Cook Illinois Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is a financial benefit provided to individuals holding non-exercisable stock options in Cook Illinois Corporation upon a merger or consolidation event. This cash award serves as compensation for the value of these options that cannot be exercised due to the company's merger or consolidation. Cook Illinois, a leading corporation in its industry, recognizes the importance of acknowledging employees' contributions and ensuring fair treatment during mergers or consolidations. This type of award provides financial security to those who hold non-exercisable stock options, ensuring they are compensated for the value they would have received if the options could be exercised. The Cook Illinois Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation offers various benefits to eligible participants. These benefits may include monetary compensation, aligned with the value of the non-exercisable stock options. The amount of the cash award is typically determined based on factors such as the current market value of the stock options, the terms of the merger or consolidation agreement, and the financial status of the company involved. Different types of Cook Illinois Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation may include: 1. Standard Cash Award: This refers to the basic compensation provided to eligible stock option holders in the event of a merger or consolidation. It represents a fair value of the non-exercisable stock options, ensuring holders receive an equitable sum for their restricted options. 2. Performance-based Cash Award: In some cases, Cook Illinois may offer additional cash incentives based on the performance of the company after the merger or consolidation. This type of award rewards stock option holders if the merged or consolidated entity achieves specific financial or operational targets. 3. Milestone-based Cash Award: Cook Illinois may introduce milestone-based cash awards to incentivize stock option holders to contribute to successful post-merger integration or consolidation efforts. These awards are triggered upon reaching predetermined milestones, which may include revenue goals, market share expansion, or cost-saving initiatives. It is important for stock option holders to review the terms and conditions of the Cook Illinois Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation carefully. They should consult with the company's human resources department or legal advisors to fully understand their eligibility, the calculation methodology, and any specific restrictions or requirements associated with the cash award.

Cook Illinois Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cook Illinois Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

