Franklin Ohio Approval of Director Warrants Overview: The Franklin Ohio approval of director warrants is a process that allows the board of directors to grant warrants to directors of a company, providing them with the right to purchase company shares at a specified price in the future. These warrants are typically offered as compensation or incentives to directors, aligning their interests with the long-term success of the company. Types of Franklin Ohio Approval of Director Warrants: 1. Stock Option Warrants: Stock option warrants are the most common type of director warrants issued in Franklin Ohio. These warrants give directors the right to purchase company stock at a predetermined price, known as the exercise price, within a specified timeframe. Once exercised, directors may choose to hold the shares as an investment or sell them on the open market. 2. Restricted Stock Warrants: Restricted stock warrants provide directors with the right to purchase company shares; however, these shares are subject to certain restrictions. Directors must satisfy specific performance metrics or tenure requirements before exercising the warrants. These warrants encourage directors to actively contribute to the company's growth and enhance their commitment to shareholder value. 3. Performance-Based Warrants: Performance-based warrants are tied to the achievement of predetermined performance goals set by the board of directors. These goals may include financial targets, such as revenue growth or profitability, or non-financial objectives like market share expansion or innovation milestones. Directors can exercise these warrants only if the set performance criteria are met, reinforcing their responsibility for driving the company's success. 4. Non-Qualified Stock Warrants: Non-qualified stock warrants are a type of director warrant that differs from traditional stock options regarding tax treatment. These warrants are often offered at a discount to market price and subject to income tax upon exercise. Directors need to carefully consider the tax implications of exercising non-qualified warrants and consult tax advisors for guidance. 5. Phantom Stock Warrants: Phantom stock warrants are a non-equity form of compensation granted to directors during the Franklin Ohio approval process. Rather than receiving actual shares, directors receive a cash payment equivalent to the appreciation in the company's stock price over a specific period. These warrants prove to be less dilute as they do not involve issuing new shares to directors. In conclusion, the Franklin Ohio approval of director warrants allows the board of directors to award various types of warrants to directors as incentives or compensation. These warrants can include stock options, restricted stock, performance-based warrants, non-qualified stock warrants, or phantom stock warrants. Such warrants serve as valuable tools to attract and retain talented directors while aligning their interests with the long-term success of the company.

Franklin Ohio Approval of director warrants

Description

How to fill out Franklin Ohio Approval Of Director Warrants?

Creating forms, like Franklin Approval of director warrants, to manage your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for a variety of scenarios and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Franklin Approval of director warrants form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Franklin Approval of director warrants:

- Ensure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Franklin Approval of director warrants isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin using our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Go to your local police station The most direct way to find out if there is a warrant for your arrest is to go to a police station and ask. If a warrant has been issued for your arrest, you may be arrested and released on a promise to appear.

The easiest way to find out if you have a warrant in Franklin County is to search the county's municipal court website records. Simply enter your name, case number, or ticket number into the search engine. You can filter search results by name, year of the case, and the status of the warrant.

According to Tennessee law, misdemeanor warrants must be served within five years.

§ 68-120-117 authorizes the issuance of an administrative inspection warrant when an owner or person in charge of premises refuses consent to an inspection to determine compliance with safety codes or ordinances. The building official requesting the warrant must be certified under T.C.A. § 68-120-113.

Log on to the internet and go to the Tennessee Warrants Directory. This directory is part of Tennessee's public records and exists to help individuals find out if there is a warrant out for their arrest.

Finding an outstanding warrant in TN Of course, the easiest way to find out if there are any outstanding arrest warrants against you is to visit or call your local sheriff's or county court office. However, this is also the easiest way to get arrested if it does turn out there's an active warrant against you.

A warrant issued by a judge on the application of an administrative agency. Administrative agencies with enforcement power often seek administrative warrants to check for contraband or other evidence of non-compliance with the law.

