Wayne Michigan Stock Option Plan is a specific type of employee compensation program offered by WSFS Financial Corporation, a renowned financial institution. This plan allows employees who work in the Wayne, Michigan area to receive stock options as part of their overall compensation package. Stock options are considered to be a valuable incentive for employees, as they provide the opportunity to purchase a specific number of shares of the company's stock at a predetermined price within a specified period. The Wayne Michigan Stock Option Plan aims to motivate and reward employees by giving them the potential to share in the company's success by becoming partial owners and benefiting from increases in stock price. Under the Wayne Michigan Stock Option Plan of WSFS Financial Corporation, there can be several types of stock options available to employees. Some of the most common types include: 1. Non-Qualified Stock Options: These stock options do not receive favorable tax treatment and are usually given to executives or high-ranking employees. Non-qualified stock options allow employees to purchase company stock at a predetermined price, which may be lower than the current market price when the options are granted. 2. Incentive Stock Options: Incentive stock options, also known as SOS, are typically granted to employees at all levels. These options provide potential tax advantages as they qualify for favorable tax treatment under the Internal Revenue Code. To receive these tax benefits, employees must meet specific holding period requirements. 3. Restricted Stock Units: Restricted Stock Units (RSS) can also be part of the Wayne Michigan Stock Option Plan. RSS represents the right to receive shares of company stock at a later date. Unlike traditional stock options, RSS do not require employees to purchase shares, but instead, they are granted a specified number of units that convert into stock over time, often subject to vesting conditions. The Wayne Michigan Stock Option Plan of WSFS Financial Corporation aims to align the interests of employees and shareholders, fostering a sense of ownership and dedication to the company's success. By offering stock options, WSFS Financial Corporation can attract and retain top talent in the Wayne, Michigan area, ultimately contributing to the company's growth and profitability. Disclaimer: This description is a general overview and should not be considered as legal, financial, or tax advice. Employees and potential participants should consult with the corporation's official documentation and seek professional advice to understand the specific details and tax implications of the Wayne Michigan Stock Option Plan.

Wayne Michigan Stock Option Plan of WSFS Financial Corporation

Description

How to fill out Wayne Michigan Stock Option Plan Of WSFS Financial Corporation?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

