The Dallas Texas Directors and Distributors Stock Option Plan is a comprehensive and highly beneficial program designed to incentivize and reward key individuals within the company's leadership and distribution ecosystem. This plan enables directors and distributors to own a stake in the company by providing them with various stock options that can be exercised over a specific period of time. One type of Dallas Texas Directors and Distributors Stock Option Plan is the Non-Qualified Stock Option (NO) plan. Under this plan, directors and distributors have the flexibility to purchase company stock at a predetermined exercise price. This price is typically set at the fair market value of the stock at the time the options are granted. Nests do not qualify for special tax treatment, meaning the option holder is subject to regular income tax rates upon exercise. Another type of plan is the Incentive Stock Option (ISO) plan, which offers numerous tax advantages to directors and distributors. SOS are typically only available to key employees and must comply with certain Internal Revenue Service (IRS) regulations. These options can be exercised at a predetermined price, which is often lower than the fair market value of the stock. Upon exercise, the difference between the exercise price and the fair market value is treated as a capital gain, offering potential tax savings. Additionally, there may be variations of the Dallas Texas Directors and Distributors Stock Option Plan, such as a Restricted Stock Unit (RSU) plan. RSS represents a promise to deliver company stock at a future date or upon achievement of specific performance criteria. Once the stock is granted, directors and distributors receive the full value of the stock at the time of vesting, regardless of its market value. RSS may provide flexibility in terms of timing the receipt of stocks, allowing for potential strategic tax planning. The Dallas Texas Directors and Distributors Stock Option Plan is a valuable tool for attracting and retaining top talent while aligning the interests of key individuals with the success of the company. By offering stock options, directors and distributors have the opportunity to share in the company's growth, fostering a sense of ownership and motivation. It is essential for companies to evaluate and structure such plans carefully to ensure compliance with applicable laws, regulations, and accounting standards, and to align with the overall compensation and corporate governance strategies.

Dallas Texas Directors and Distributors Stock Option Plan

Description

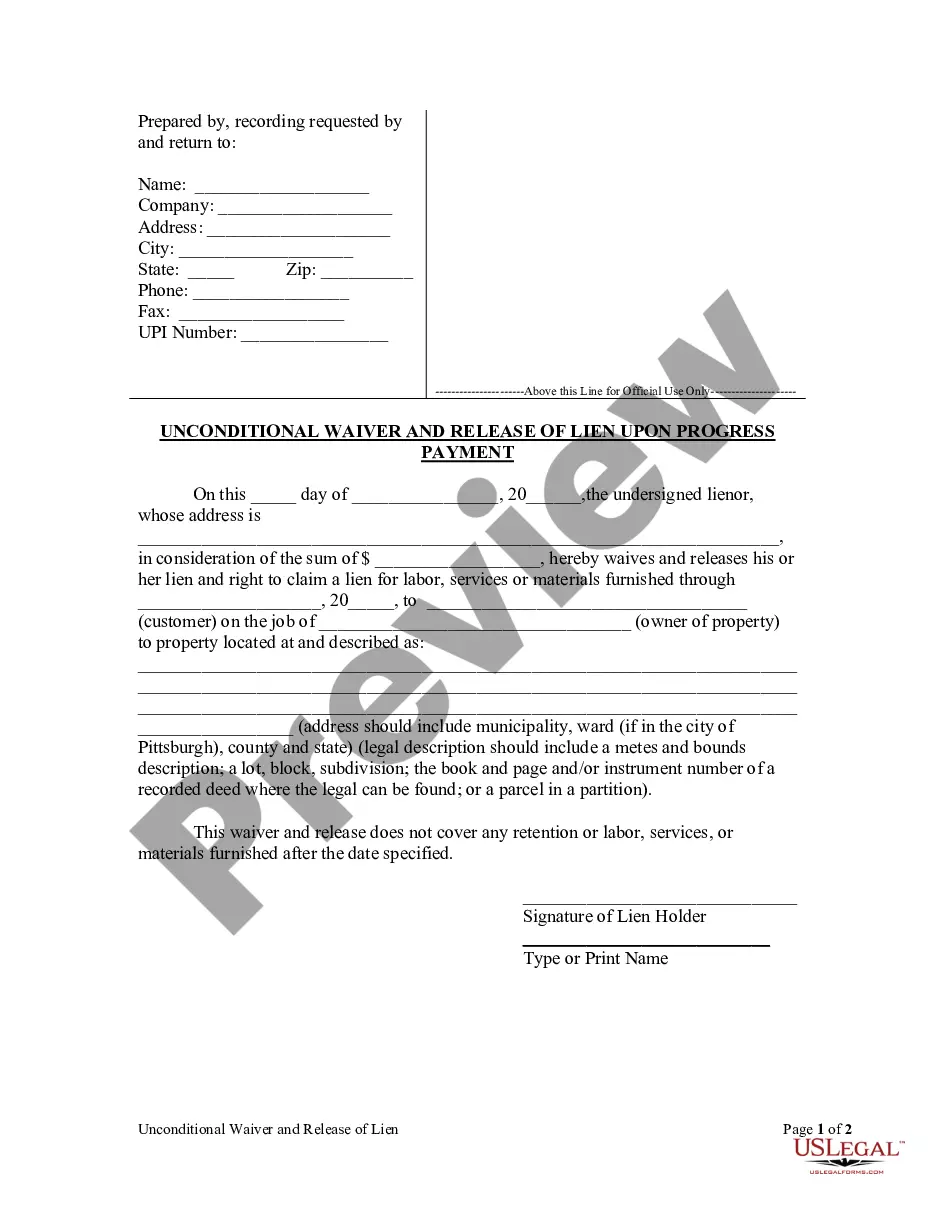

How to fill out Dallas Texas Directors And Distributors Stock Option Plan?

If you need to find a reliable legal paperwork supplier to get the Dallas Directors and Distributors Stock Option Plan, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of supporting resources, and dedicated support make it simple to locate and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Dallas Directors and Distributors Stock Option Plan, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Dallas Directors and Distributors Stock Option Plan template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate agreement, or complete the Dallas Directors and Distributors Stock Option Plan - all from the comfort of your sofa.

Sign up for US Legal Forms now!