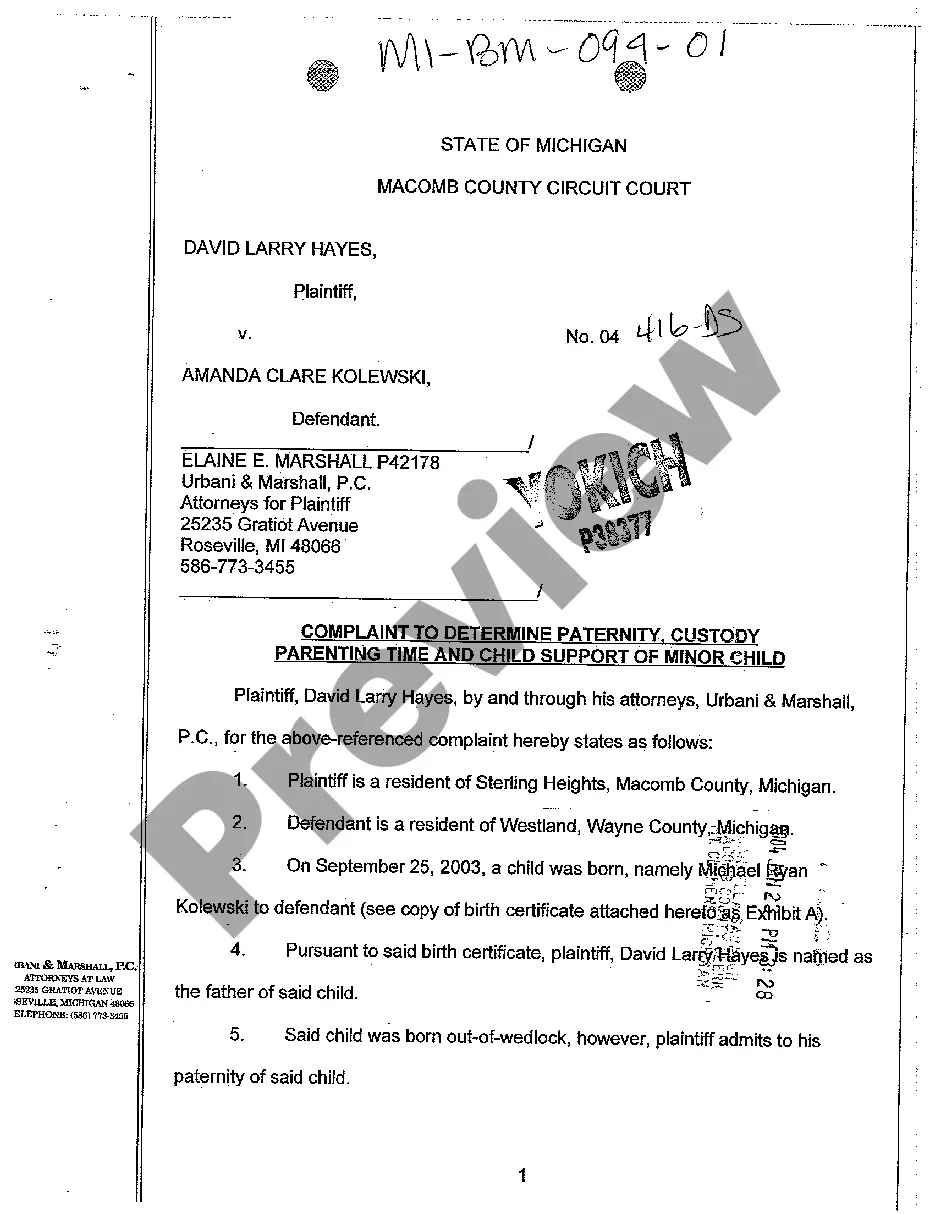

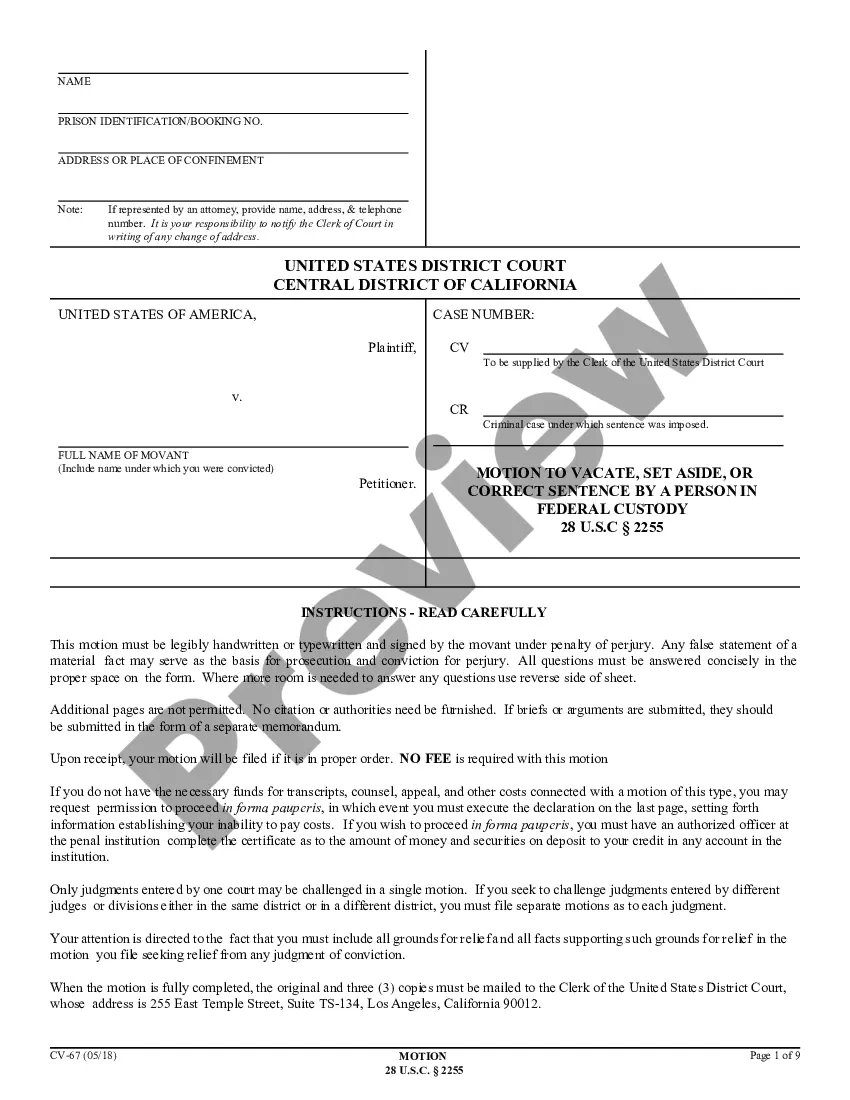

Phoenix Arizona Dividend Equivalent Shares are a type of financial investment that offer individuals the opportunity to receive dividend payments similar to stockholders, even if they do not directly own stocks in a particular company. These shares are designed to provide individuals with similar benefits as those who hold stocks, allowing them to participate in the profits generated by a company. Dividend Equivalent Shares, also known as Dividend Equivalent Rights or Hers, are a derivative instrument that allows investors to mimic the cash flows received by stockholders. They are particularly attractive to individuals who want to earn dividends without actually owning shares or to those who find it challenging to directly purchase stocks. These shares function as a contractual agreement between the investor and the company, entitling the investor to receive a proportional dividend payment as if they were a stockholder. It is important to note that Phoenix Arizona Dividend Equivalent Shares are not actual shares of stock. They are solely a mechanism by which individuals can indirectly access the benefits of owning stocks. There are several types of Phoenix Arizona Dividend Equivalent Shares available: 1. Single-Stock Dividend Equivalent Shares: These are dividend equivalent shares offered by a specific company. Investors can select a particular stock and purchase dividend equivalent shares to receive dividends similar to stockholders of that specific company. 2. Index Dividend Equivalent Shares: These shares are based on the performance of an index, such as the S&P 500 or NASDAQ. Investors can buy dividend equivalent shares that track the performance of the index and receive dividend payments accordingly. 3. Dividend Equivalent Exchange-Traded Funds (ETFs): These are ETFs that track a basket of dividend-paying stocks. Investors can purchase dividend equivalent ETFs to gain exposure to a diversified portfolio of stocks and receive dividend payments based on the collective performance of the underlying assets. Phoenix Arizona Dividend Equivalent Shares offer a unique opportunity for investors to indirectly participate in the dividend income generated by stocks. They provide individuals with a flexible and accessible means to earn dividends without the complexities involved in stock ownership. By offering different types of dividend equivalent shares, investors can choose the type that best aligns with their investment goals and risk preferences.

Phoenix Arizona Dividend Equivalent Shares

Description

How to fill out Phoenix Arizona Dividend Equivalent Shares?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, finding a Phoenix Dividend Equivalent Shares suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Phoenix Dividend Equivalent Shares, here you can find any specific document to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Phoenix Dividend Equivalent Shares:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Phoenix Dividend Equivalent Shares.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!