Kings New York Acquisition, Merger, or Liquidation refers to the various methods and processes through which the company Kings New York can either be acquired by another entity, merge with another company, or be liquidated and dissolved altogether. These strategic decisions are commonly undertaken by businesses to optimize their operations, expand their market presence, or handle financial difficulties. Acquisition is a process in which one company purchases another, generally by buying a significant portion or all of its shares. In the context of Kings New York, this could entail an external entity acquiring the company by obtaining a majority stake or complete ownership. Such an acquisition can be classified as a friendly (voluntary) or hostile (involuntary) takeover. Merger, on the other hand, refers to the combination of two or more separate entities to form a new company. In this scenario, Kings New York could merge with another company, leading to the creation of a new legal entity where the assets, liabilities, and operations of both Kings New York and the merging company would be combined. Liquidation, also known as winding-up, involves the process of shutting down and selling off a company's assets in order to settle debts and obligations. It is typically initiated when a company is facing severe financial distress, bankruptcy, or when its business model is deemed unsustainable. Kings New York liquidation would involve the sale of its assets to repay creditors and distribute remaining funds to shareholders. Keywords: Kings New York, acquisition, merger, liquidation, company acquisition, friendly takeover, hostile takeover, merger process, merging entities, liquidation process, winding-up, asset sale, financial distress, bankruptcy.

Kings New York Acquisition, Merger, or Liquidation

Description

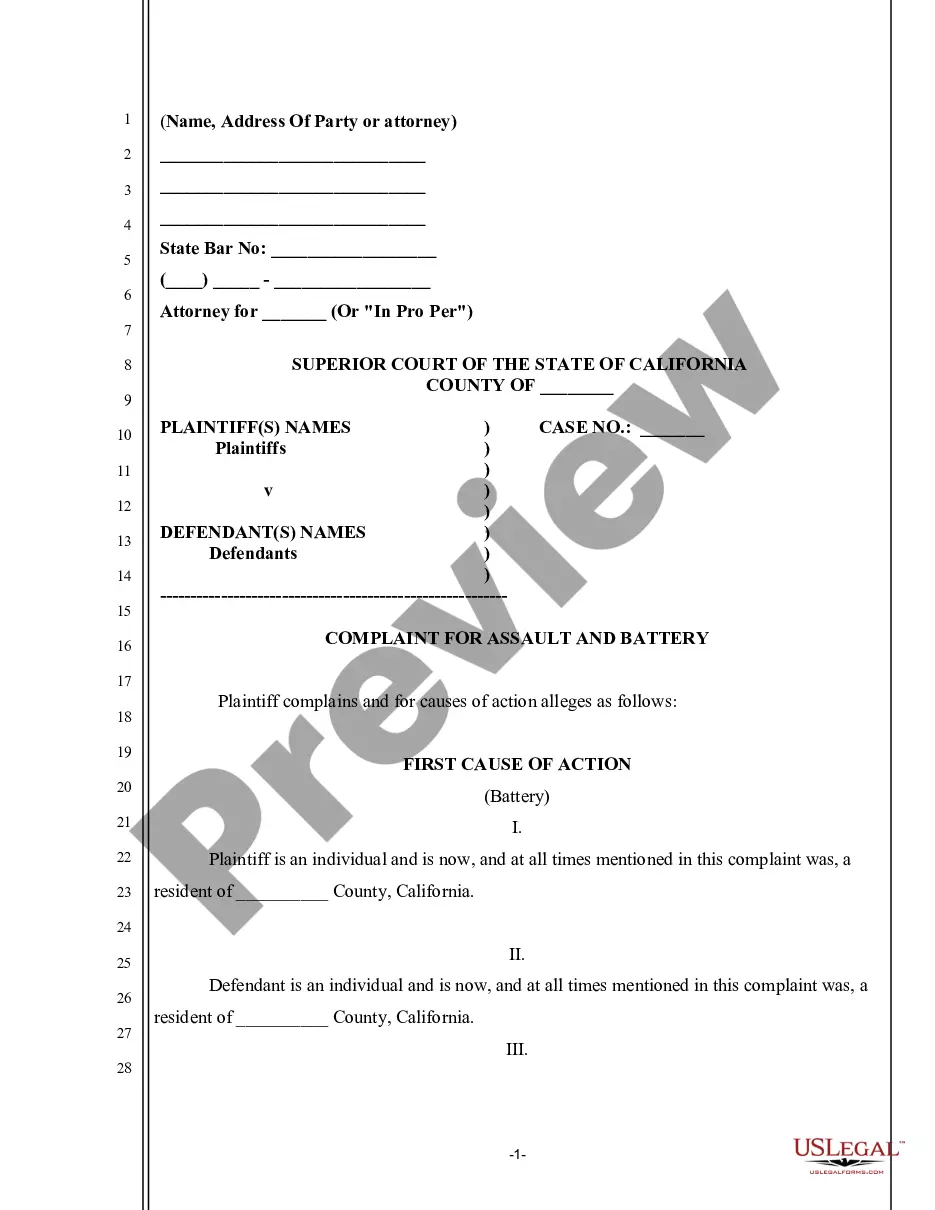

How to fill out Kings New York Acquisition, Merger, Or Liquidation?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Kings Acquisition, Merger, or Liquidation, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Kings Acquisition, Merger, or Liquidation from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Kings Acquisition, Merger, or Liquidation:

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

First, conditional laws for a statutory merger are set by state corporate law. Second, the board of directors of each corporation must give their approval for the merger. Third, the shareholders of each company must approve the merger through their voting rights.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

Because the FTC and the Department of Justice share jurisdiction over merger review, transactions requiring further review are assigned to one agency on a case-by-case basis depending on which agency has more expertise with the industry involved.

Mergers are transactions involving the combination of generally two or more companies into a single entity. The need for shareholder approval of a merger is governed by state law. Typically, a merger must be approved by the holders of a majority of the outstanding shares of the target company.

Merger by Acquisition is where a company, without going into liquidation, is dissolved and its assets and liabilities are transferred to a company in exchange for shares in the acquiring company with/without any cash payment.

MERGER & CONSOLIDATION: PROCEDURE Short-Form Merger: A merger between a parent and a subsidiary (at least 90% owned by the parent) which can be accomplished without shareholder approval.

The vote for a merger is typically a vote requiring the approval of either a majority or two-thirds of all shares issued and outstanding for the company.

The federal tax code provides for tax free mergers and acquisitions in certain situations. In tax-free mergers, the acquiring company uses its stock as a significant portion of the consideration paid to the acquired company.

Once the meeting is held, if a majority of the shareholders vote in favor of the merger agreement, the merger is approved. Keep in mind that Section 251 contains a number of exceptions for when a vote of the shareholders is not required.

The board is responsible for approving a company's strategic plan, and the board should evaluate proposed acquisitions in the context of that plan.