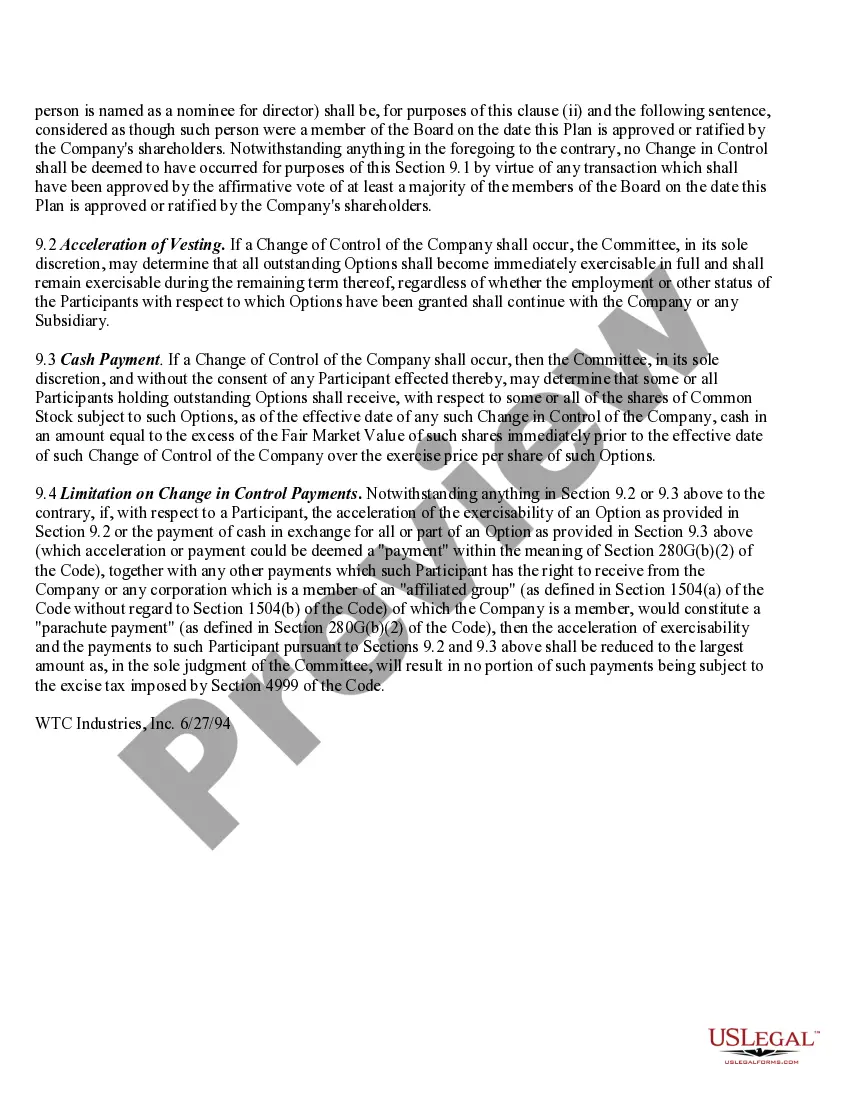

Cook Illinois Change of Control of WTC Industries, Inc. refers to a significant transformation in ownership or management within the company. This change can occur due to a variety of reasons, such as mergers, acquisitions, or investment buyouts. Cook Illinois is a well-established company specializing in transportation services, while WTC Industries, Inc. represents the target company experiencing the change. When Cook Illinois undergoes a change of control, it can bring about new leadership, strategic direction, and operational policies. This transformation can influence the company's stakeholders, including its employees, customers, suppliers, and investors. Moreover, it often leads to modifications in the corporate structure, governance, and overall business landscape. The Cook Illinois Change of Control process involves a thorough evaluation of the target company's financial health and growth potential, taking into account its assets, liabilities, and future prospects. This assessment helps the acquiring entity, Cook Illinois, determine if the investment is feasible and aligns with its objectives. Different types of Cook Illinois Change of Control of WTC Industries, Inc. can be categorized based on the nature and purpose of the transaction. These may include: 1. Merger: This occurs when Cook Illinois and WTC Industries, Inc. combine their assets and operations, forming a new entity or integrating into an existing one. The merger aims to leverage the strengths of both companies to gain a competitive edge, expand market share, or achieve synergy. 2. Acquisition: In an acquisition, Cook Illinois acquires a controlling interest in WTC Industries, Inc. This typically involves purchasing a majority stake in the target company's shares, granting Cook Illinois decision-making power and ownership of the assets. 3. Management Buyout (HBO): In some cases, the change of control may involve the current management team of Cook Illinois purchasing the majority stake in WTC Industries, Inc. The management team then takes control of the target company, making strategic decisions to drive growth and profitability. 4. Leveraged Buyout (LBO): An LBO occurs when Cook Illinois acquires WTC Industries, Inc. using a significant amount of debt financing. Typically, the assets of the target company are used as collateral for the loan, and the cash flows generated post-acquisition are utilized to repay the debt. Regardless of the type, Cook Illinois Change of Control of WTC Industries, Inc. is a complex process that aims to bring about positive changes, enhance value, and foster growth opportunities for both companies involved. It signifies a significant shift in the corporate landscape and can have far-reaching implications for the industry and market in which they operate.

Cook Illinois Change of Control of WTC Industries, Inc.

Description

