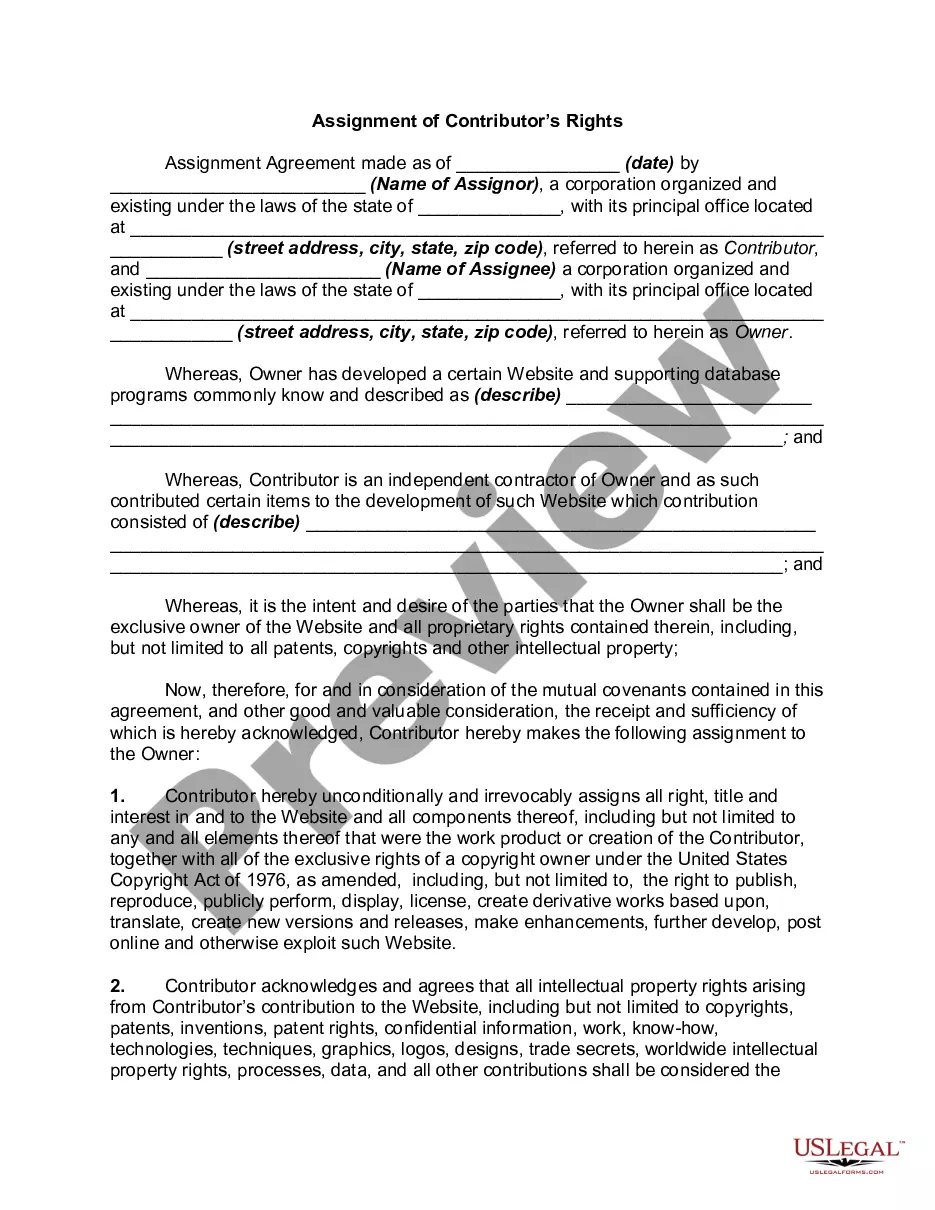

Mecklenburg North Carolina Stock Option Agreement is a legally binding contract between a company and an employee, granting the employee the right to purchase company stock at a predetermined price within a specified time period. This agreement aims to incentivize employees by allowing them to share in the company's ownership and potential future success. Stock options are a popular form of employee compensation, especially in the tech industry and startups, as they provide an opportunity for employees to benefit from the company's growth and value appreciation. Mecklenburg County, located in North Carolina, follows state and federal regulations in the implementation and enforcement of Stock Option Agreements. Key terms and provisions included in a Mecklenburg North Carolina Stock Option Agreement may include: 1. Granting of Options: This section outlines the number of stock options being granted to the employee, along with any vesting schedule or specific conditions that must be met for the options to become exercisable. 2. Exercise Price: The agreement specifies the exercise price, which is the price per share that the employee will pay to purchase the stock options. This price is typically set at or above the current market value of the company's stock at the time of the grant. 3. Exercise Period: The agreement defines the exercise period during which the employee can exercise their options. This period can range from a few years to several years, encouraging long-term commitment and engagement from the employee. 4. Tax Implications: This section addresses the tax implications for the employee upon exercising the stock options. It may include information on the treatment of stock options as ordinary income or capital gains, along with any relevant state and federal tax laws. 5. Termination: The agreement may outline the conditions under which the stock options will terminate, such as upon the employee's resignation, retirement, or termination for cause. Different types of Mecklenburg North Carolina Stock Option Agreements can exist, such as: 1. Incentive Stock Options (SOS): These options are typically granted to employees and offer certain tax advantages. SOS must comply with specific requirements outlined by the Internal Revenue Service (IRS), including a maximum exercise period of ten years and restrictions on the exercise price. 2. Non-Qualified Stock Options (SOS): SOS are another common type of stock option that does not meet the criteria set by the IRS for SOS. The exercise price for SOS may be lower than the fair market value at the time of the grant, which could result in different tax treatment for employees. 3. Restricted Stock Units (RSS): While not technically stock options, RSS are an alternative form of equity compensation. Under an RSU agreement, an employee is granted units that convert into actual shares of company stock at a future date or upon meeting certain conditions. RSS have their own unique terms and conditions, including vesting schedules and potential restrictions. In summary, a Mecklenburg North Carolina Stock Option Agreement is a contract that outlines the terms and conditions for granting stock options to employees. The agreement may vary depending on the type of options granted, such as SOS, SOS, or RSS, and encompasses key aspects such as grant details, exercise price, exercise period, tax implications, and termination conditions.

