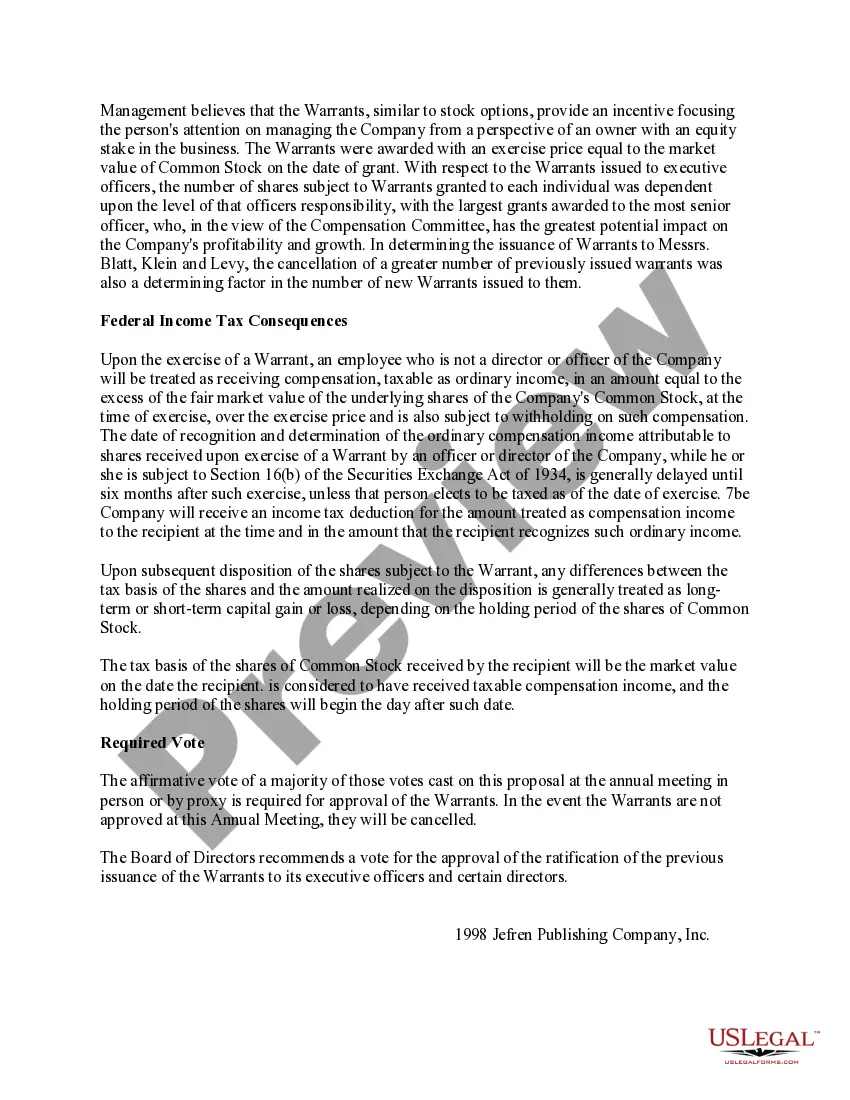

Title: Bexar Texas Proposal to Ratify Issuance of Warrants to Executive Officers and Certain Directors Introduction: The Bexar Texas Proposal to ratify issuance of warrants to executive officers and certain directors is an important initiative aimed at providing benefits and incentives for key individuals responsible for the success of an organization. This detailed description will provide an overview of the proposal's objectives, its relevance, and highlight different types of warrants that may be considered. 1. Objectives of the Proposal: The primary objective of the Bexar Texas Proposal is to encourage executive officers and certain directors to remain dedicated and motivated towards the organization's growth and long-term success. By offering warrants, the organization intends to align the interests of these key individuals with those of the shareholders, thus fostering a sense of ownership and accountability. 2. Relevance of the Proposal: The issuance of warrants to executive officers and selected directors provides them with the opportunity to purchase shares at a predetermined price and within a specified timeframe. This incentivizes performance-driven outcomes, encourages retention, and strengthens the organization's talent pool. Additionally, it enhances executive compensation structures, providing a balanced mix of cash and equity-based incentives. 3. Types of Warrants: a) Non-Qualified Warrants: These warrants are usually granted to executive officers and directors as part of their compensation package. Non-qualified warrants are subject to ordinary income tax rates upon exercise, and any subsequent appreciation in share value is taxed as capital gains when the shares are eventually sold. b) Incentive Warrants: Incentive warrants are another type of warrant that can be offered to executive officers and directors. These warrants are often advantageous to recipients as they may qualify for favorable tax treatment. They typically require the holder to meet specific performance metrics or targets in order to exercise the warrants. c) Restricted Stock Warrants: Restricted stock warrants have certain conditions, such as a vesting schedule or performance targets, that must be met before the warrants can be exercised. These warrants are commonly utilized to reward long-term commitment and exceptional performance, ensuring the alignment of interests between executives/directors and shareholders. d) Cashless Exercise Warrants: The cashless exercise warrants enable executives and directors to exercise their warrants without requiring immediate cash outlays. Instead, the organization facilitates the purchase of shares by surrendering a portion of the shares' appreciation value. This type of warrant is often preferred to incentivize individuals without imposing financial burdens. Conclusion: The Bexar Texas Proposal to ratify issuance of warrants to executive officers and certain directors is a strategic move to foster a mutually beneficial relationship between the organization and its key individuals. By carefully selecting and offering various types of warrants, the proposal aims to create motivation, align interests, retain talent, and drive long-term success while effectively rewarding those instrumental to the organization's growth.

