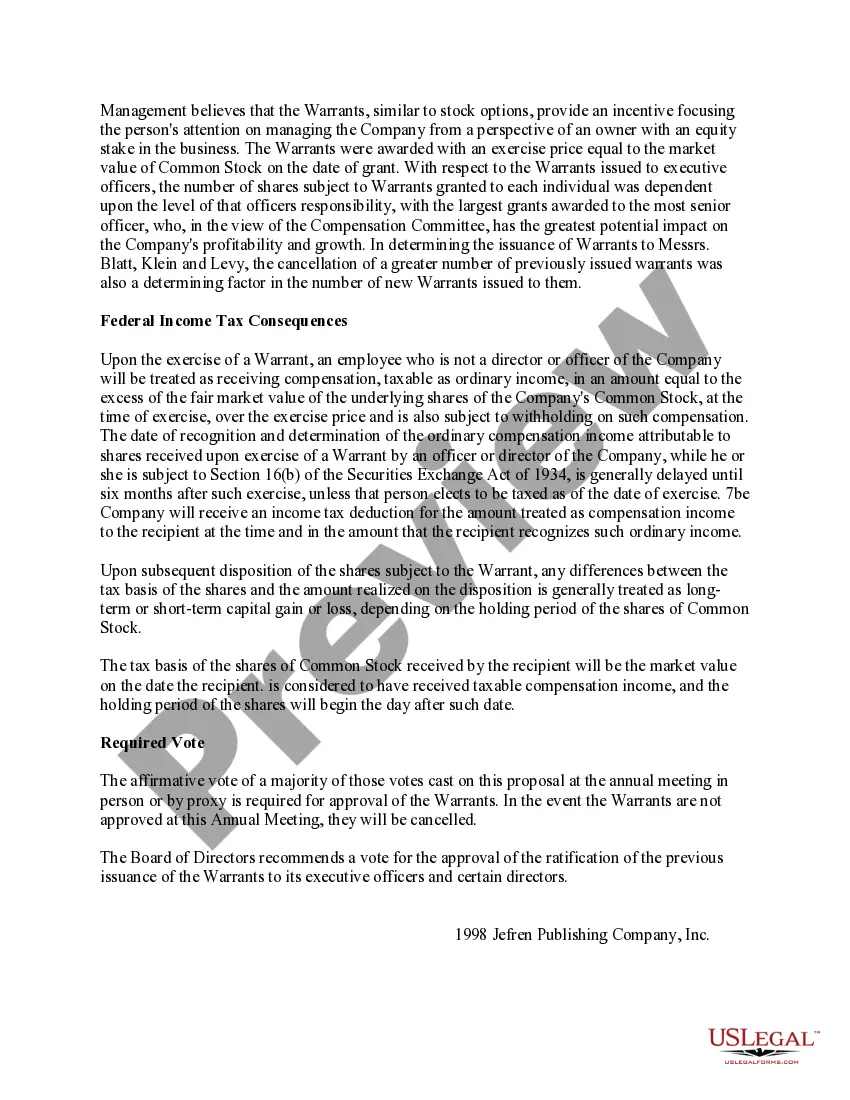

Allegheny Pennsylvania Proposal to Ratify Issuance of Warrants to Executive Officers and Certain Directors The Allegheny Pennsylvania Proposal to ratify issuance of warrants to executive officers and certain directors is a strategic move aiming to provide incentives and rewards to key individuals within the organization. This proposal allows for the granting of warrants, a financial instrument, to executive officers and specific directors of a company. Warrants are derivative securities that enable the holders to purchase company stock at a predetermined price within a particular time frame. By issuing warrants to executive officers and certain directors, companies can align their interests with those of top-level management, fostering long-term commitment and dedication. These warrants act as a form of compensation, encouraging executives and directors to contribute to the growth and success of the company in the following ways: 1. Retention and Attraction: Issuing warrants to executive officers and certain directors serves as a retention tool, incentivizing them to stay within the organization for a longer tenure. Moreover, it helps attract talented individuals, as the potential for future financial gains becomes an attractive proposition. 2. Performance Enhancement: The proposal encourages executives and directors to enhance their performance, as the value of their warrants will be directly tied to the company's success. This alignment drives motivation and accountability, urging them to maximize shareholder value and pursue strategic goals. 3. Shareholder Interests: By granting warrants, the Allegheny Pennsylvania Proposal ensures that executive officers and certain directors possess a direct stake in the performance of the company. This aligns their interests with those of shareholders, promoting responsible decision-making and long-term value creation. 4. Corporate Governance: The proposal also ensures proper corporate governance structures by limiting the granting of warrants to specific executive officers and directors. This allows shareholders to have confidence in the management team, knowing that warrants are being issued to individuals with proven expertise and responsibility. It is vital to note that there can be variations of Allegheny Pennsylvania proposals to ratify the issuance of warrants to executive officers and certain directors. Some variations may include: 1. Vesting Period: This specifies the duration an executive officer or director must remain with the company before exercising their warrants. It ensures retention and continued dedication. 2. Exercise Price: This sets the price at which warrants can be exercised to purchase company stock. A lower exercise price can offer additional incentives. 3. Quantity and Allocation: The proposal may outline the number of warrants available for issuance and the allocation among executive officers and specific directors based on their roles and contributions. In conclusion, the Allegheny Pennsylvania Proposal to ratify the issuance of warrants to executive officers and certain directors is a thoughtful initiative that aims to align the interests of top-level management with shareholders. By granting warrants, the company incentivizes commitment, performance, and shareholder value creation. Different variations of this proposal can exist, each having its particular terms and conditions tailored to meet specific organizational objectives.

