Nassau New York Dividend Equivalent Shares are a form of investment instrument offered by the Nassau County in New York that allows investors to indirectly participate in the dividends of a specific company or portfolio. These shares are specifically designed to provide investors with a cash flow similar to that of regular dividends without requiring direct ownership of the underlying assets. The main purpose of Nassau New York Dividend Equivalent Shares is to offer income-focused investors an opportunity to generate regular cash flow from their investments, similar to those who directly own dividend-paying stocks. These shares are particularly attractive for individuals who prefer a steady income stream rather than relying solely on capital appreciation. Investors in Nassau New York Dividend Equivalent Shares receive distributions that mimic the dividend payments made by the underlying company or portfolio. These distributions are typically paid out on a regular basis, such as quarterly, semi-annually, or annually, depending on the specific terms and conditions. Nassau New York Dividend Equivalent Shares come in various types, including: 1. Single-Company Dividend Equivalent Shares: These shares allow investors to indirectly receive dividends from a single company. They offer a focused exposure to the dividend performance of that particular company. Investors interested in dividend payments from a specific corporation can invest in these shares. 2. Dividend ETF Equivalent Shares: These shares provide investors with exposure to a diversified portfolio of stocks that pay dividends, typically through an exchange-traded fund (ETF) structure. By investing in these shares, investors can gain exposure to a broader range of dividend-paying stocks across various industries and sectors. 3. Dividend Index Equivalent Shares: These shares are linked to a specific dividend index, such as the S&P Dividend Aristocrats Index or the FTSE Dividend+ Index. They enable investors to track the performance of a specific dividend-focused index and benefit from the dividend payments of the underlying component stocks. 4. Global Dividend Equivalent Shares: These shares allow investors to access dividend payments from companies located around the world. They provide an opportunity to diversify dividend income sources geographically and capture potential dividend growth opportunities from international markets. Nassau New York Dividend Equivalent Shares offer income-seeking investors an efficient way to generate regular cash flow without the complexities and risks associated with direct stock ownership. They can be a suitable investment option for individuals looking for consistent income or those who want to participate in dividend payments without the need for active stock selection and management.

