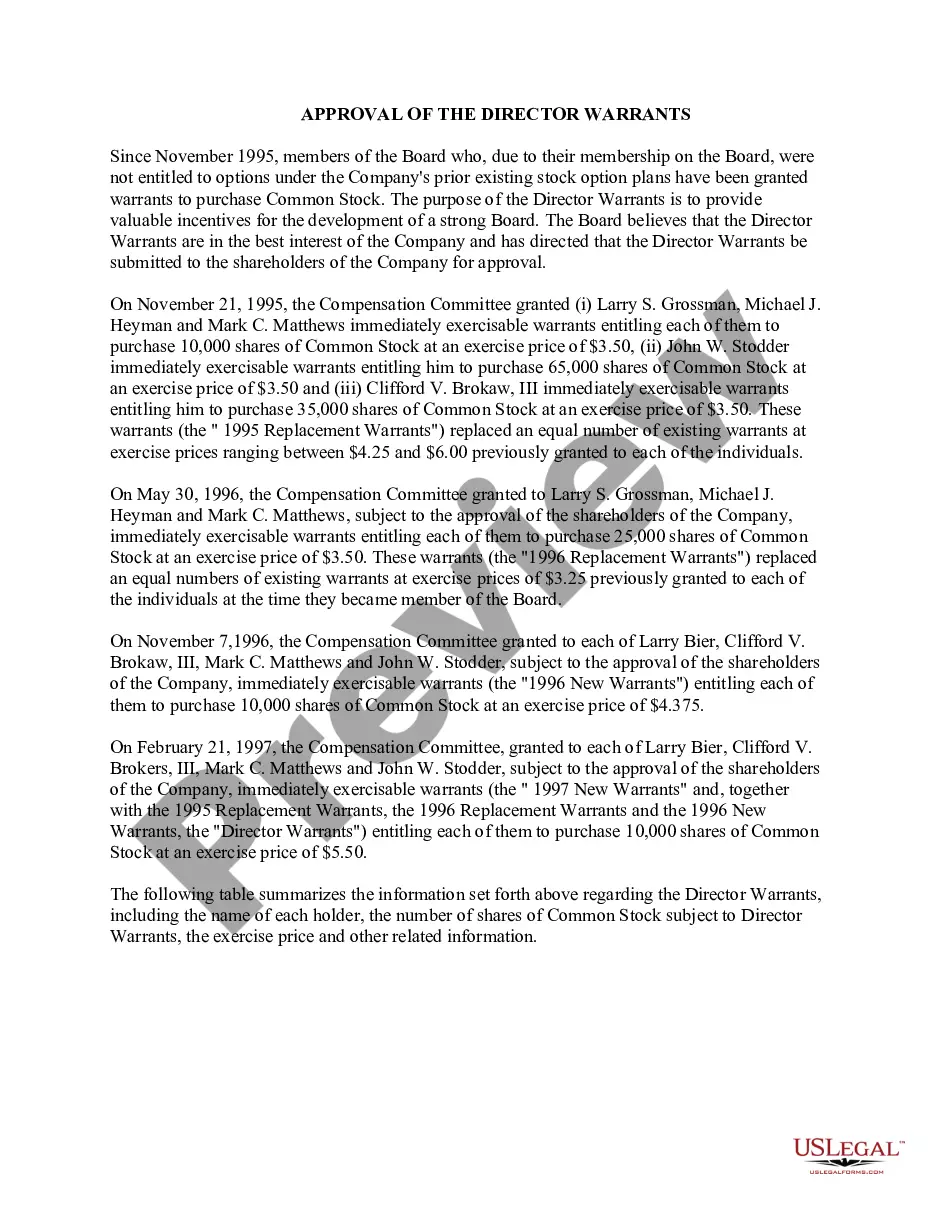

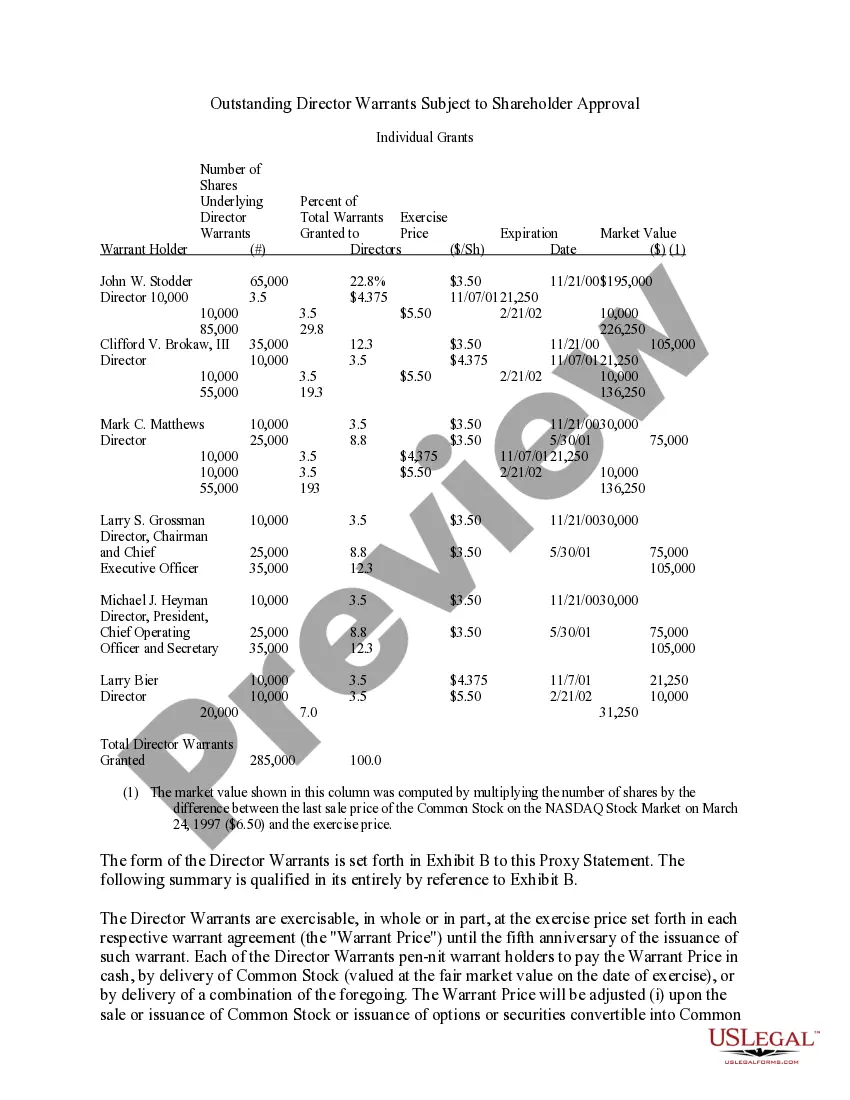

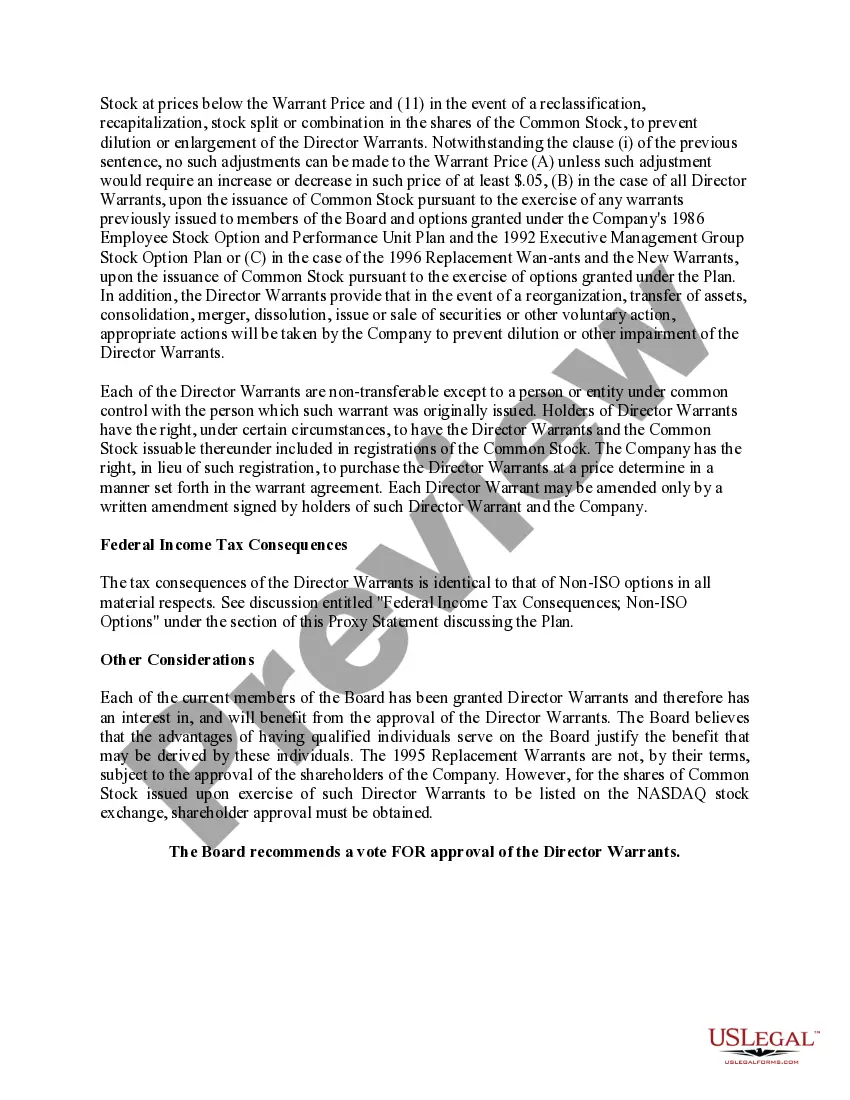

Phoenix, Arizona Approval of Director Warrants: A Comprehensive Guide Introduction: In Phoenix, Arizona, approval of director warrants is an essential aspect of corporate governance. Director warrants grant company directors the right to purchase additional shares of company stock at a predetermined price and within a specific time frame. This guide provides a detailed description of what Phoenix Arizona Approval of Director Warrants entails, and highlights various types of director warrants applicable in this jurisdiction. Explore the following sections to gain a comprehensive understanding of this topic. 1. Understanding Director Warrants: Director warrants are essentially financial instruments that offer corporate directors the option to purchase a specified number of shares at a predetermined price (exercise price) for a predetermined period. This option can be valuable as it enables directors to capitalize on potential future gains in the company's stock value. 2. Role of Phoenix, Arizona in Approval of Director Warrants: Phoenix, being the capital of Arizona, follows state laws governing director warrants. Among various legal provisions, the Arizona Revised Statutes (AS) play a crucial role in regulating the issuance, approval, and exercise of director warrants within the jurisdiction. 