Allegheny Pennsylvania Proposal to ratify issuance of warrants to executive officers and certain directors

Description

How to fill out Allegheny Pennsylvania Proposal To Ratify Issuance Of Warrants To Executive Officers And Certain Directors?

Preparing papers for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Allegheny Proposal to ratify issuance of warrants to executive officers and certain directors without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Allegheny Proposal to ratify issuance of warrants to executive officers and certain directors on your own, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Allegheny Proposal to ratify issuance of warrants to executive officers and certain directors:

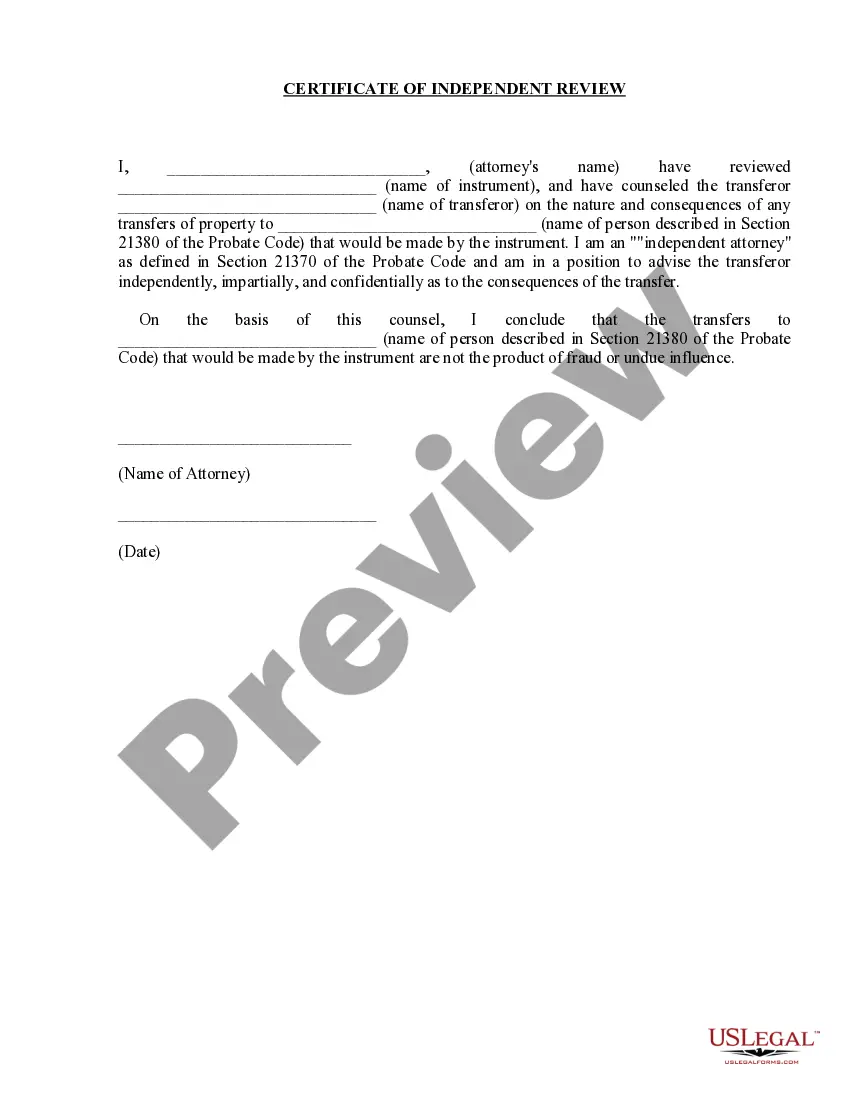

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!