Nassau New York Dividend Equivalent Shares

Description

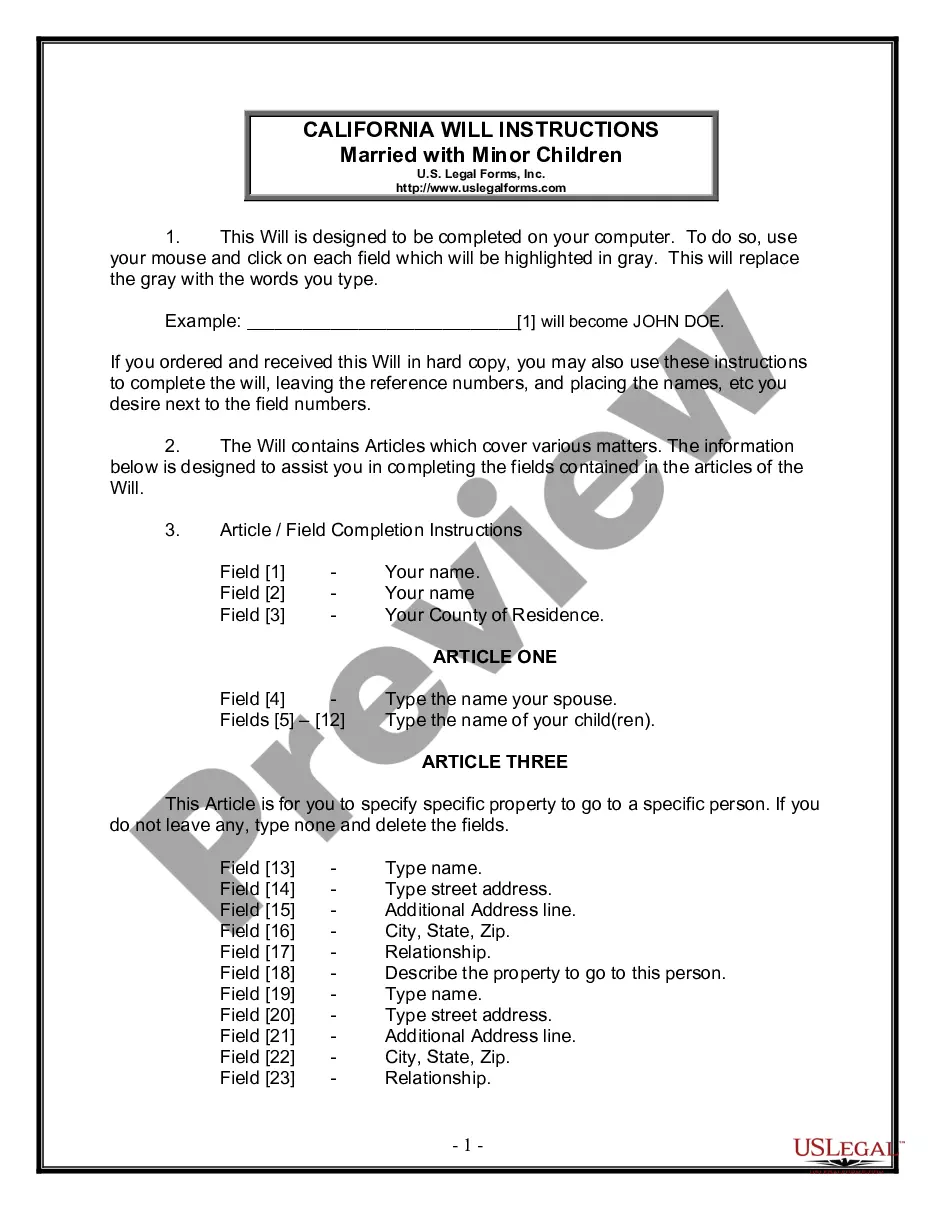

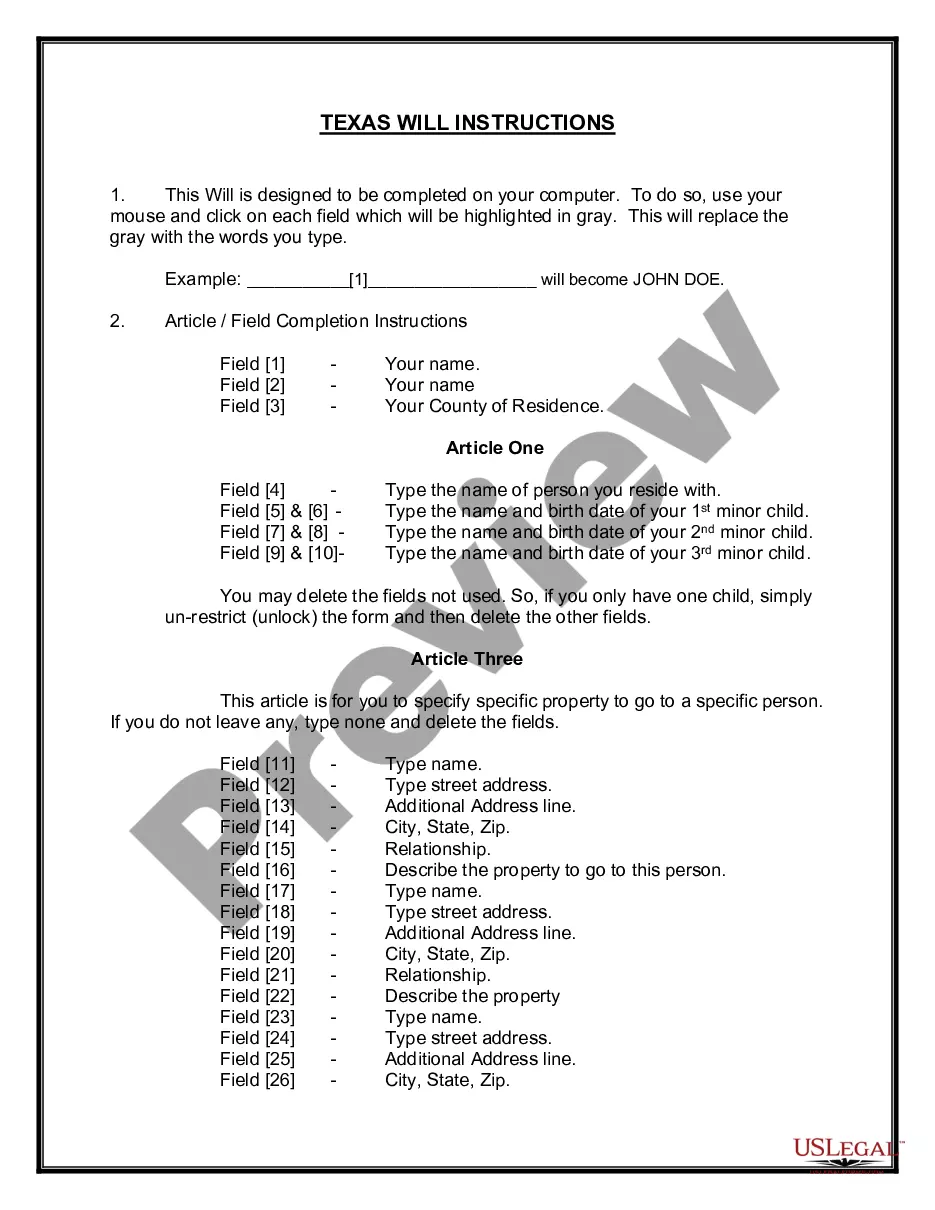

How to fill out Nassau New York Dividend Equivalent Shares?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