Title: Bexar Texas Proposal to Ratify Issuance of Warrants to Executive Officers and Certain Directors Introduction: The Bexar Texas Proposal to ratify issuance of warrants to executive officers and certain directors is an important initiative aimed at providing benefits and incentives for key individuals responsible for the success of an organization. This detailed description will provide an overview of the proposal's objectives, its relevance, and highlight different types of warrants that may be considered. 1. Objectives of the Proposal: The primary objective of the Bexar Texas Proposal is to encourage executive officers and certain directors to remain dedicated and motivated towards the organization's growth and long-term success. By offering warrants, the organization intends to align the interests of these key individuals with those of the shareholders, thus fostering a sense of ownership and accountability. 2. Relevance of the Proposal: The issuance of warrants to executive officers and selected directors provides them with the opportunity to purchase shares at a predetermined price and within a specified timeframe. This incentivizes performance-driven outcomes, encourages retention, and strengthens the organization's talent pool. Additionally, it enhances executive compensation structures, providing a balanced mix of cash and equity-based incentives. 3. Types of Warrants: a) Non-Qualified Warrants: These warrants are usually granted to executive officers and directors as part of their compensation package. Non-qualified warrants are subject to ordinary income tax rates upon exercise, and any subsequent appreciation in share value is taxed as capital gains when the shares are eventually sold. b) Incentive Warrants: Incentive warrants are another type of warrant that can be offered to executive officers and directors. These warrants are often advantageous to recipients as they may qualify for favorable tax treatment. They typically require the holder to meet specific performance metrics or targets in order to exercise the warrants. c) Restricted Stock Warrants: Restricted stock warrants have certain conditions, such as a vesting schedule or performance targets, that must be met before the warrants can be exercised. These warrants are commonly utilized to reward long-term commitment and exceptional performance, ensuring the alignment of interests between executives/directors and shareholders. d) Cashless Exercise Warrants: The cashless exercise warrants enable executives and directors to exercise their warrants without requiring immediate cash outlays. Instead, the organization facilitates the purchase of shares by surrendering a portion of the shares' appreciation value. This type of warrant is often preferred to incentivize individuals without imposing financial burdens. Conclusion: The Bexar Texas Proposal to ratify issuance of warrants to executive officers and certain directors is a strategic move to foster a mutually beneficial relationship between the organization and its key individuals. By carefully selecting and offering various types of warrants, the proposal aims to create motivation, align interests, retain talent, and drive long-term success while effectively rewarding those instrumental to the organization's growth.