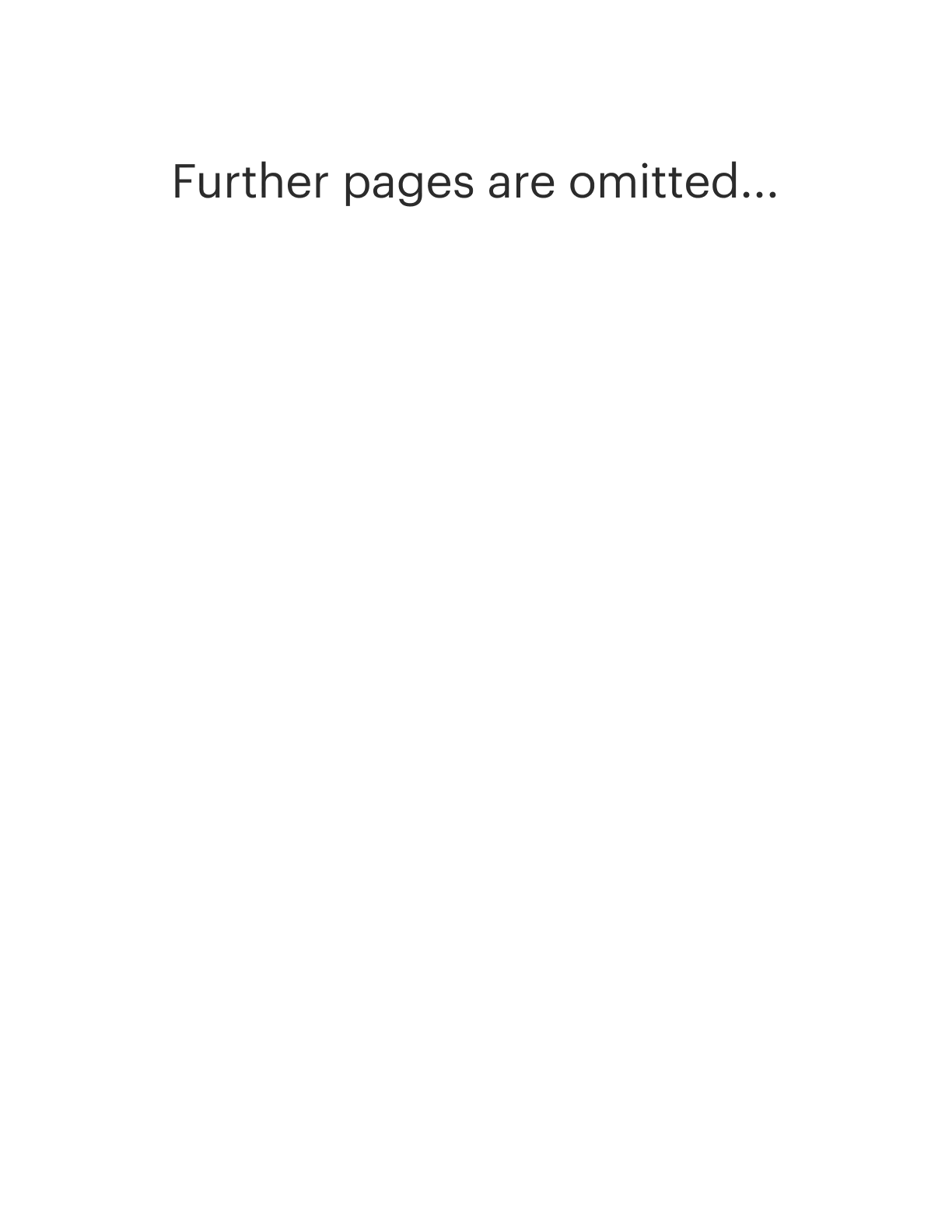

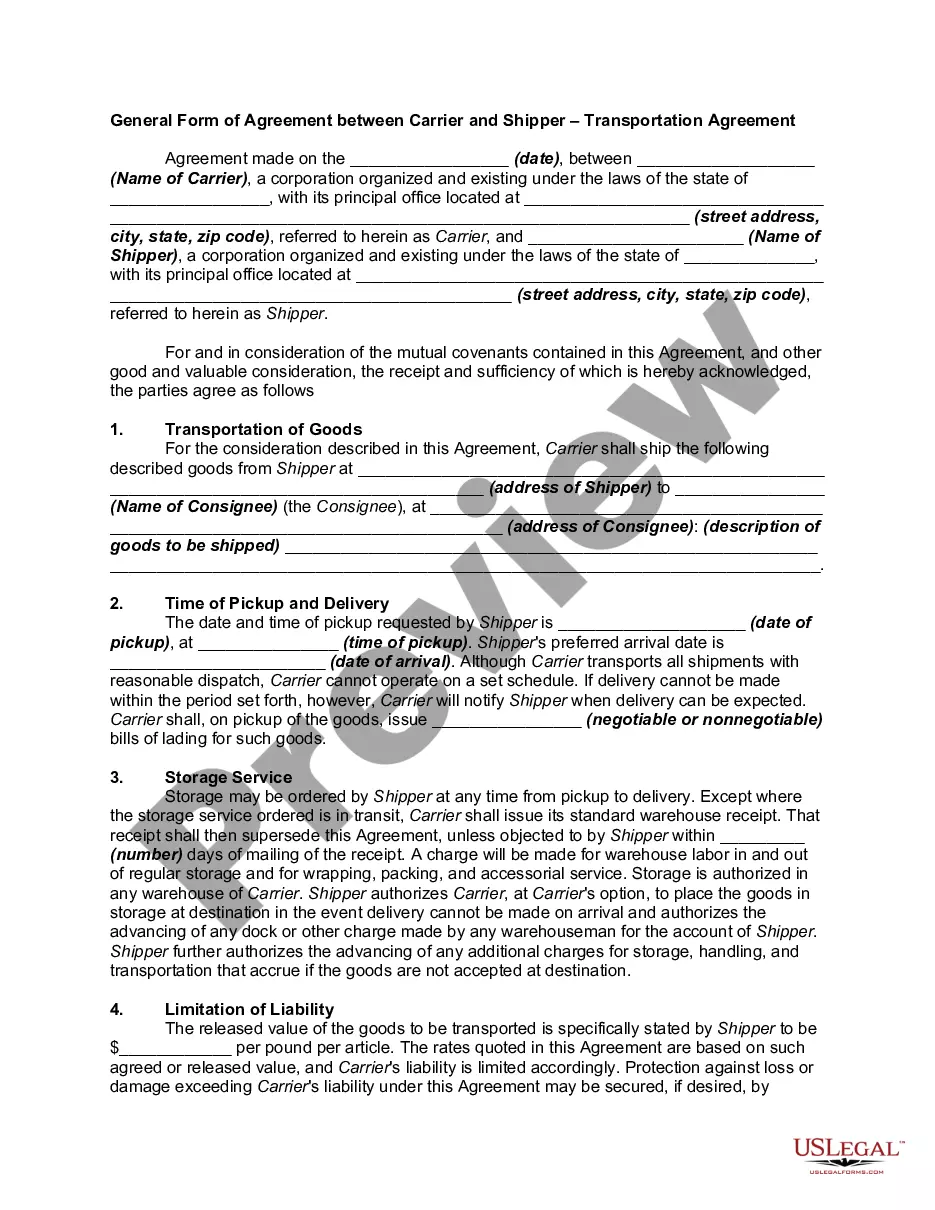

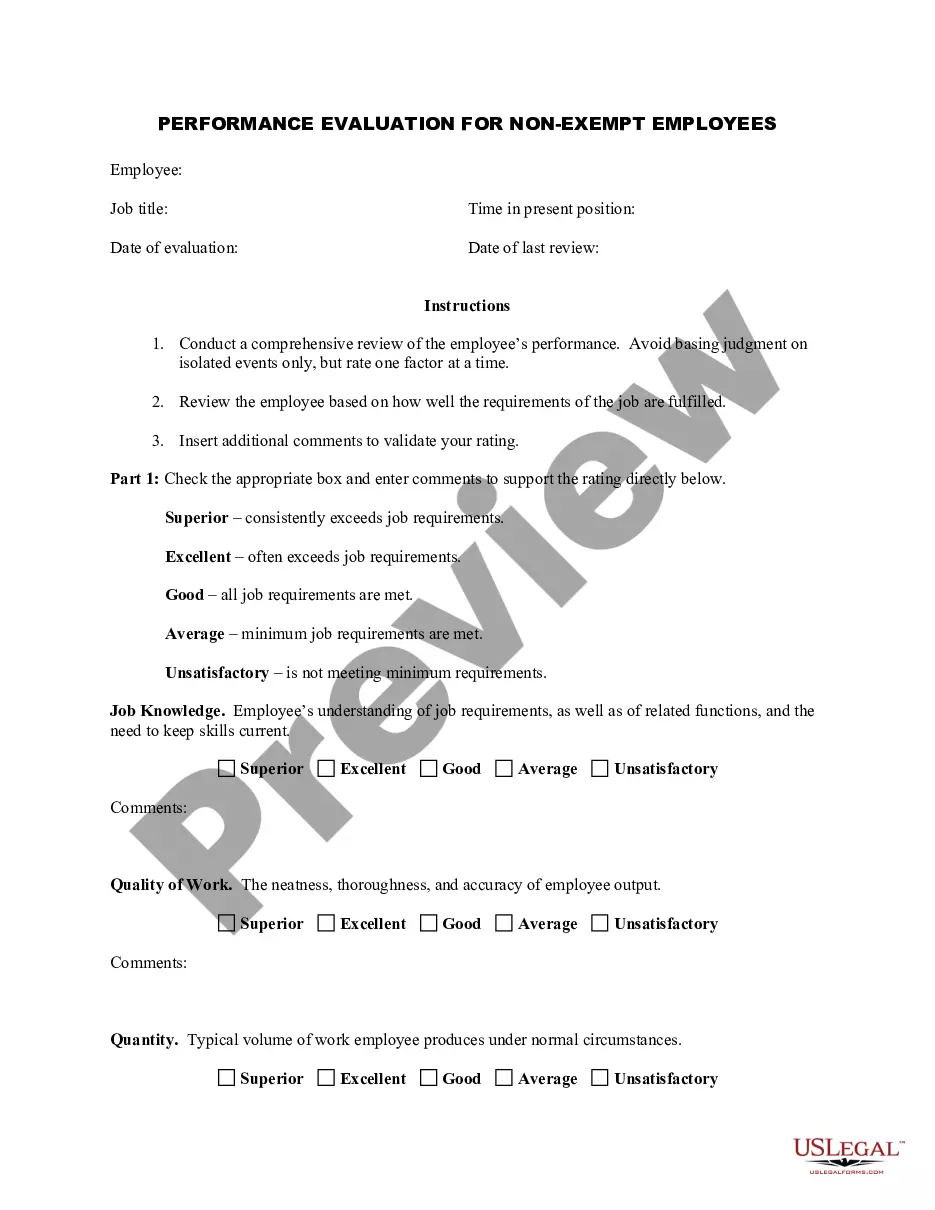

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your county, including the Wayne Stock Option Plan of WSFS Financial Corporation.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Wayne Stock Option Plan of WSFS Financial Corporation will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Wayne Stock Option Plan of WSFS Financial Corporation:

- Ensure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Wayne Stock Option Plan of WSFS Financial Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

The integration of WSFS Wealth and Bryn Mawr Trust Wealth Management groups will take place throughout 2022. Both banks' Customers, however, have immediate and free access to the combined WSFS and Bryn Mawr Trust ATM network of more than 600 ATMs. The new board members bring a wealth of knowledge and experience.

