Hennepin Minnesota Proposal to Ratify the Prior Grant of Options to Each Director to Purchase Common Stock The Hennepin Minnesota Proposal aims to ratify the prior grant of options to each director, allowing them to purchase common stock. This proposal is critical for ensuring transparency and proper governance within the organization. By ratifying these options, the directors can exercise their rights to obtain shares of common stock, thus aligning their interests with those of the company and its shareholders. Some key keywords relevant to this proposal include: 1. Hennepin Minnesota: Referring to the specific jurisdiction and location where this proposal is being put forth. 2. Proposal: Denoting the formal suggestion to ratify the granting of options to the directors. 3. Ratify: Indicating the act of officially approving or confirming the prior grant of options. 4. Prior Grant: Relating to the earlier issuance of options to the directors, which is now being reviewed and sanctioned. 5. Options: Describing the financial derivative instruments that grant the right (but not the obligation) to purchase common stock at a predetermined price within a specified timeframe. 6. Directors: Signifying the individuals holding positions on the board of directors, responsible for making crucial decisions on behalf of the company. 7. Purchase: Expressing the act of acquiring or buying. 8. Common Stock: Representing equity ownership in the company, usually available to the public and providing voting rights and potential dividends. It is important to note that while the main focus of the proposal is to ratify the prior grant of options, there might be specific types of Hennepin Minnesota Proposals within this context. These categories can include amendments to the grant terms, such as increasing or decreasing the number of options awarded, altering the exercise price, or modifying the vesting schedule. The specific types, if any, would depend on the details of the proposal being presented in Hennepin Minnesota.

Hennepin Minnesota Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

How to fill out Hennepin Minnesota Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

