The Wayne, Michigan Proposal aims to seek approval for the ratification of the previous grant of options to each director to purchase common stock. This proposal is essential for ensuring transparency, accountability, and alignment of interests between the directors and shareholders within the company. The ratification of options grants provides directors with the opportunity to purchase a predetermined number of common stocks at a specified price (exercise price). These options are typically granted to directors as a form of incentive, encouraging them to contribute to the company's growth and success. By approving this proposal, shareholders are acknowledging and endorsing the prior grants of options to directors, affirming their confidence in the directors' abilities to drive the company's performance. This resolution also enables directors to hold a stake in the company, aligning their interests with the long-term success of the shareholders. It is important to note that there might be different types of proposals encompassed under the Wayne, Michigan Proposal to ratify the prior grant of options to each director to purchase common stock. These may include: 1. Option Grant Ratification for Non-Executive Directors: This type of proposal specifically outlines the ratification of options granted to non-executive directors, who contribute valuable guidance and expertise to the company's strategic decisions. 2. Option Grant Ratification for Executive Directors: This proposal pertains to the ratification of options granted to executive directors who hold key leadership roles within the company, actively involved in its day-to-day operations and management. 3. Option Grant Ratification for Independent Directors: Independent directors, who bring an unbiased perspective and oversight to the company, might have their own separate proposal seeking ratification of their option grants. 4. Option Grant Ratification with Performance-Based Criteria: In some cases, options may be granted to directors based on achieving specific performance targets or milestones. This type of proposal ensures that the grants are ratified only if these predefined targets are met, reinforcing a pay-for-performance philosophy. In conclusion, the Wayne, Michigan Proposal to ratify the prior grant of options to each director to purchase common stock is crucial for supporting equitable incentives and fostering a sense of ownership among the directors. Shareholders play a significant role in approving these grants, ensuring alignment of interests and promoting the long-term success of the company.

Wayne Michigan Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

How to fill out Wayne Michigan Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life situation, finding a Wayne Proposal to ratify the prior grant of options to each directors to purchase common stock meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Aside from the Wayne Proposal to ratify the prior grant of options to each directors to purchase common stock, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Wayne Proposal to ratify the prior grant of options to each directors to purchase common stock:

- Check the content of the page you’re on.

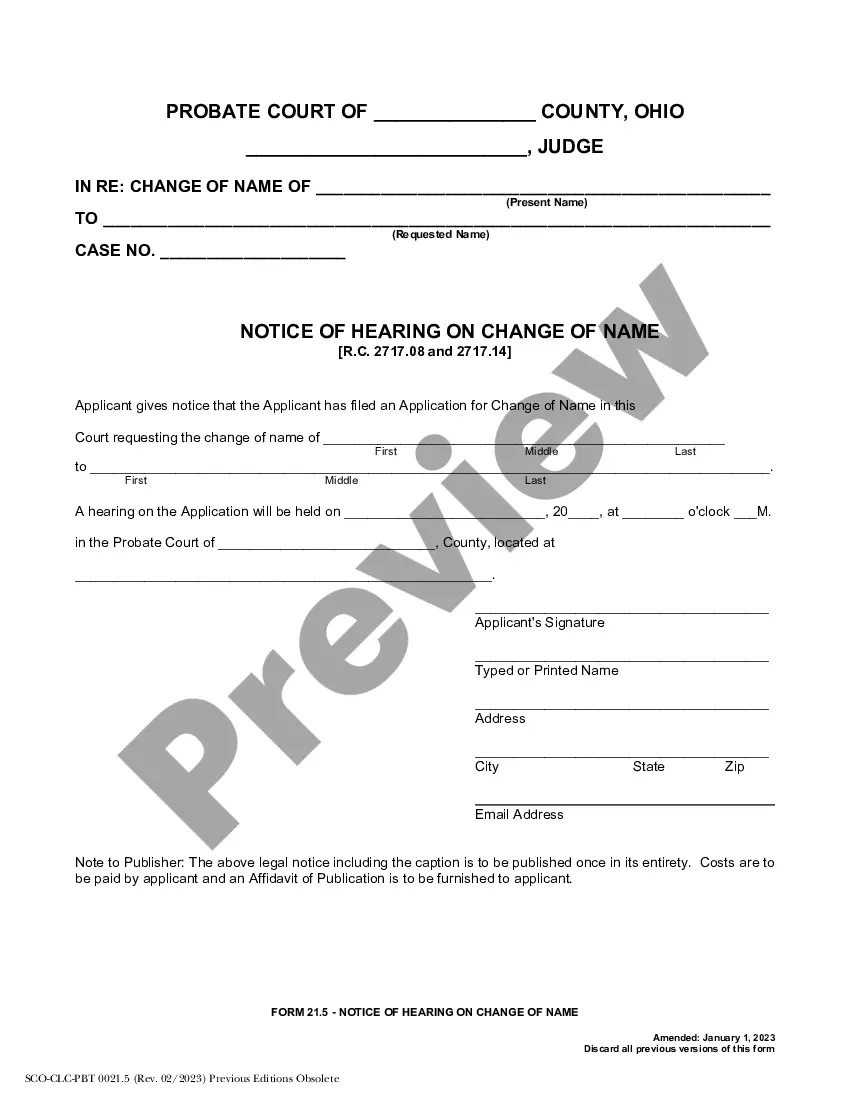

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Proposal to ratify the prior grant of options to each directors to purchase common stock.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!