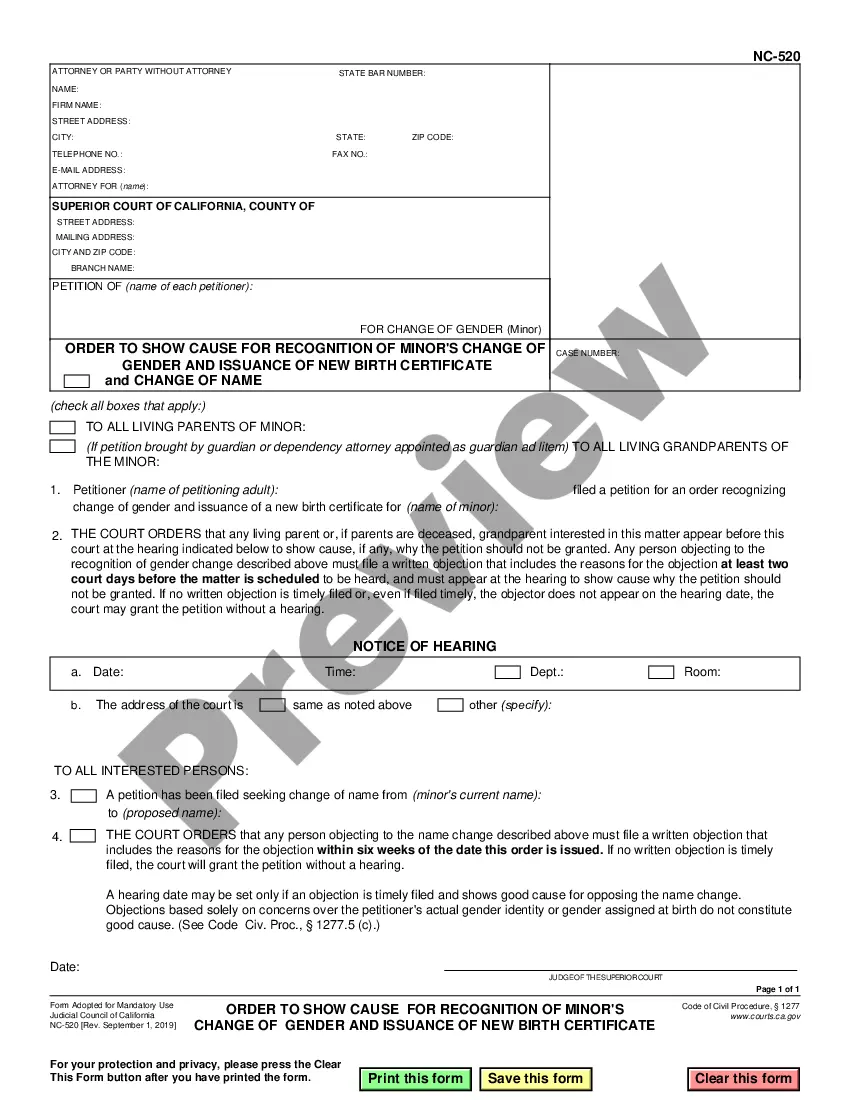

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Houston Stock Option Plan of WSFS Financial Corporation and download it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!