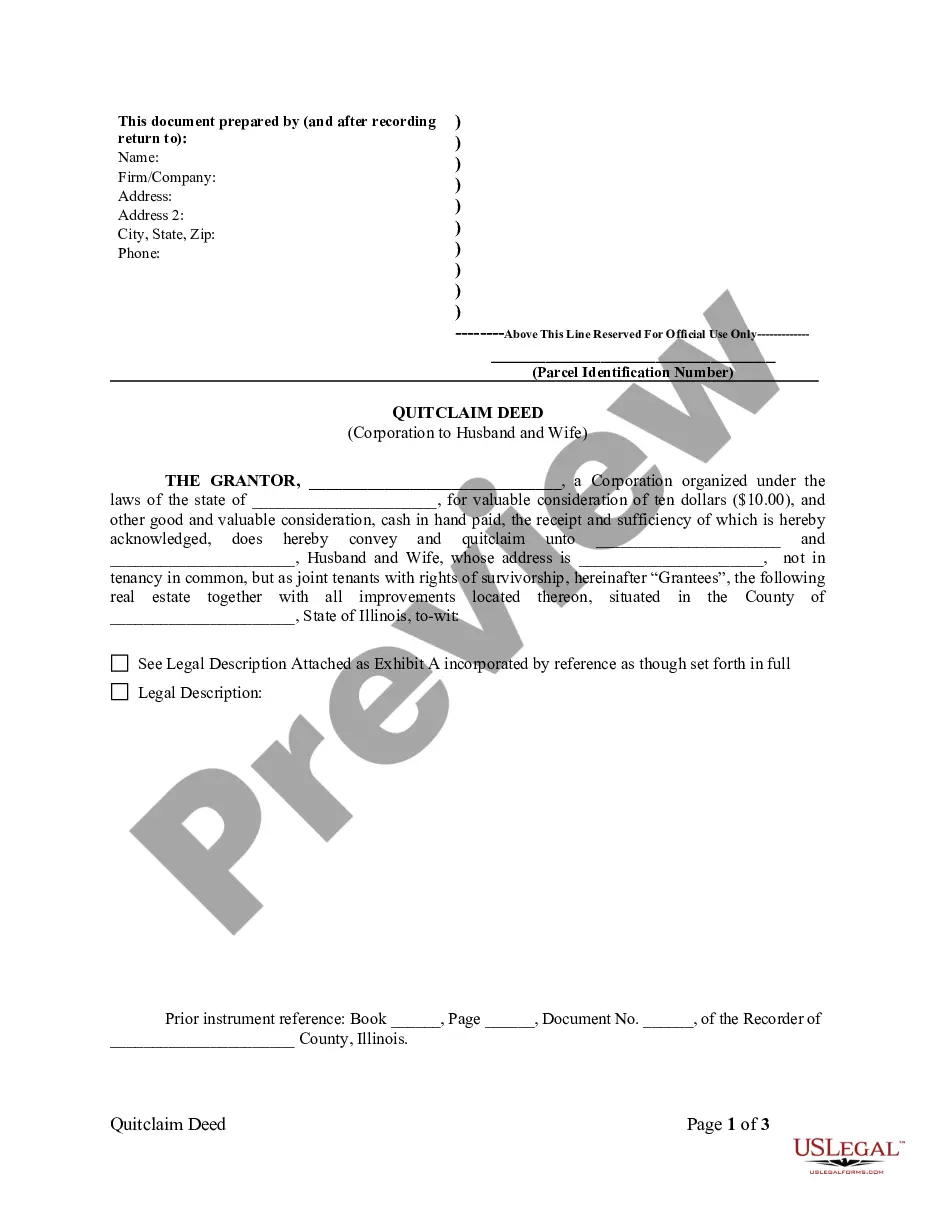

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Nassau Dividend Equivalent Shares.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Nassau Dividend Equivalent Shares will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Dividend Equivalent Shares:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Dividend Equivalent Shares on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

A dividend equivalent right entitles the recipient to receive credits equal to the cash or stock dividends or other distributions that would have been received on shares of stock had the shares been issued and outstanding on the dividend record date.

The Dividend Equivalents will be reinvested in the form of additional DSUs (Dividend Equivalent Units) determined by dividing the value of the Dividend Equivalent by the Fair Market Value of a share of Common Stock on GrafTech's dividend payment date.

RSU Dividend Equivalents means, to the extent specified by the Committee only, an amount equal to all dividends and other distributions (or the economic equivalent thereof) which are payable to stockholders of record during the Restriction Period on a like number and kind of shares of Common Stock as the shares

Under Internal Revenue Code (IRC) Section 871(m) and the final regulations, a dividend equivalent is treated as a dividend from sources within the United States for purposes of taxing and withholding at source on nonresident alien individuals, foreign corporations and foreign organizations.

Dividend Equivalent Amount means an amount determined by multiplying the number of Dividend Equivalents subject to a Grant by the per-share cash Dividend paid by the Company on its outstanding Company Stock, or the per-share fair market value (as determined by the Committee) of any Dividend paid by the Company on its

For any dividends declared and paid by the Company on its outstanding Stock, the same amount of dividends shall be credited to the Award (Phantom Dividends), which Phantom Dividends shall be subject to the same restrictions and risk of forfeiture as the Award as set forth in Section 2 above.

Yes, there are different forms in which a company can give away dividends to its shareholders....It can be in different forms. What is Dividend? Types of Dividend. Cash Dividend. Stock Dividend / Bonus. Stock Repurchase. Property Dividend. Scrip Dividend.Conclusion.

Under Internal Revenue Code (IRC) Section 871(m) and the final regulations, a dividend equivalent is treated as a dividend from sources within the United States for purposes of taxing and withholding at source on nonresident alien individuals, foreign corporations and foreign organizations.