Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation: A Comprehensive Overview Montgomery, Maryland, a county located in central Maryland near the Washington, D.C. metro area, offers a unique cash award program to holders of non-exercisable stock options upon merger or consolidation. This incentive aims to reward employees for their contributions and align their interests with the company's success during a corporate merger or consolidation process. In the context of corporate restructuring, mergers or consolidations occur when two companies combine to form a single entity or when a company incorporates another business into its operations. During such transitions, stock options granted to employees may become non-exercisable due to various contractual terms or because of the change in ownership structure. However, to ensure equity and motivate employees, Montgomery Maryland offers a cash award program as a form of compensation in these situations. The Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation enables eligible employees to receive a monetary compensation equal to the value the stock options held, even if they cannot be exercised. This program ensures that employees who held stock options in the pre-merger or pre-consolidation period are not disadvantaged and are appropriately rewarded based on the value they would have derived if the options were exercisable. Specific types of Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation may include: 1. Non-Exercisable Stock Option Conversion Cash Award: Under this type, employees holding non-exercisable stock options receive a cash award based on the value of their options before the merger or consolidation event. 2. Non-Exercisable Stock Option Replacement Cash Award: In certain cases, companies may replace non-exercisable stock options with cash awards, ensuring that employees do not miss out on the financial benefits they would have received through exercising the options. 3. Non-Exercisable Stock Option Enhancement Cash Award: This type of cash award grants additional compensation beyond the value of non-exercisable stock options, acknowledging employees' contributions during the merger or consolidation process. It is important to note that the eligibility criteria, calculation methods, and specific terms of the Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation may vary depending on the specific merger or consolidation agreement and the company's policies. Therefore, employees should consult their employers or legal advisors for precise information about their entitlements under this program. In summary, the Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is a program designed to ensure fair compensation for employees who hold non-exercisable stock options during corporate mergers or consolidations. By offering cash awards equivalent to the value of these options, Montgomery Maryland incentivizes employees, promotes employee satisfaction, and supports a smooth transition during these complex corporate restructurings.

Montgomery Maryland Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Montgomery Maryland Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

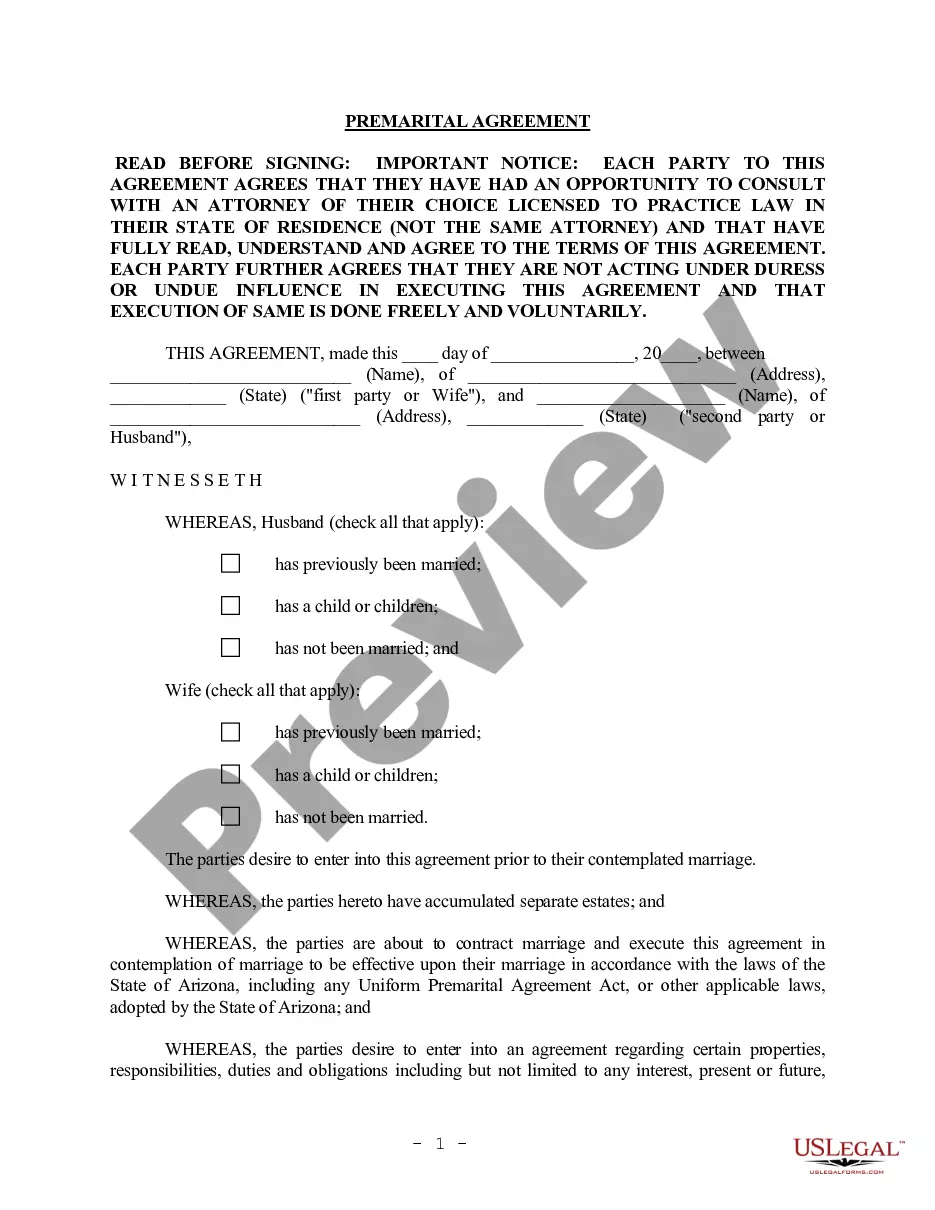

Draftwing paperwork, like Montgomery Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, to manage your legal affairs is a difficult and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for a variety of cases and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Montgomery Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Montgomery Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation:

- Ensure that your template is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Montgomery Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our service and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!