The San Antonio Texas Stock Appreciation Right Plan is a compensation plan offered by Helene Curtis Industries, Inc. to its employees located in San Antonio, Texas. This plan allows eligible employees to receive additional financial benefits tied to the performance of the company's stock over a specific period. Under the San Antonio Texas Stock Appreciation Right Plan, employees are granted the right to receive either cash or stock appreciation rights (SARS) once certain performance goals are met. SARS is a type of employee benefit that allows participants to profit from the increase in a company's stock price over a predetermined time frame. There are two types of San Antonio Texas Stock Appreciation Right Plans offered by Helene Curtis Industries, Inc.: 1. Performance-based SARS: These plans are designed to reward employees based on the company's financial performance and achievement of specific goals. For example, an employee may be granted SARS that can be exercised and converted to cash or company stock if the company's stock price increases by a certain percentage within a specified period. 2. Time-based SARS: In this type of plan, employees become eligible for SARS after a certain period of continuous service with the company, such as five years. The SARS granted will vest over time, meaning employees gain the right to exercise and receive the financial benefits gradually over a predetermined period. This provides an incentive for employees to stay with the company and contribute to its long-term success. Both types of San Antonio Texas Stock Appreciation Right Plans aim to align the interests of employees with the company's performance and create a sense of ownership. By offering these plans, Helene Curtis Industries, Inc. motivates and rewards its employees for their contributions, promotes loyalty, and fosters a sense of shared purpose within the organization. In summary, the San Antonio Texas Stock Appreciation Right Plan of Helene Curtis Industries, Inc. is a compensation program that grants eligible employees the right to receive financial benefits tied to the company's stock performance. Both performance-based and time-based SARS are offered, allowing employees to leverage the growth of the company's stock over time.

San Antonio Texas Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

How to fill out San Antonio Texas Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

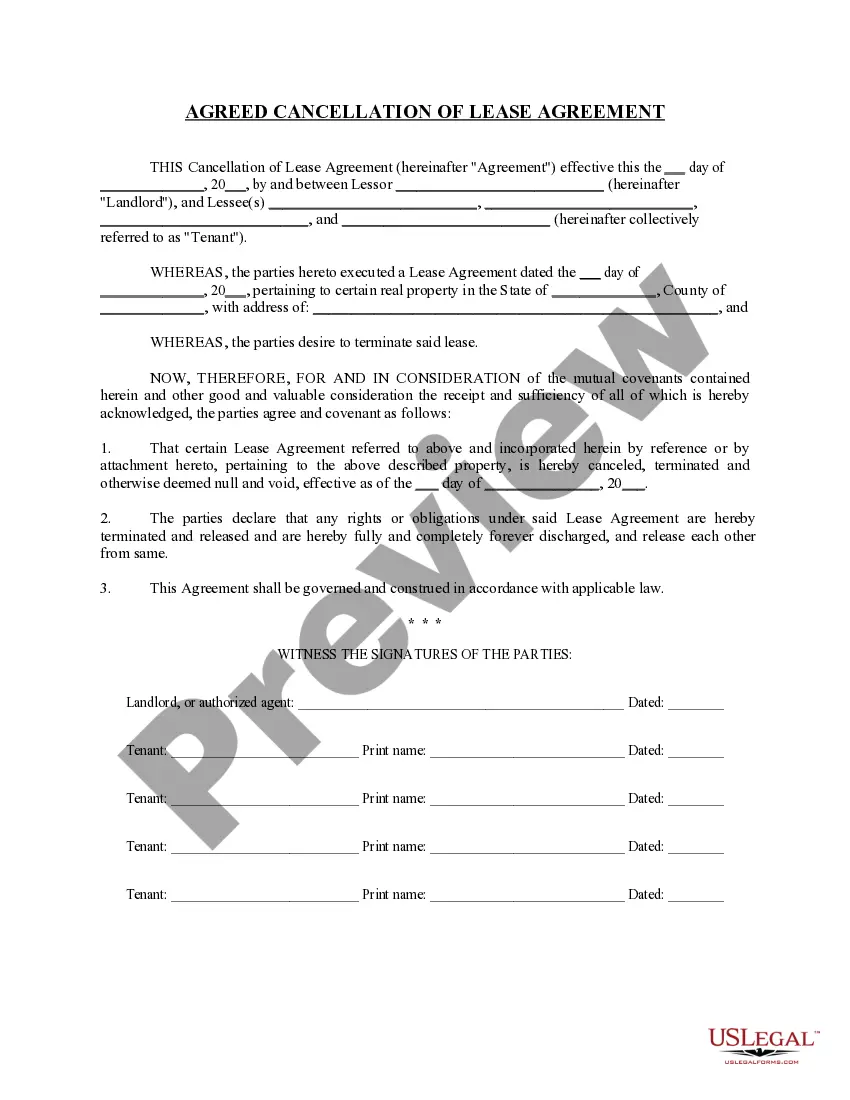

Preparing paperwork for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate San Antonio Stock Appreciation Right Plan of Helene Curtis Industries, Inc. without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Antonio Stock Appreciation Right Plan of Helene Curtis Industries, Inc. by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the San Antonio Stock Appreciation Right Plan of Helene Curtis Industries, Inc.:

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

In 1950 Helene Curtis introduced one of the first hair sprays with its aerosol product Spray Net. Other introductions included Stopette deodorant and Enden dandruff shampoo. The company went public in 1956. During the 1960s the company introduced hair conditioning products Quik Care and Sure Thing.

Helene Curtis was founded in Chicago in 1927 as the National Mineral Company by partners Gerald Gidwitz and Louis Stein. The company began by manufacturing a facial mudpack product, sold to beauty salons nationwide.

Helene Curtis Industries agreed yesterday to be acquired by the British-Dutch consumer-products giant Unilever P.L.C. for $70 a share, or $770 million in cash, marking yet another big consolidation in the highly competitive global personal- and beauty-care products industry.

Helene Curtis Industries agreed yesterday to be acquired by the British-Dutch consumer-products giant Unilever P.L.C. for $70 a share, or $770 million in cash, marking yet another big consolidation in the highly competitive global personal- and beauty-care products industry.

In 1996 Unilever acquired Salon Selectives. In 2011 the line was relaunched to give consumers salon quality product at everyday value pricing. In 2018 Salon Selectives was acquired by Evergreen Consumer Brands for several global markets including North America.

Helene Curtis was founded in Chicago in 1927 as the National Mineral Company by partners Gerald Gidwitz and Louis Stein. The company began by manufacturing a facial mudpack product, sold to beauty salons nationwide.

Helene Curtis Industries, Inc. manufactures and markets personal care products, primarily shampoo and conditioners, hand and body lotions, and deodorants and antiperspirants. Shampoo constitutes Helene Curtis's primary strengthSuave is one of the top shampoo brands in the United States.

Helene Curtis, which was controlled by the Gidwitz family until it was sold to Unilever for $910 million in 1996, has been manufacturing at the 92-year-old facility since the late 1940s, according to a Unilever spokesman.