The Alameda California Stock Option Plan is a comprehensive program offered by Stewart Information Services Corp. specifically designed for their Region Managers. This plan serves as a valuable incentive for managers to drive performance, promote stakeholder engagement, and align their interests with those of the company. By providing stock options, Stewart Information Services Corp. empowers Region Managers to actively participate in the company's growth and success. Key features of the Alameda California Stock Option Plan for Region Managers include: 1. Stock Options Allocation: Under this plan, Region Managers are granted a predetermined number of stock options based on their level of responsibility, tenure, and performance within the company. 2. Vesting Schedule: Stock options typically vest over a specific period, encouraging long-term commitment and loyalty from the Region Managers. Vesting schedules may vary based on specific terms outlined in the plan. 3. Exercise Price: The stock options are usually offered at a predetermined exercise price, allowing Region Managers to buy company shares at a favorable price when they choose to exercise their options. 4. Exercising Options: Once vested, Region Managers have the flexibility to exercise their stock options at their discretion. This means they can purchase company shares at the agreed exercise price and potentially profit from any increase in stock value in the future. 5. Stock Ownership: When Region Managers exercise their stock options, they become shareholders of Stewart Information Services Corp., aligning their interests with the company's long-term success. 6. Additional Benefits: In addition to stock options, the Alameda California Stock Option Plan of Stewart Information Services Corp. may include other benefits and rewards to further enhance the value proposition for Region Managers. These benefits can vary and might be detailed individually within the plan. It is important to note that specific terms and conditions of the Alameda California Stock Option Plan for Region Managers may vary depending on the company's policies and agreements. These variations could include different vesting periods, exercise price mechanisms, and other unique features tailored to meet the needs of the Region Managers. In conclusion, the Alameda California Stock Option Plan of Stewart Information Services Corp. offers Region Managers the opportunity to share in the success of the company through stock ownership. By implementing this incentivized program, Stewart Information Services Corp. aims to foster employee dedication, drive performance, and retain key talent crucial for their continued growth and profitability.

Alameda California Stock Option Plan of Stewart Information Services Corp. for Region Managers

Description

How to fill out Alameda California Stock Option Plan Of Stewart Information Services Corp. For Region Managers?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Alameda Stock Option Plan of Stewart Information Services Corp. for Region Managers, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Alameda Stock Option Plan of Stewart Information Services Corp. for Region Managers from the My Forms tab.

For new users, it's necessary to make some more steps to get the Alameda Stock Option Plan of Stewart Information Services Corp. for Region Managers:

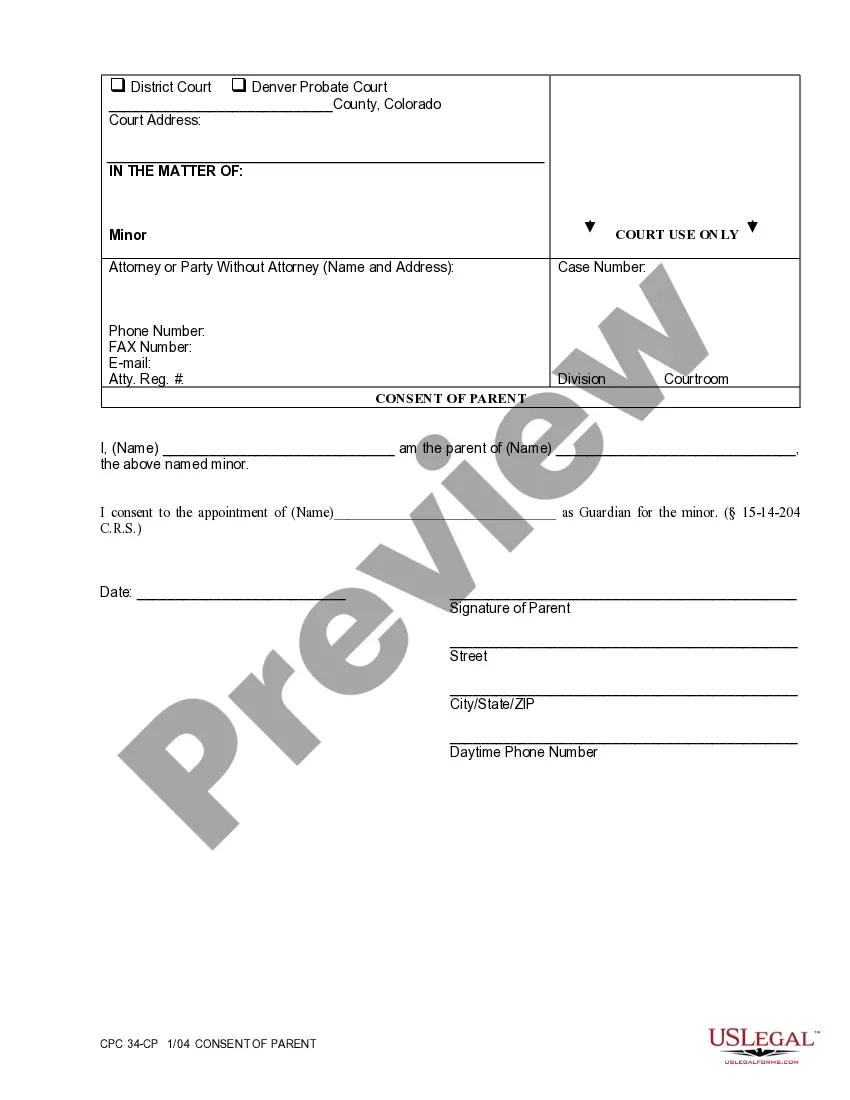

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ESOPs give the sponsoring companythe selling shareholderand participants various tax benefits, making them qualified plans.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

As an example, an employee may be granted an option to purchase 2,000 shares of the employer's stock at $100 per share. This is referred to as the strikeor exercise-price. The employee will be unable to exercise the options until they are considered to be vested.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Employee stock options are the right given to an employee of a public or private company to purchase shares of the company at a given price (Strike Price or Exercise Price).

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company; this interest takes the form of shares of stock. ESOPs give the sponsoring companythe selling shareholderand participants various tax benefits, making them qualified plans.

Research by the Department of Labor shows that ESOPs not only have higher rates of return than 401(k) plans and are also less volatile. ESOPs lay people off less often than non-ESOP companies. ESOPs cover more employees, especially younger and lower income employees, than 401(k) plans.

A. All employees who receive stock options of the Company must keep the matter confidential without inquiring other employees for information or disclosing related information to others, including but not limited to the quantity of options received and the interest related thereof.