Houston Texas Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd serves as a legally binding document that outlines the rights and obligations pertaining to stock options granted by Shore wood Packaging Corp. to Jefferson Capital Group, Ltd. This agreement grants Jefferson Capital Group the option to purchase a predetermined number of shares of Shore wood Packaging Corp.'s stock at a future date and at a specified price. The Houston Texas Stock Option Agreement is a comprehensive contract that sets forth the terms, conditions, and mechanisms governing the stock options exchanged between the parties involved. It covers crucial elements, such as exercise price, vesting period, expiration date, and any potential restrictions or conditions associated with the stock options. The agreement encompasses various types of stock options, including: 1. Incentive Stock Options (SOS): This type of stock option is subject to specific rules and regulations outlined by the Internal Revenue Code (IRC). SOS provide tax advantages to the recipient when exercised, but they also require adherence to certain conditions, such as holding the acquired shares for a specific duration. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not qualify for the same tax benefits. They offer greater flexibility as they are not subject to the same restrictions and requirements as SOS. 3. Performance-Based Stock Options: These options are contingent on achieving predetermined performance criteria. They may be tied to financial metrics, such as revenue growth or earnings per share, or other corporate objectives. Such options help align the interests of Jefferson Capital Group with the performance of Shore wood Packaging Corp. Additionally, the Houston Texas Stock Option Agreement may include provisions related to the acceleration of vesting, change of control clauses, and post-termination exercise periods. These provisions address potential scenarios such as company mergers, acquisitions, or the departure of key individuals involved in the agreement. Overall, the Houston Texas Stock Option Agreement between Shore wood Packaging Corp. and Jefferson Capital Group, Ltd serves to establish a framework for the issuance and exercise of stock options, ensuring both parties understand their rights and responsibilities. It aims to incentivize and reward Jefferson Capital Group's involvement and contributions while aligning their interests with the long-term success of Shore wood Packaging Corp.

Houston Texas Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd

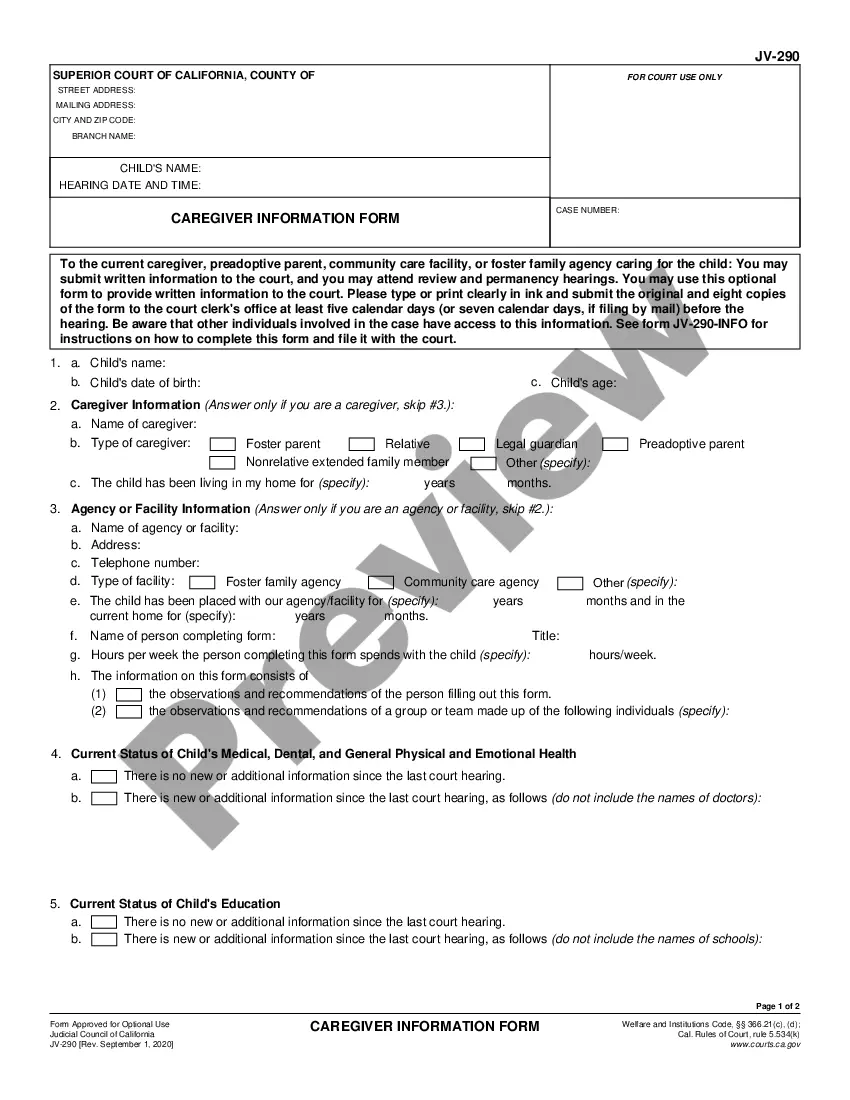

Description

How to fill out Houston Texas Stock Option Agreement Between Shorewood Packaging Corp. And Jefferson Capital Group, Ltd?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Houston Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Houston Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Houston Stock Option Agreement between Shorewood Packaging Corp. and Jefferson Capital Group, Ltd:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!