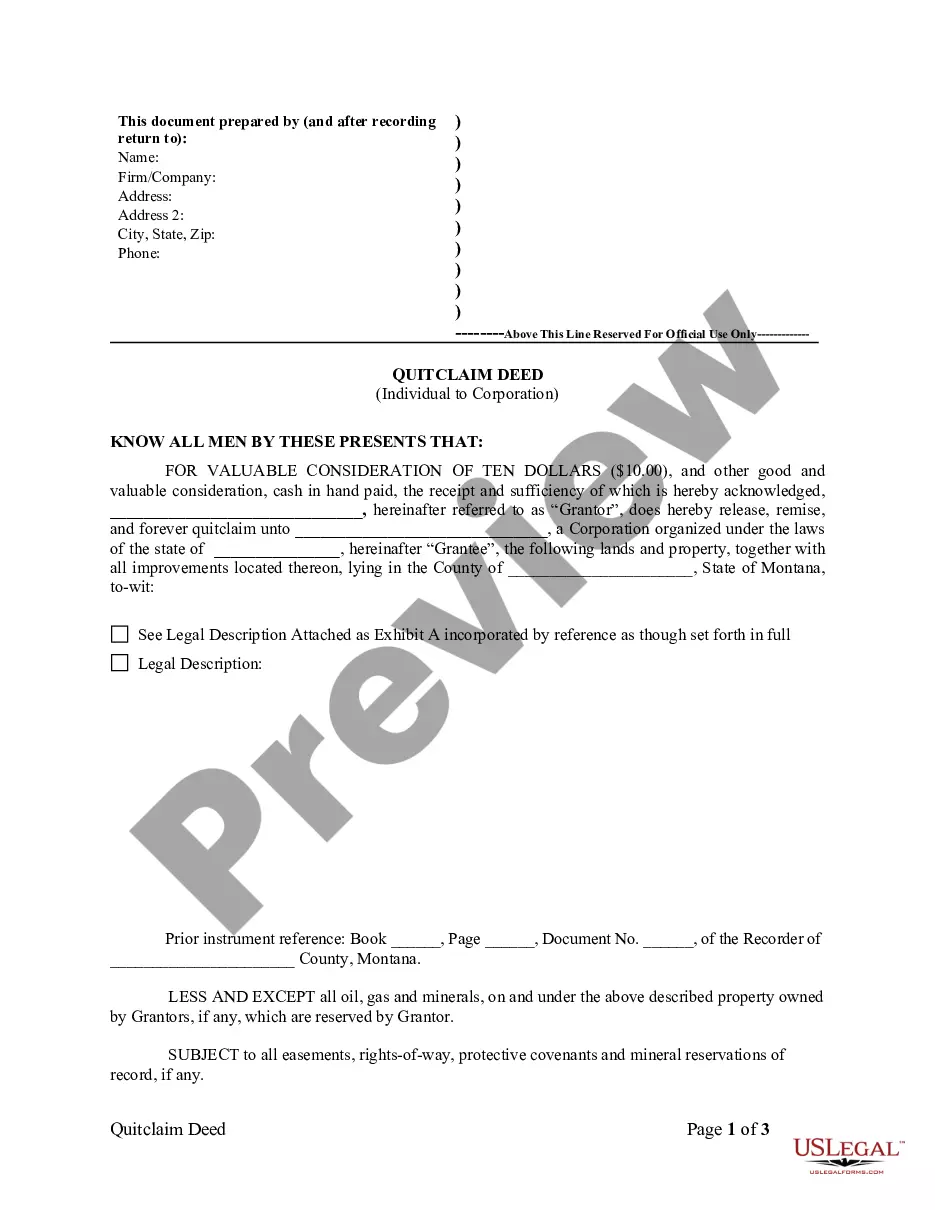

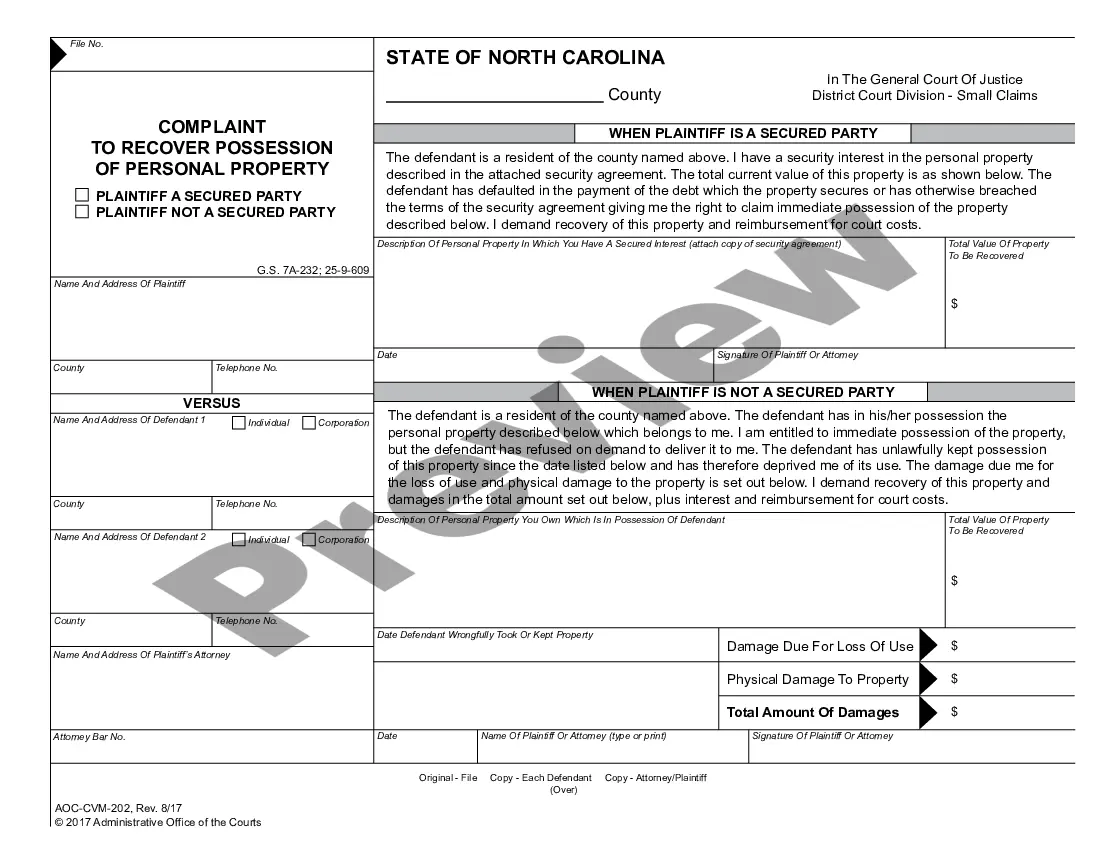

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Hennepin Proposal to ratify the prior grant of options to each directors to purchase common stock, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any activities related to paperwork execution simple.

Here's how to locate and download Hennepin Proposal to ratify the prior grant of options to each directors to purchase common stock.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Hennepin Proposal to ratify the prior grant of options to each directors to purchase common stock.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Hennepin Proposal to ratify the prior grant of options to each directors to purchase common stock, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to cope with an exceptionally challenging case, we recommend using the services of an attorney to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!

Form popularity

FAQ

S corporations can issue both incentive stock options and non-qualified stock options to employees, consultants, advisors and other service providers.

Yes, companies can absolutely offer stock options to their contractors, but contractors need to consider how the vesting, taxation, financial planning, and investment management related to the stock options fit into their personal financial plan.

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

An incentive stock option must be granted within 10 years from the date that the plan under which it is granted is adopted or the date such plan is approved by the stockholders, whichever is earlier. To grant incentive stock options after the expiration of the 10-year period, a new plan must be adopted and approved.

Your employer is not required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs. The acronym NSO is also used. These do not qualify for special tax treatment.

Under the said Rules, ESOPs can be issued only to the employees of an unlisted private limited company.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don't pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares.