Collin Texas Anti-Dilution Adjustments refer to a specific provision utilized in investment agreements, particularly in the context of venture capital and private equity transactions within Collin County, Texas. This provision safeguards the investors' ownership percentage in a company's equity, protecting them from potential dilution caused by subsequent rounds of funding or issuing additional shares. The purpose of Collin Texas Anti-Dilution Adjustments is to maintain the value of the investors' initial investment and prevent their ownership from being significantly reduced due to the issuance of new shares at a lower price. There are primarily two types of Collin Texas Anti-Dilution Adjustments: 1. Full Ratchet Anti-Dilution: In this type of provision, the conversion price of the initial investment is adjusted downward to match the price of the newly issued shares. The full ratchet mechanism is considered more advantageous to the investor, as it provides complete protection against dilution by adjusting the conversion price to the lowest price found in subsequent financing rounds. 2. Weighted Average Anti-Dilution: This type of adjustment takes into account both the price and quantity of shares issued in subsequent financings. The conversion price of the initial investment is adjusted based on a formula that considers the old and new prices, as well as the number of shares before and after the new issuance. The weighted average anti-dilution provision provides a more balanced approach, considering the extent of dilution and preventing a substantial reduction in the investor's ownership stake. Collin Texas Anti-Dilution Adjustments play a crucial role in protecting the interests of investors in startup and high-growth companies. By implementing these provisions, investors can maintain their ownership percentage and preserve the value of their investment, mitigating the risk of dilution as the company progresses through multiple funding rounds. Entrepreneurs seeking investment in Collin County, Texas should be aware of these provisions and carefully consider their implications while negotiating investment agreements.

Collin Texas Anti-Dilution Adjustments

Description

How to fill out Collin Texas Anti-Dilution Adjustments?

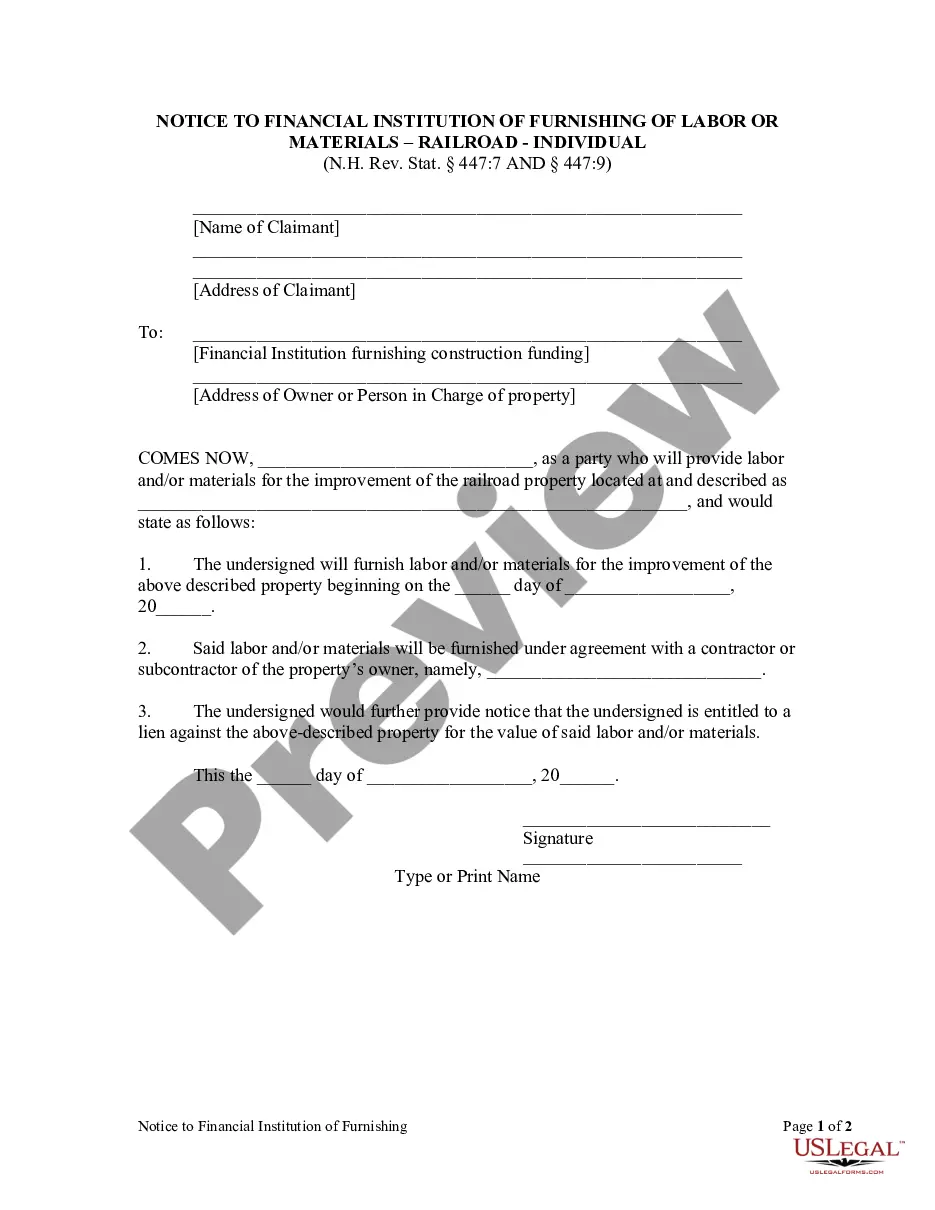

If you need to get a reliable legal paperwork provider to obtain the Collin Anti-Dilution Adjustments, consider US Legal Forms. Whether you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support make it easy to find and execute various documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Collin Anti-Dilution Adjustments, either by a keyword or by the state/county the form is created for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Collin Anti-Dilution Adjustments template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first business, organize your advance care planning, create a real estate contract, or complete the Collin Anti-Dilution Adjustments - all from the convenience of your home.

Sign up for US Legal Forms now!