Alameda California Approval of Director Warrants: A Comprehensive Overview In Alameda, California, the process of approving director warrants is a significant part of corporate governance. Director warrants are a type of financial instrument granted to board members, allowing them to purchase company stock at a predetermined price within a specified period. This detailed description aims to provide a comprehensive understanding of Alameda California's approval process for director warrants, encompassing its significance, types, and relevant keywords. Significance of Alameda California Approval of Director Warrants: The approval of director warrants in Alameda, California is crucial for ensuring fair compensation, incentivizing board members' performance, and aligning their interests with the success of the company. Director warrants enable directors to participate in a company's long-term growth and financial success, further motivating them to make strategic decisions that drive value for stakeholders. Types of Alameda California Approval of Director Warrants: 1. Non-Qualified Director Warrants: These are director warrants that do not qualify for favorable tax treatment and are subject to income tax upon exercise. Non-qualified director warrants provide flexibility in terms of pricing and grant date, making them attractive for compensating directors. 2. Incentive Director Warrants: Incentive director warrants, also known as qualified stock options, offer tax advantages to directors by allowing preferential tax treatment upon exercise. These warrants must adhere to specific Internal Revenue Service (IRS) guidelines and limitations to qualify for this tax treatment. 3. Restricted Director Warrants: Restricted director warrants come with certain limitations or vesting schedules that regulate when a director can exercise or sell the warrants. These restrictions are often time-based or tied to specific performance goals, promoting accountability and long-term commitment from board members. 4. Performance-based Director Warrants: Performance-based director warrants are granted based on predetermined performance criteria such as revenue targets, profitability goals, or stock price appreciation. The exercise of these warrants is contingent upon the directors' successful achievement of specified milestones, incentivizing exceptional performance. Relevant Keywords: — Alameda California director warrant— - Director warrant approval process — Alameda corporatgovernancenc— - Compensation for board members — Tax implications of director warrant— - Qualified vs. non-qualified warrants — Incentive director warrant— - Restricted director warrants — Performance-based director warrant— - Board of directors compensation — Corporate stock options in Alameda Understanding the approval process and various types of director warrants in Alameda, California is pivotal for companies operating in the region. By implementing effective approval systems and choosing the right type of director warrant, businesses can attract and retain talented directors who are driven to contribute to their long-term success.

Alameda California Approval of director warrants

Description

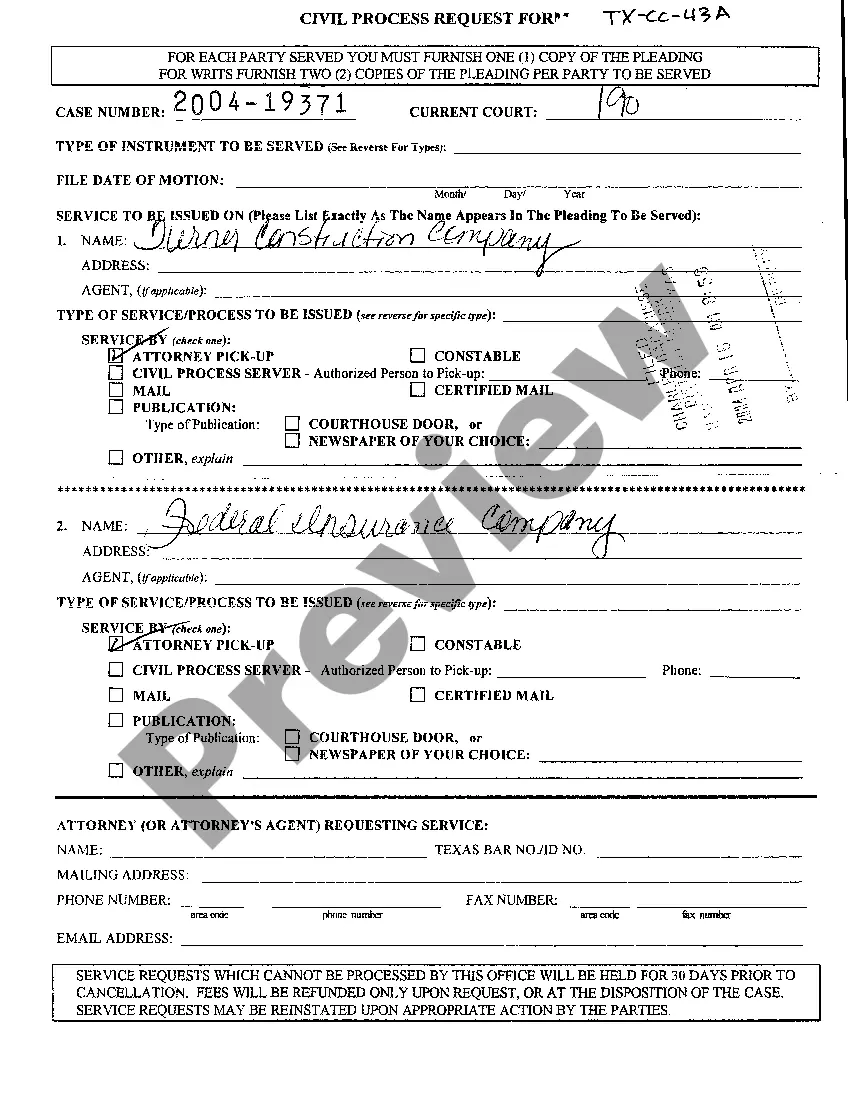

How to fill out Alameda California Approval Of Director Warrants?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Alameda Approval of director warrants is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Alameda Approval of director warrants. Adhere to the guide below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Approval of director warrants in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!

Form popularity

FAQ

If you aren't sure which department to contact, contact the County Operator at 510.208. 9770 or visit the contact us page.

If you want to know if you have a warrant, please call the JCSO Warrants Unit at 303-271-6475 or visit . You can turn yourself in on any day of the week and at any time.

Go to your local police department or sheriff's station. They can conduct a search to see if you have a warrant.

WARRANT CHECK FORM When you need a fast, reliable and up to date no cost warrant search in Alameda, then we are the go-to company. To find out if you have a warrant taken out in your name, fill out the form on this page, give us a call at (408)298-3333. You can also visit us at 595 Park Avenue, San Jose, CA 95110.

Stale Dated Warrants. Definition. A Stale Dated Warrant is any warrant issued by the County that is not presented for payment within six months after its original issuance date therefore becomes stale.

Melissa Wilk is directly responsible for managing all staff and operations of the Auditor-Controller/Clerk-Recorder, including: Issue more than $2 billion in payments to over 13,000 vendors. Levy and apportion property taxes of more than $3 billion to over 80,000 jurisdictions.

The best way to search for a warrant in California is to go to the city, county, or California state government website where you think the warrant exists. Note that you will need to visit the official government site. Official government websites end in .

The Auditor-Controller is the chief accounting officer of the county responsible for budget control, disbursements and receipts, and financial reporting. In addition, this office is responsible for audits of certain agencies within the county.

When reading statute, a warrant is an order to pay issued by the Auditor to the Treasurer to give to the payee money from the County Treasury. The check is financial instrument directing the bank or financial institution to take money from the payers account and issue to the payee on the check.