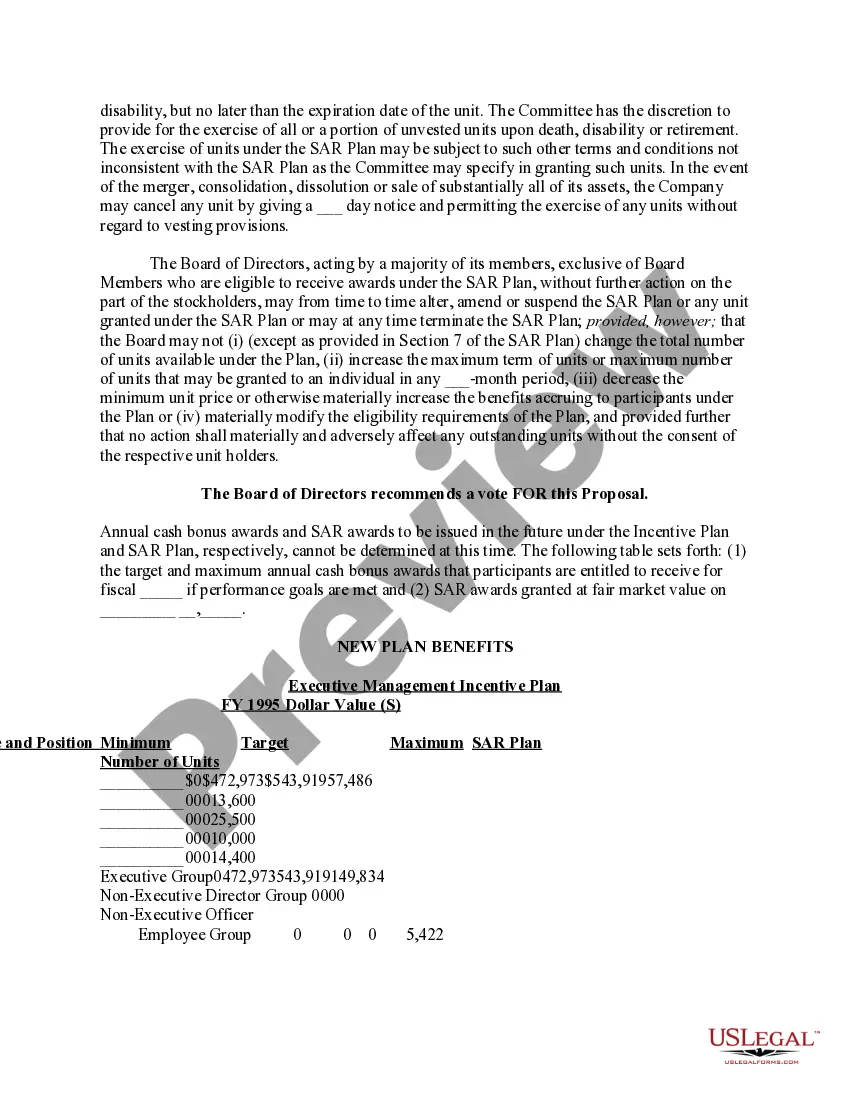

Houston, Texas Proposal to Approve Material Terms of Stock Appreciation Right Plan Introduction: As an integral part of the thriving business landscape in Houston, Texas, numerous organizations propose stock appreciation right plans to attract and retain top talent. In this detailed description, we will explore the concept of stock appreciation right plans, their significance, and the various types available within Houston. 1. Stock Appreciation Right Plans in Houston, Texas: Stock appreciation right plans, commonly known as SARS, refer to compensation schemes offered by companies to their employees. SARS provides an opportunity for employees to share in the financial success of the company without directly owning the company's stock. These plans grant the participants the right to receive payment in cash, stock, or a combination of both, based on the increase in the company's stock price over a predetermined period. 2. Material Terms of Stock Appreciation Right Plans: The Houston, Texas Proposal to Approve Material Terms of Stock Appreciation Right Plan focuses on outlining crucial aspects of the plan, including: a. Eligibility Criteria: The proposal defines the eligibility criteria for employees to participate in the stock appreciation right plan. Specific positions, years of service, or performance-based metrics may be considered when determining eligibility. b. Vesting Schedule: The vesting schedule determines the timeframe over which the granted stock appreciation rights will become exercisable by the employees. It aims to incentivize long-term commitment and performance. c. Calculation Method: The calculation method stipulates how the stock appreciation rights' value will be determined. Typically, it involves the price difference between the stock's fair market value at the grant date and the exercise date. d. Payment Options: The proposal presents various payment options available to employees upon exercising their stock appreciation rights. It could include cash payments equivalent to the stock's value or stock-based compensation to allow employees to become partial owners. e. Termination Provisions: The plan must address termination provisions, including circumstances under which stock appreciation rights may be forfeited or accelerated. This provision ensures fairness and promotes alignment of employee and company interests. f. Tax Implications: The proposal should outline the potential tax implications associated with stock appreciation right plans for both the company and participating employees. Understanding the tax implications is crucial for effective plan implementation. 3. Types of Stock Appreciation Right Plans in Houston, Texas: Houston, being a hub of diverse businesses, offers various types of stock appreciation right plans. These may include: a. Performance-Based SARS: Performance-based SARS link the stock appreciation rights' payout to the company's performance. This type of plan motivates employees to achieve specific financial goals or surpass performance benchmarks. b. Time-Based SARS: Time-based SARS vest according to a predetermined schedule based on an employee's length of service or tenure within the company. This plan encourages employees to remain with the organization for an extended period, fostering loyalty and commitment. c. Reload SARS: Reload SARS enable employees to exercise their vested stock appreciation rights and, at the same time, receive additional rights to maintain their equity stake. This helps in retaining valuable employees and aligning their interests with the company's growth. Conclusion: Houston, Texas, demonstrates its commitment to attracting and retaining talented professionals by proposing stock appreciation right plans. Such plans provide employees an opportunity to benefit from the company's success without direct stock ownership. Companies in Houston can choose between performance-based, time-based, or reload SARS to incentivize and motivate employees towards improved performance and long-term commitment. With proper approval, implementation, and adherence to material terms, these plans can cultivate a motivated and engaged workforce in the thriving business environment of Houston, Texas.

Houston Texas Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Houston Texas Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Laws and regulations in every area differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Houston Proposal to approve material terms of stock appreciation right plan, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Houston Proposal to approve material terms of stock appreciation right plan from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Houston Proposal to approve material terms of stock appreciation right plan:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!