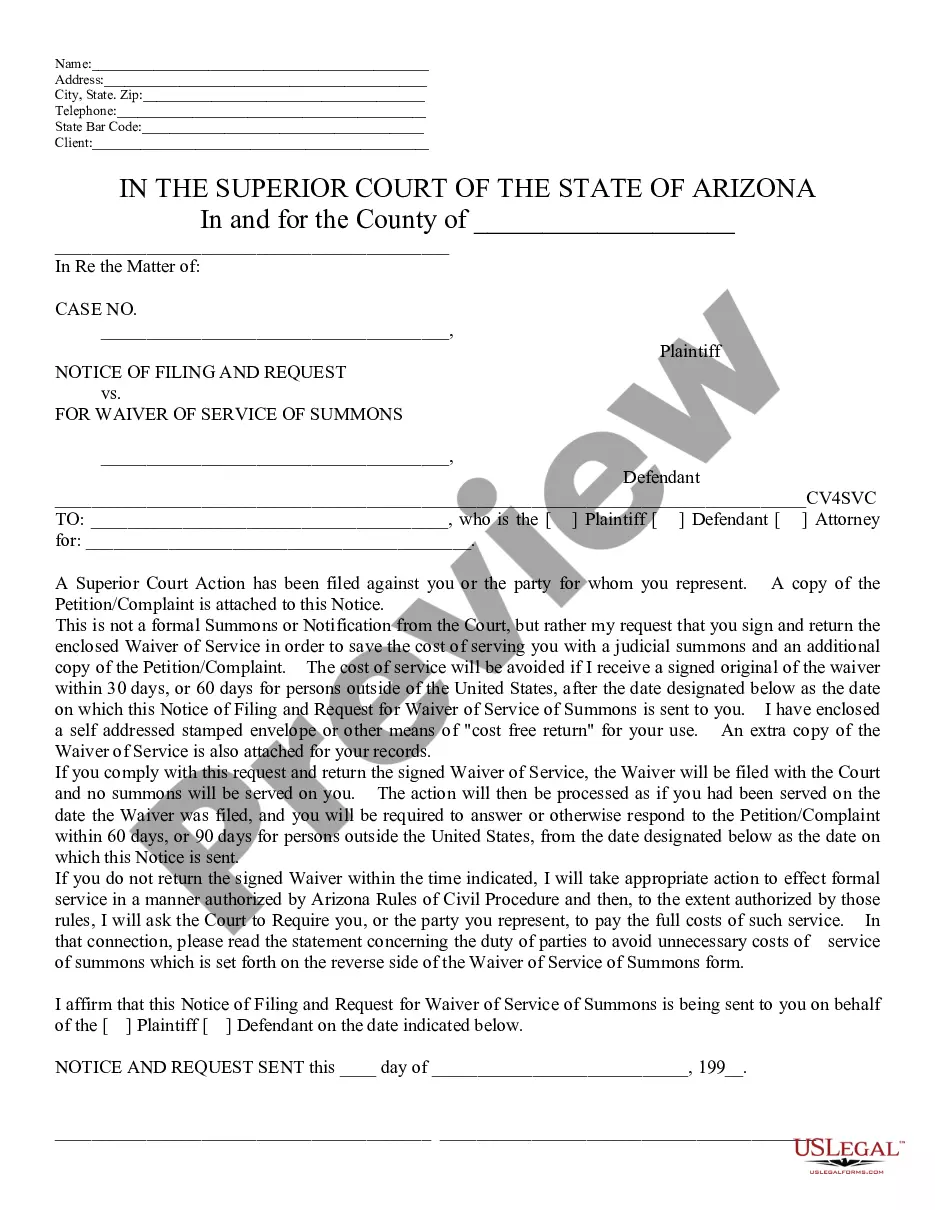

This is a picture of a judicial warrant: An administrative warrant is simply a document signed by an ICE agent, stating that a person is being designated for possible arrest and possible deportation proceedings. An administrative warrant is not signed by a judge, nor does it pass constitutional muster.

Interested parties may contact the court clerk in the county where the warrant was originally issued for information about warrants. Since warrant records are public information, requestors may also visit public databases and websites.

In a misdemeanor case, if a process, warrant, precept or summons has not been served, returned or quashed within five (5) years from the date of its issuance, the process, warrant, precept or summons shall be automatically terminated and removed from the records.