Mecklenburg North Carolina Stock Option Agreement

Description

How to fill out Mecklenburg North Carolina Stock Option Agreement?

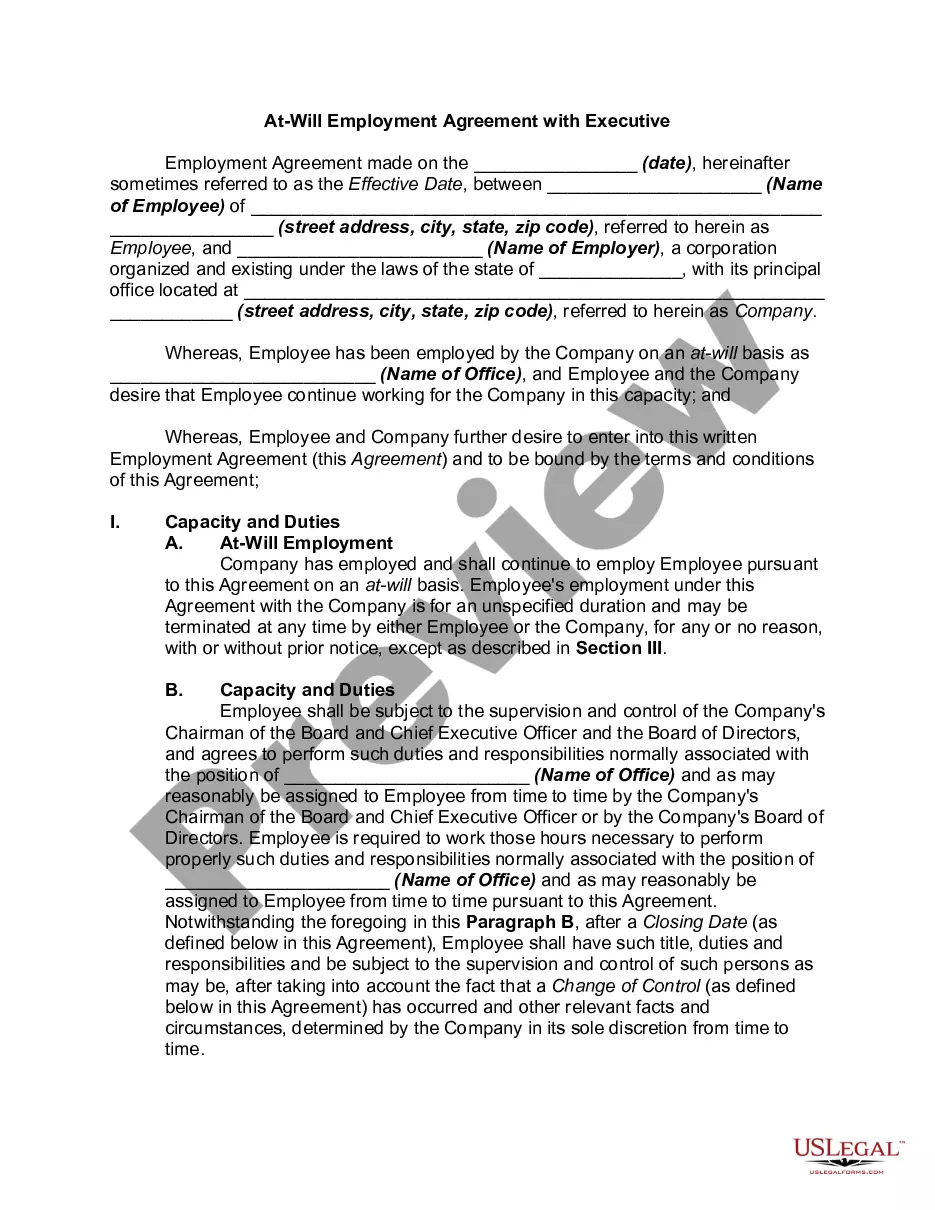

Creating paperwork, like Mecklenburg Stock Option Agreement, to take care of your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for different scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Mecklenburg Stock Option Agreement form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before getting Mecklenburg Stock Option Agreement:

- Ensure that your document is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Mecklenburg Stock Option Agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and download the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!