San Diego, California is a vibrant city located on the West Coast of the United States. Known for its stunning beaches, year-round mild climate, and diverse culture, San Diego attracts visitors and residents alike. Beyond its breathtaking coastline, this city offers a rich history, plenty of entertainment options, and a thriving business community. One notable proposal currently under consideration in San Diego, California is the approval of material terms for a stock appreciation rights plan. This plan aims to provide an incentive for employees and executives by giving them the opportunity to benefit from the appreciation in the company's stock value over a specified period of time. There are several types of proposals related to approving material terms of a stock appreciation rights plan in San Diego, California. These may include: 1. Employee Stock Appreciation Rights Plan (EARP): This type of proposal specifically focuses on providing employees with the opportunity to earn additional compensation based on the increase in the company's stock price. 2. Executive Stock Appreciation Rights Plan (EARP): This proposal targets top-level executives and management personnel, offering them a similar opportunity to benefit from stock price appreciation as a part of their overall compensation package. 3. Performance-Based Stock Appreciation Rights Plan (PS ARP): This type of proposal links the stock price appreciation to specific performance metrics or goals, ensuring that the benefits of the plan are tied to the company's success and achievements. 4. Restricted Stock Appreciation Rights Plan (RS ARP): This proposal limits the sale or transferability of the stock appreciation rights, providing a more restricted framework for participants to benefit from stock price appreciation. Approving material terms of a stock appreciation rights plan can be a complex decision for any organization. It is crucial to consider factors such as the vesting period, exercise price, eligibility criteria, and potential tax implications. San Diego, California recognizes the importance of attracting and retaining top talent, which makes this proposal especially relevant in the region's business landscape. In conclusion, San Diego, California showcases its commitment to fostering a thriving business environment by considering proposals to approve material terms of stock appreciation rights plans. These proposals aim to motivate employees and executives, align their interests with the company's success, and ultimately contribute to the overall growth and prosperity of the city.

San Diego California Proposal to approve material terms of stock appreciation right plan

Description

How to fill out San Diego California Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like San Diego Proposal to approve material terms of stock appreciation right plan is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the San Diego Proposal to approve material terms of stock appreciation right plan. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

