San Bernardino California Stock Option Agreement of Full House Resorts, Inc., is a legal contract that grants employees or certain individuals the right to purchase a specific number of shares of Full House Resorts, Inc. stock at a predetermined price within a set period of time. Full House Resorts, Inc. is a publicly traded company that operates and manages casinos, resorts, and other entertainment properties in various locations, including San Bernardino, California. As part of the compensation package offered to key employees or directors, the company may offer stock options to incentivize and retain talent. The San Bernardino California Stock Option Agreement of Full House Resorts, Inc. outlines the terms and conditions of the stock options, including the quantity of shares, exercise price, vesting schedule, expiration date, and any restrictions or conditions attached to the options. The stock options granted under the agreement may be classified into different types, depending on their purpose or intended recipient. Some common types of stock options offered by Full House Resorts, Inc. may include: 1. Employee Stock Options: These options are typically granted to employees of Full House Resorts, Inc. as part of their compensation and may be subject to a vesting period before they can be exercised. 2. Director Stock Options: Full House Resorts, Inc. may also offer stock options to members of its board of directors. These options serve as a means to align the interests of directors with the company's shareholders. 3. Incentive Stock Options (SOS): SOS are a type of stock option that carries certain tax advantages for the recipient. These options have specific requirements and are often granted to employees in order to encourage long-term commitment and loyalty. 4. Non-Qualified Stock Options (Nests): Nests are stock options that do not qualify for the same tax advantages as SOS. They are often granted to employees, consultants, or contractors and can provide flexibility in terms of exercise price and timing. The San Bernardino California Stock Option Agreement of Full House Resorts, Inc. ensures that the stock options granted are in compliance with applicable laws and regulations, particularly regarding stock-based compensation plans. It also protects the interests of both the company and the option holders by clearly defining the rights and obligations of each party. It is important for individuals who receive stock options to carefully review the agreement, seek legal or financial advice if necessary, and fully understand the terms and implications before accepting or exercising the options.

San Bernardino California Stock Option Agreement of Full House Resorts, Inc.

Description

How to fill out San Bernardino California Stock Option Agreement Of Full House Resorts, Inc.?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Bernardino Stock Option Agreement of Full House Resorts, Inc., it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the recent version of the San Bernardino Stock Option Agreement of Full House Resorts, Inc., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Bernardino Stock Option Agreement of Full House Resorts, Inc.:

- Look through the page and verify there is a sample for your area.

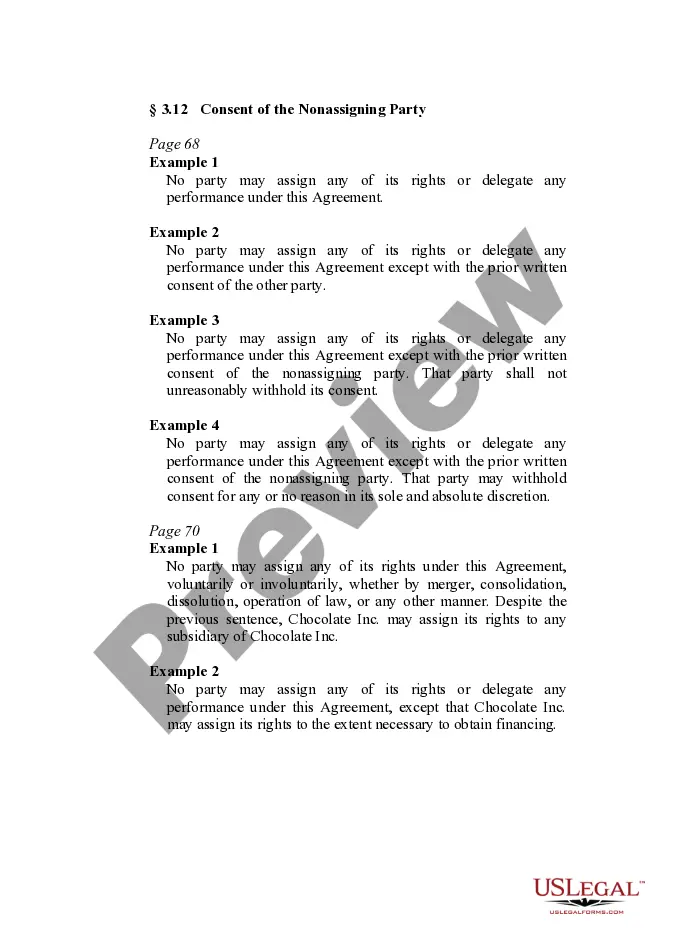

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your San Bernardino Stock Option Agreement of Full House Resorts, Inc. and download it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!