WILMINGTON, Del., Jan. 03, 2022 (GLOBE NEWSWIRE) -- WSFS Financial Corporation (Nasdaq: WSFS), the parent company of WSFS Bank, completed the acquisition of the Bryn Mawr Bank Corporation (Nasdaq: BMTC) (Bryn Mawr), and its primary subsidiary, The Bryn Mawr Trust Company (Bryn Mawr Trust), as of January 1, 2022.

WILMINGTON WSFS Bank announced Monday that its merger with Bryn Mawr Bank Corp., the parent company of Bryn Mawr Trust based northwest of Philadelphia, has received its final approvals.

By the 1980s, WSFS had expanded from northern New Castle County into Kent and Sussex counties, and went public in 1986 on the NASDAQ market.

WILMINGTON, Del., Jan. 03, 2022 (GLOBE NEWSWIRE) -- WSFS Financial Corporation (Nasdaq: WSFS), the parent company of WSFS Bank, completed the acquisition of the Bryn Mawr Bank Corporation (Nasdaq: BMTC) (Bryn Mawr), and its primary subsidiary, The Bryn Mawr Trust Company (Bryn Mawr Trust), as of January 1, 2022.

Beneficial Bank, the oldest and largest bank based in Philadelphia, is officially no more after 166 years. New owner WSFS Financial Corp. completed the rebranding and systems conversion of all Beneficial branches, offices and ATMs over the weekend.

2008 to present Additionally, the WSFS Bank brand was introduced in New Jersey in August 2019 when former Beneficial Bank branches were rebranded as WSFS Bank.

Bryn Mawr Bank Corporation will merge with WSFS Financial Corporation following the signing of a definitive merger agreement by the two financial institutions last week.

Beneficial is now officially part of the WSFS Bank family. We can be reached at 302-792-3446 weekdays 7am 7pm and weekends 9am 3pm. WSFS Online and Mobile Banking are now available.

The $976.4 million Bryn Mawr acquisition deal will grow WSFS' assets by about 25% and its wealth management assets by more than 40%, totaling post-merger nearly $20 billion and $43 billion, respectively, as of Dec.