Alameda California Acquisition, Merger, or Liquidation involves the corporate processes of acquiring, merging, or liquidating businesses in the city of Alameda, California. These activities are significant in the commercial landscape and can greatly impact the local economy. Here is a detailed description of the different types and their key keywords: 1. Acquisition: Acquisition in Alameda California refers to the process by which one company gains control over another company's operations, assets, or shares. The acquiring company usually purchases a majority stake in the target company, allowing it to control its business decisions and operations. Keywords associated with this type of activity include "Alameda California acquisition," "corporate takeover," "purchase of assets," "buyout," and "mergers and acquisitions." 2. Merger: A merger in Alameda California occurs when two or more companies combine to form a new entity. It often involves a mutual decision between companies of similar size and market presence to merge their operations, resources, and workforce. This collaboration aims to enhance competitiveness, increase market share, and achieve synergies. Relevant keywords include "Alameda California merger," "business consolidation," "corporate partnership," "merger announcement," and "amalgamation of firms." 3. Liquidation: Liquidation in Alameda California refers to the process of winding down a company's operations and selling its assets to cover outstanding debts. This typically occurs when a company faces insolvency or decides to cease operations due to various reasons. Liquidation involves converting assets into cash and distributing it among creditors and shareholders. Keywords associated with this process include "Alameda California liquidation," "company closure," "business dissolution," "asset liquidation," and "debts settlement." Overall, Alameda California Acquisition, Merger, or Liquidation plays a crucial role in the dynamic business environment of Alameda, leading to increased market competitiveness, business growth, and the redistribution of resources within the local economy.

Alameda California Acquisition, Merger, or Liquidation

Description

How to fill out Alameda California Acquisition, Merger, Or Liquidation?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Alameda Acquisition, Merger, or Liquidation, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Alameda Acquisition, Merger, or Liquidation from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Alameda Acquisition, Merger, or Liquidation:

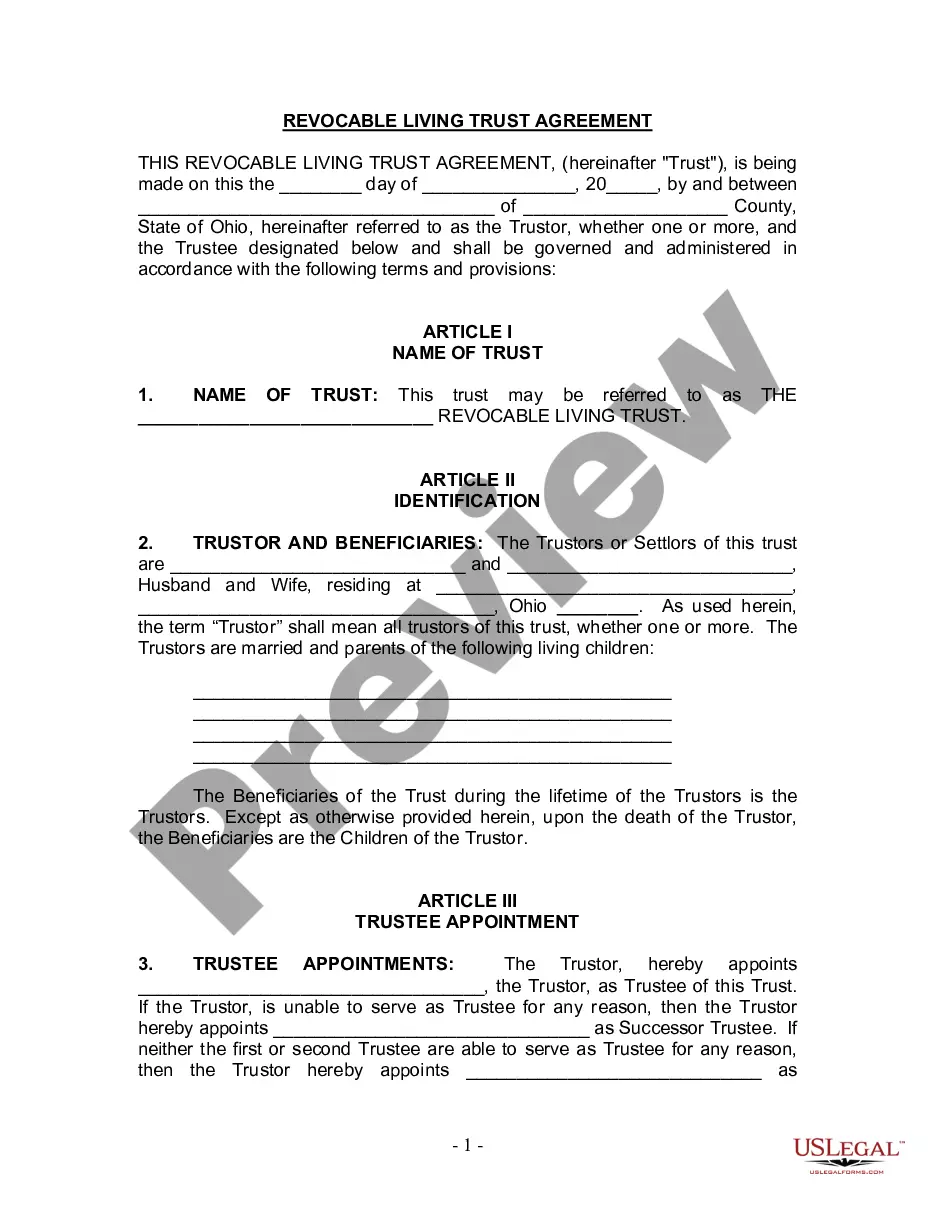

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports. The actual report type (8-K, 10-K, or proxy) will vary. Use the database Thomson One to find the SEC merger filings.

51. Merger Documents means the collective reference to the Merger Agreement, all material exhibits and schedules thereto and all agreements expressly contemplated thereby.

The stocks of both companies in a merger are surrendered, and new equity shares are issued for the combined entity. An acquisition is when one company takes over another company, and the acquiring company becomes the owner of the target company.

Both terms often refer to the joining of two companies, but there are key differences involved in when to use them. A merger occurs when two separate entities combine forces to create a new, joint organization. Meanwhile, an acquisition refers to the takeover of one entity by another.

Resource: When important M&A transactions occur, it can have a major impact on markets and stock prices.... Reuters.com.SeekingAlpha.com.Pitchbook.com.CNBC.NYTimes.com.TheMiddleMarket.com.Genengnews.com.FT.com.

Resource: When important M&A transactions occur, it can have a major impact on markets and stock prices. M&A also creates key opportunities for investors.... Reuters.com.SeekingAlpha.com.Pitchbook.com.CNBC.NYTimes.com.TheMiddleMarket.com.Genengnews.com.FT.com.

SEC filings provide company merger and acquisition details. Both the acquirer and acquiree must file reports. Specific merger or acquisition terms must be disclosed in the company's 8-K report; 8-K reports must be filed within four days of the M & A. Use EDGAR find SEC filings.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

Refinitiv (formerly Thomson Financial) is the premier source for information on individual M&A deals. Their data can be accessed through Refinitiv Workspace and Wharton Research Data Services. The database has details on all announced deals, whether completed or uncompleted.

Use SEC filings to find details about a company's merger or acquisition. Both the target and acquirer will file reports. The actual report type (8-K, 10-K, or proxy) will vary. Use the database Thomson One to find the SEC merger filings.