3. Types of Director Warrants in Phoenix, Arizona: a) Non-Qualified Director Warrants: Non-qualified director warrants are granted at a price below the current market value of the company's stock. These warrants are subject to ordinary income tax rates at the time of exercise, and the difference between the exercise price and the fair market value of the shares is taxable as compensation. b) Incentive Director Warrants: Incentive director warrants, also known as qualified stock options, are granted to directors in a manner that meets specific eligibility requirements outlined by the Internal Revenue Service (IRS). These warrants provide potential tax advantages to the director by allowing them to receive long-term capital gains treatment upon exercise. 4. Approval Process for Director Warrants: a) Board of Directors' Approval: The board of directors, typically through a majority vote, approves the granting of director warrants. The decision is based on evaluating the individual's contribution to the company, past performance, and the potential for future contributions. b) Shareholder Approval: In some cases, shareholder approval might be necessary for director warrants, especially if a substantial number of new shares are being issued. This process ensures transparency and aligns the interests of key stakeholders. 5. Exercise and Vesting of Director Warrants: Once approved, directors can exercise their warrants by purchasing shares at the predetermined exercise price. Directors may be subject to vesting requirements, which means they must remain with the company for a specific period before gaining full ownership of the shares acquired through the warrant exercise. Conclusion: Phoenix, Arizona's approval of director warrants plays a crucial role in corporate governance, ensuring directors' interests are aligned with those of the company and its shareholders. Non-qualified and incentive director warrants are the two main types granted in Phoenix, each with its unique tax implications. Understanding the approval process and rights associated with director warrants ensures compliance with relevant laws and maximizes their benefits for both directors and the organization.

Phoenix Arizona Approval of director warrants

Description

How to fill out Phoenix Arizona Approval Of Director Warrants?

If you need to find a trustworthy legal document provider to obtain the Phoenix Approval of director warrants, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to get and complete various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to search or browse Phoenix Approval of director warrants, either by a keyword or by the state/county the form is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Phoenix Approval of director warrants template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less pricey and more affordable. Set up your first company, arrange your advance care planning, draft a real estate contract, or execute the Phoenix Approval of director warrants - all from the convenience of your sofa.

Sign up for US Legal Forms now!