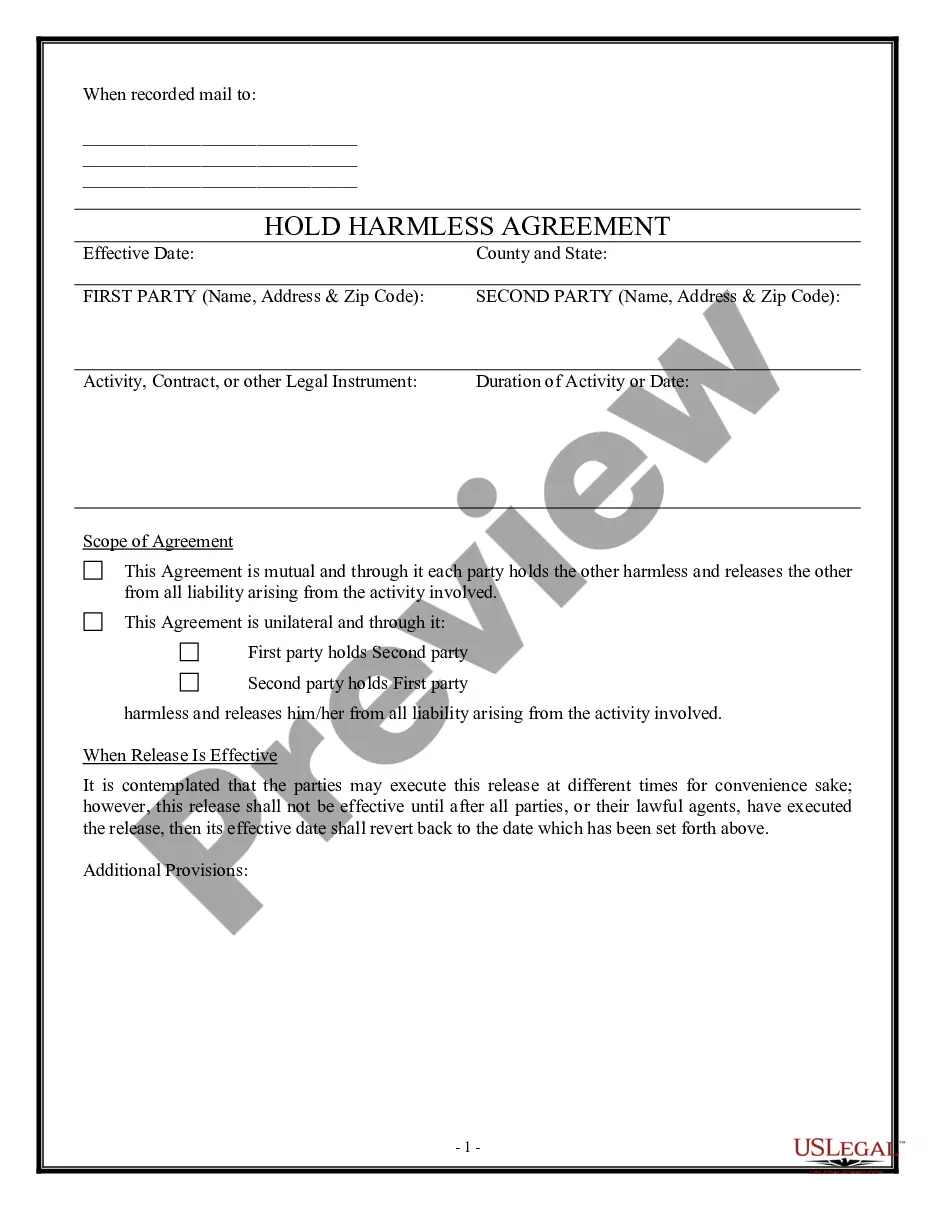

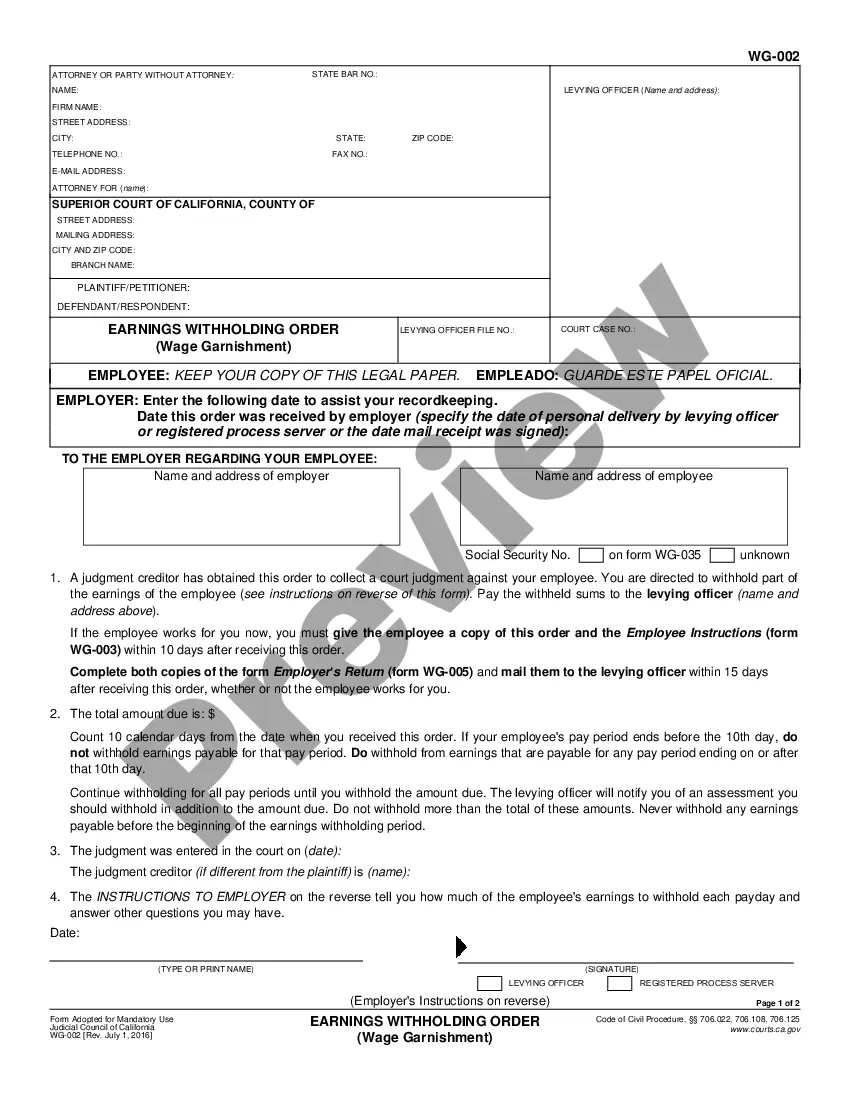

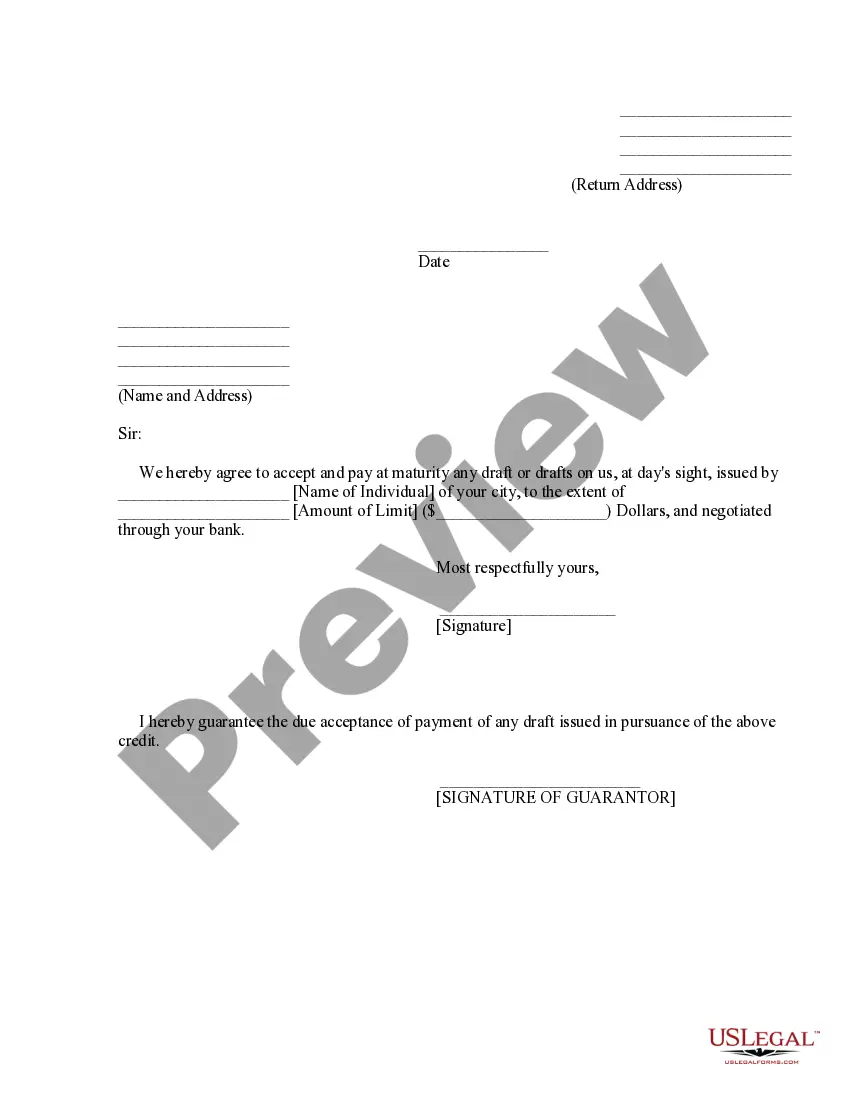

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Cook Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities associated with paperwork completion simple.

Here's how to purchase and download Cook Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the similar forms or start the search over to locate the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Cook Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Cook Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you need to cope with an extremely complicated case, we recommend getting a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

What Happens to Call Options in a Merger? When a merger is completed the two companies that merged combine into a new entity. At that time, trading in the options of the previous entities will cease and all options on that security that were out-of-the-money will become worthless.

If the acquiring company decides to give you company shares, either you will receive publicly traded shares, and your situation will mimic the IPO outcome, or if acquired by a private company, you will receive private shares and you will be back in the same situation as before: waiting for liquidity.

When the buyout occurs, and the options are restructured, the value of the options before the buyout takes place is deducted from the price of the option during adjustment. This means the options will become worthless during the adjustment if you bought out of the money options.

A cashless exercise, also known as a "same-day sale," is a transaction in which an employee exercises their stock options by using a short-term loan provided by a brokerage firm. The proceeds from exercising the stock options are then used to repay the loan.

Unlike the traditional IPO process where the lockup period is usually 180 days, after a SPAC merger, employees with stock options may have to wait 6 months to a year for all restrictions to be lifted. Sometimes employees are able to sell a preset number of shares after closing in a tender offer.

When a merger is completed the two companies that merged combine into a new entity. At that time, trading in the options of the previous entities will cease and all options on that security that were out-of-the-money will become worthless. Generally, this is determined by the very last closing price on that stock.

With a cashless exercise/same-day sale, the full exercise spread income is reported on Form W-2, and you report it on your tax return as ordinary income. Even though you never owned all the stock after exercise, you also need to report this transaction on Form 8949 and Schedule D.

If you buy and hold, you will report the bargain element as income for Alternative Minimum Tax purposes. Report this amount on Form 6251: Alternative Minimum Tax for the year you exercise the ISOs. When you sell the stock in a later year, you must report another adjustment on your Form 6251 for the year of sale.

