Clark Nevada Adjustments are measures taken in the event of reorganization or changes in the capital structure of a company. These adjustments aim to realign the financial and operational aspects of the business to accommodate the new changes effectively. They can include various types of adjustments, such as capital restructuring, debt conversion, and equity exchanges. Understanding these different adjustments is crucial for companies to navigate successfully through periods of reorganization or capital structure changes. 1. Capital Restructuring: Capital restructuring is a type of Clark Nevada Adjustment that involves modifying the company's capital base. It typically entails changing the mix of debt and equity financing to optimize the company's financial structure for enhanced profitability and growth. This adjustment may involve issuing new shares, repurchasing existing shares, or issuing new debt instruments. 2. Debt Conversion: Debt conversion is another type of Clark Nevada Adjustment that facilitates the conversion of debt obligations into equity ownership. When a company undergoes reorganization or a change in its capital structure, it may choose to convert some of its outstanding debt into equity shares. This adjustment can help reduce the company's debt burden, improve its financial health, and provide a more favorable capital structure for future growth. 3. Equity Exchanges: Equity exchanges, also known as stock swaps or equity swaps, are adjustments where a company exchanges its existing equity shares for new shares or shares of another company. This type of Clark Nevada Adjustment occurs during mergers, acquisitions, or corporate restructuring, allowing the involved parties to align their ownership interests. Equity exchanges often aim to create synergies, enhance market presence, or streamline operations between the companies involved. 4. Rights Offerings: Rights offerings are a type of Clark Nevada Adjustment that involves issuing additional shares to existing shareholders at a discounted price. This adjustment is commonly used to raise capital quickly or strengthen the company's financial position. Shareholders are typically given the right to purchase new shares in proportion to their existing ownership, ensuring they maintain their relative ownership stake within the company. 5. Dividend Modifications: Dividend modifications are adjustments made to a company's dividend policy in response to reorganization or changes in the capital structure. During times of reorganization, a company may need to reassess its dividend payments due to changes in profitability, cash flow requirements, or investor expectations. Dividend modifications can include increasing, decreasing, suspending, or eliminating dividend payments altogether. In conclusion, Clark Nevada Adjustments encompass various measures taken during reorganization or changes in a company's capital structure. These adjustments may include capital restructuring, debt conversion, equity exchanges, rights offerings, and dividend modifications. By effectively implementing these adjustments, companies can adapt to new market conditions, optimize their capital structure, and position themselves for future success.

Clark Nevada Adjustments in the event of reorganization or changes in the capital structure

Description

How to fill out Clark Nevada Adjustments In The Event Of Reorganization Or Changes In The Capital Structure?

Drafting documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Clark Adjustments in the event of reorganization or changes in the capital structure without expert assistance.

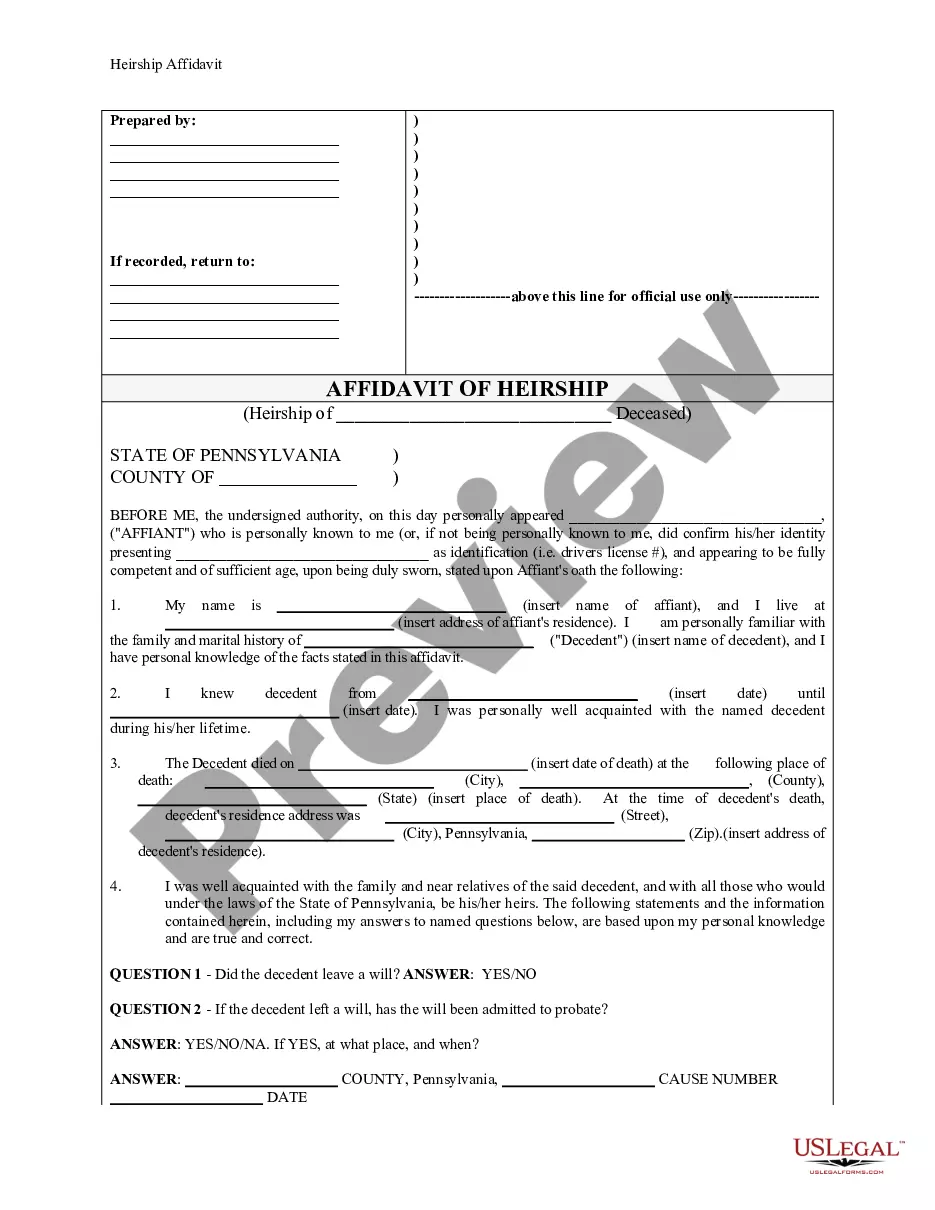

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Clark Adjustments in the event of reorganization or changes in the capital structure on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Clark Adjustments in the event of reorganization or changes in the capital structure:

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any situation with just a couple of clicks!