How to fill out Cook Illinois Change Of Control Of WTC Industries, Inc.?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Cook Change of Control of WTC Industries, Inc. is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Cook Change of Control of WTC Industries, Inc.. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Change of Control of WTC Industries, Inc. in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

5. Organization. The WTC Health Program is administered by NIOSH, which is part of CDC within HHS.

An injury, illness, or medical condition that, within the 120 days prior to and including the purchase date of your policy: Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor; Presented symptoms; or.

The Twin Towers were the centerpieces of the World Trade Center complex. At 110 stories each, 1 WTC (North Tower) and 2 WTC (South Tower) provided nearly 10 million square feet of office space for about 35,000 people and 430 companies.

? Top 5 Certified Conditions: Chronic Rhinosinusitis. Gastroesophageal Reflux Disease (GERD) Asthma. Cancers. Sleep Apnea.

The work took ten months and involved employees from dozens of City, State and federal agencies and the tireless efforts of responders, laborers, contractors, volunteers, and community organizations.

It is estimated that 400,000 people have been affected by 9/11-related cancer. The top 15 cancers related to 9/11 toxins exposure are non-melanoma skin, prostate, melanoma, lymphoma, thyroid, lung/bronchus, breast, leukemia, colon, kidney, bladder, myeloma, oropharynx, rectum, and tonsil.

Your WTC Health Program doctor will determine if your conditions falls under one of these categories....Cancers Blood and lymphoid tissue (including lymphoma, myeloma, and leukemia) Breast. Childhood cancers. Digestive system (including colon and rectum) Eye and orbit. Ovary. Head and neck (oropharynx and tonsil) Prostate.

The World Trade Center (WTC) Health Program is a federal program that provides monitoring and treatment for certified WTC-related health conditions for eligible Responders to the September 11, 2001 attacks in New York City (NYC), the Pentagon in Arlington, Virginia, and the crash site in Shanksville, Pennsylvania.

Interesting Questions

More info

It offers a luxurious stay without all the hassle. The hotel has an onsite receptionist, valet and laundry service. Also, in the event of guests changing rooms more than one day before their destination, a hotel attendant (a.k.a. “Washout”) is on staff 24 hours. The hotel is operated by the city's Department of Tourism — Ministry of Economic Development of the Russian Federation and the hotel is located in St. Michael's Cathedral. It offers an extensive list of events and receptions each year. A luxury 4-star hotel located in the famous Pravda Club neighborhood in downtown Moscow. With an exclusive private restaurant, it offers unique guests the possibility to relax and socialize. In addition, Moscow's Museum of Industry and Trade offers an impressive collection. Moscow is well known for its Moscow Summer, and it is quite easy to see why the city has been named “Europe's top summer resort”.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.