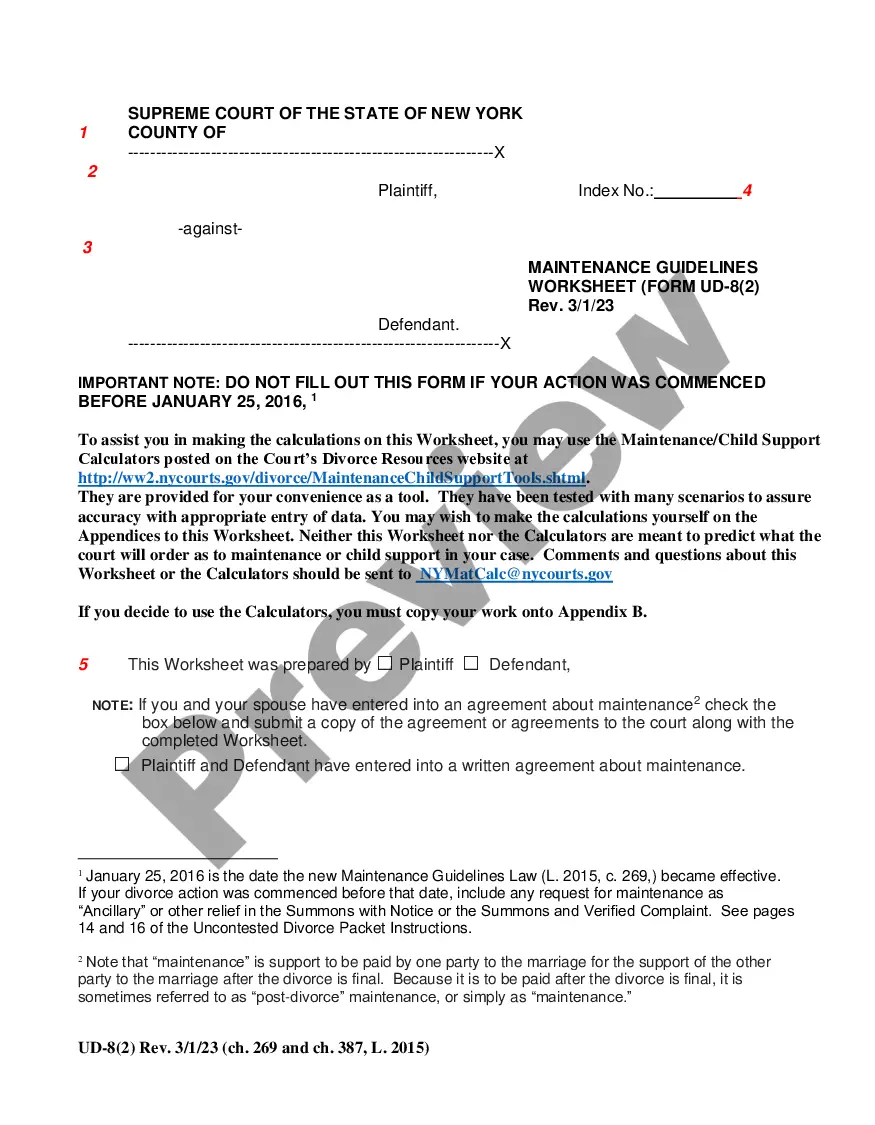

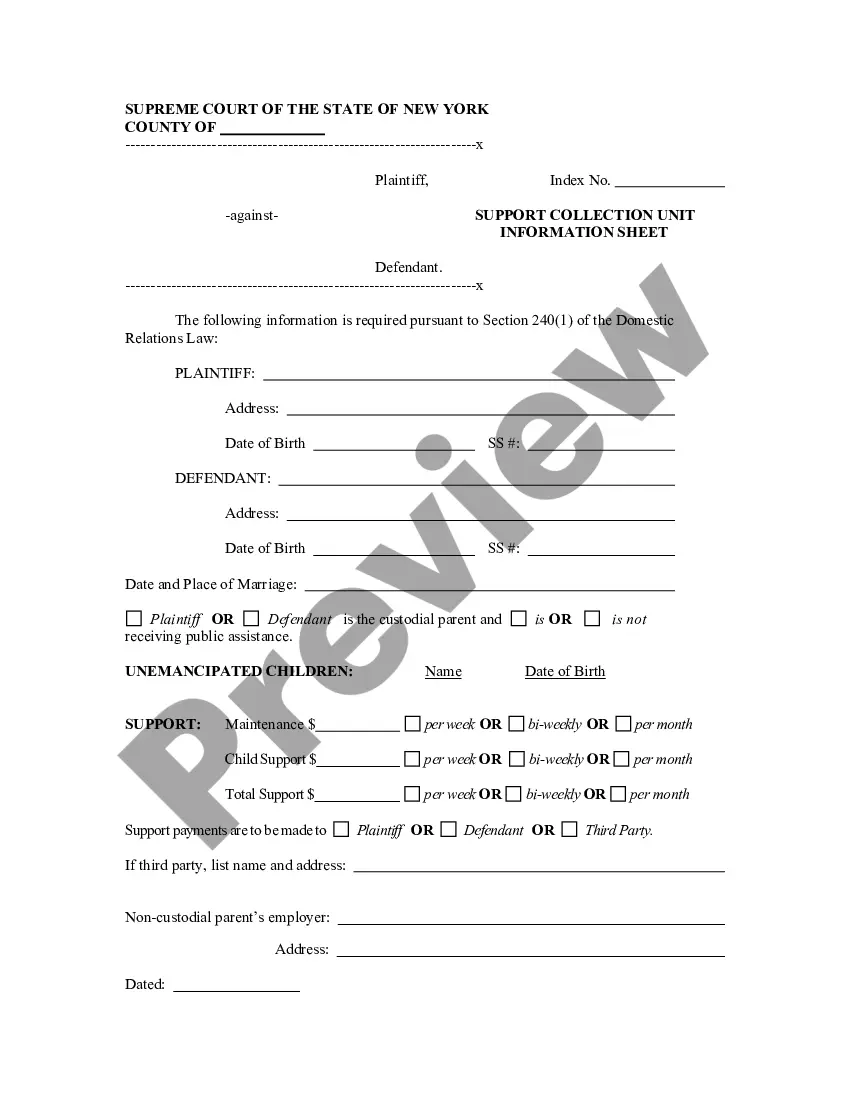

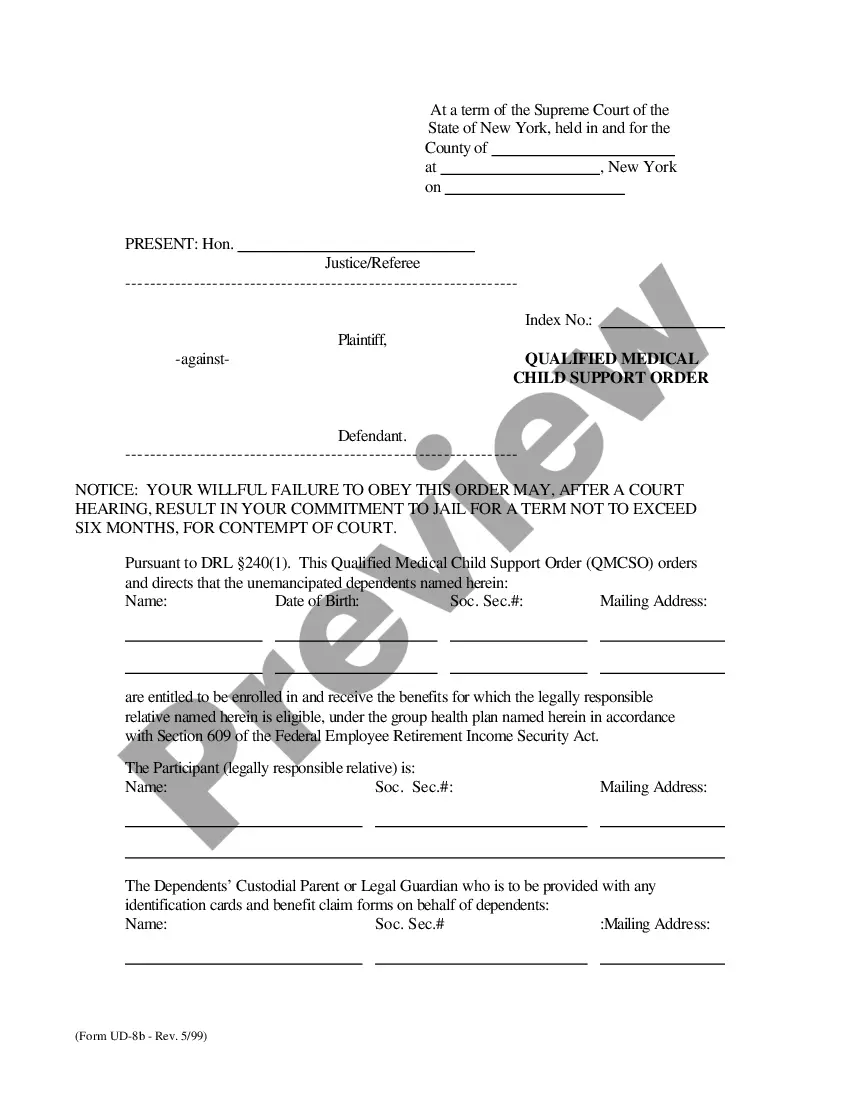

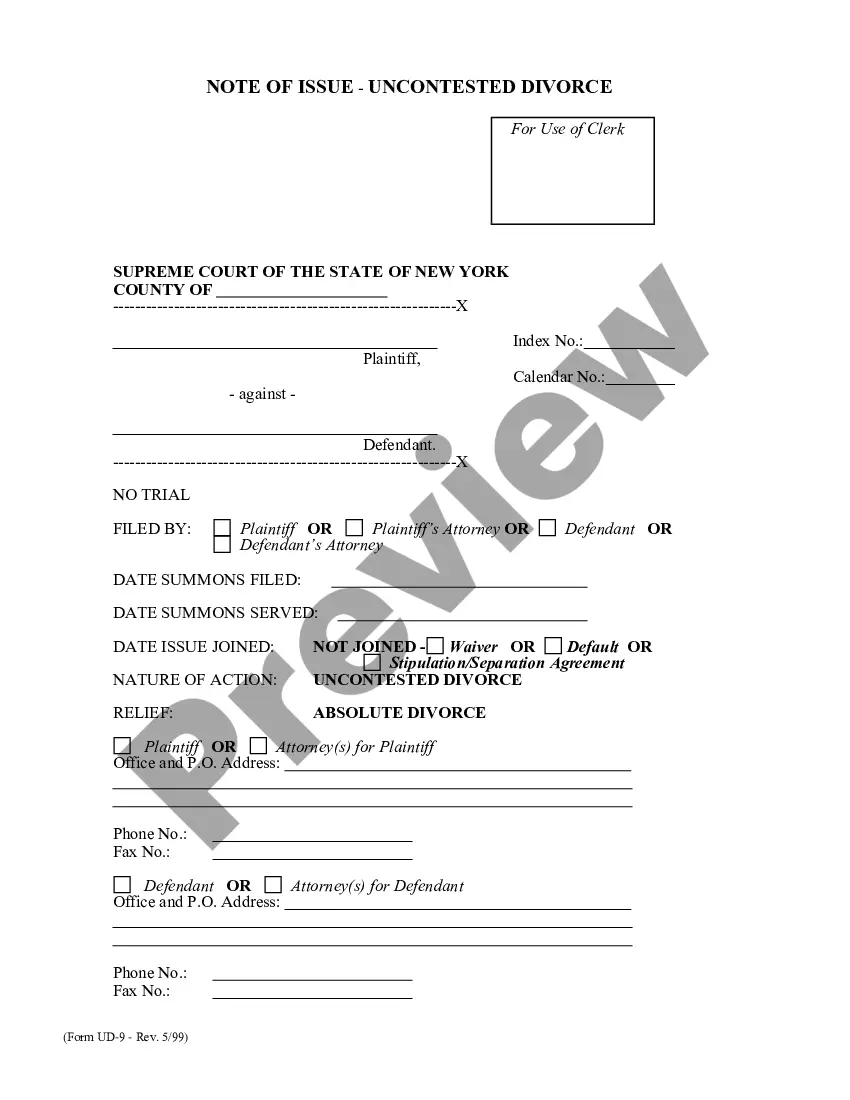

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Diego Proposal to approve material terms of stock appreciation right plan in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!