Sacramento California Anti-Dilution Adjustments

Description

How to fill out Sacramento California Anti-Dilution Adjustments?

Preparing documents for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Sacramento Anti-Dilution Adjustments without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Sacramento Anti-Dilution Adjustments by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Sacramento Anti-Dilution Adjustments:

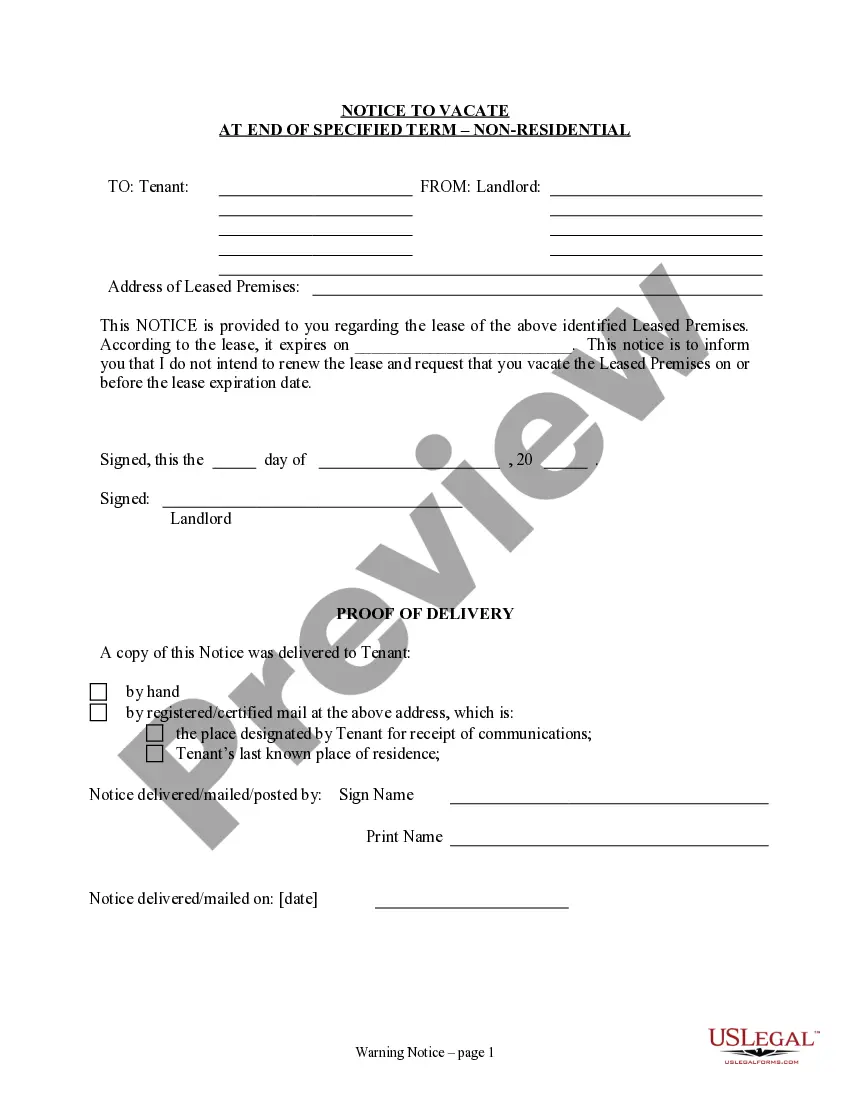

- Examine the page you've opened and check if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Anti-dilution provisions act as a buffer to protect investors against their equity ownership positions becoming diluted or less valuable. This can happen when the percentage of an owner's stake in a company decreases because of an increase in the total number of shares outstanding.

A contractual anti-dilution adjustment is an agreement between the initial investors and the company, where the company agrees to issue additional shares of common stock to the investors to maintain their ownership percentage in the company until the company raises the required capital.

Very simply, if the original conversion price was $5 and in a later round the conversion price is $2.50, the investor's original conversion price would adjust to $2.50. The weighted average provision uses the following formula to determine new conversion prices: C2 = C1 x (A + B) / (A + C)

Anti-dilution provisions are clauses that allow investors the right to maintain their ownership percentages in the event that new shares are issued. Dilution refers to a shareholder's ownership decreasing as a result of new shares being issued.

Anti-dilution provisions are clauses that allow investors the right to maintain their ownership percentages in the event that new shares are issued. They are rights that are usually associated with preferred shares. The shares are more senior than common stock but are more junior relative to debt, such as bonds..

Why Is Anti-Dilution Important? Anti-dilution provisions are important because they provide a safety net for investors. These provisions are included in agreements that are convertible to common stock. Preferred stockholders don't have voting rights in a company, but common stockholders do.

Anti-dilution covenants are a contract requiring the company to issue more shares to early investors if the company sells shares to later investors at a price below that paid by the earlier investors. How many shares the earlier investors are entitled to depends on the formula in their anti-dilution covenant.

A contractual anti-dilution adjustment is an agreement between the initial investors and the company, where the company agrees to issue additional shares of common stock to the investors to maintain their ownership percentage in the company until the company raises the required capital.

Anti-dilution is triggered when the conversion price for a round is less than the conversion price from the prior round (which is almost universally the same as the PPS for the preferred stock sold in that round).