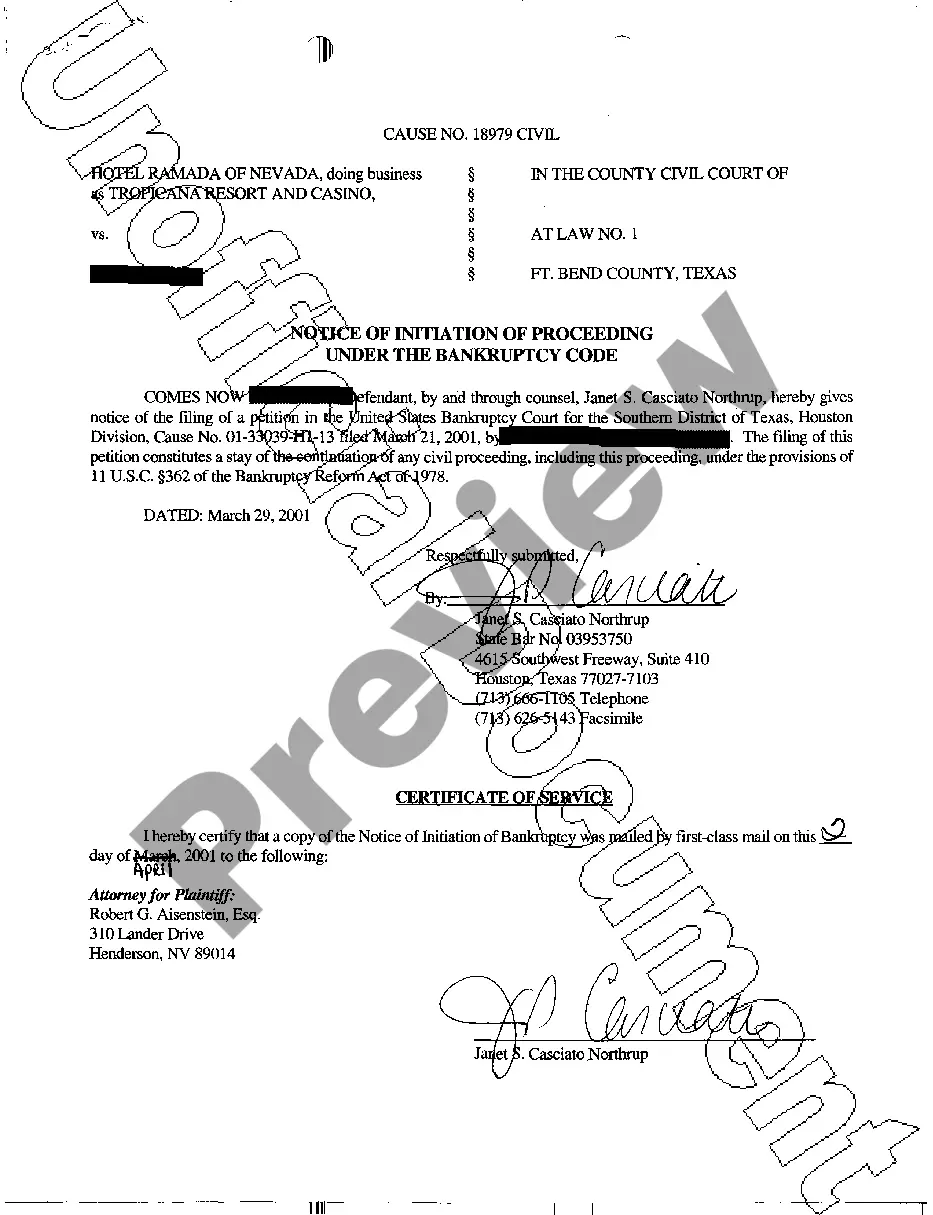

When your company (the "Target") merges into the buyer under state law, which is the usual acquisition form, it inherits the Target's contractual obligations. Those obligations include vested options. Therefore, your vested options should remain intact in a merger/reorganization scenario.

With a cashless exercise/same-day sale, the full exercise spread income is reported on Form W-2, and you report it on your tax return as ordinary income. Even though you never owned all the stock after exercise, you also need to report this transaction on Form 8949 and Schedule D.

Interesting Questions

More info

Stock. Shares granted between July 31, 2015, and December 31, 2014. See Notes 12 and 13 to the Condensed Consolidated Financial Statements of TSLA for more information. Non-Equity. As of December 31, 2015, and 2014, 5,731,000 shares are restricted for exercise and 5,731,000 shares are for sale. Stock. In March 2014, the TSX was delisted from TSX Venture Exchange, Inc. See the Change Notice, “The TSX Exchange Inc. (TSX) is delisted from the Canadian Securities Exchange (CSX) under the Exchange Act on April 1, 2014” and the “2016 Annual Meeting of stockholders” for a breakdown of the number of shares in the common stock. No equity compensation awards were granted for the period October 1, 2015, through March 2, 2016. The following table sets forth data on a per-share basis, on an as-converted basis, and on a per-employee basis.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.