Santa Clara California Stock Appreciation Right Plan is a financial benefit program offered by Helene Curtis Industries, Inc., a company based in Santa Clara, California. This plan provides employees with the opportunity to share in the company's success and value appreciation. Here's a detailed description of this plan and its different types: 1. Stock Appreciation Rights (SARS): The Stock Appreciation Right (SAR) plan allows employees to receive the monetary appreciation in Helene Curtis Industries, Inc. stock over a specified period. It is designed to reward employees for their contribution to the company's growth and success. Participants are granted the right to receive the stock value appreciation in cash, stock, or a combination of both. 2. Performance-Based SARS: Performance-Based SARS are a type of Stock Appreciation Rights plan that rewards employees based on specific performance goals. Employees must meet predetermined targets, such as achieving sales targets, increasing market share, or surpassing revenue goals, to be eligible for the SARS benefits. This plan incentivizes employees to perform at their best and aligns their interests with the company's performance. 3. Restricted SARS: Restricted SARS are a variant of the Stock Appreciation Right plan that grants employees the right to receive appreciation in stock value, but with certain restrictions. The stock appreciation rights may vest over a certain period or upon achieving specific milestones, such as remaining employed with the company for a specified number of years or reaching a certain level of performance. 4. Non-Qualified SARS: Non-Qualified SARS are a type of stock appreciation plan that does not meet the requirements of a qualified stock plan according to the Internal Revenue Code. This means that the benefits received from Non-Qualified SARS are subject to ordinary income tax rates upon exercise or sale, rather than receiving more favorable capital gains tax treatment. 5. Performance-Vested SARS: Performance-Vested SARS are Stock Appreciation Rights plans that tie the appreciation of the company's stock to predetermined performance criteria. Employees are granted the right to receive the stock appreciation only if specific performance targets, such as earnings per share (EPS), return on investment (ROI), or market share growth, are met. This plan encourages employees to contribute to the company's overall performance and aligns their efforts with the company's goals. Santa Clara California Stock Appreciation Right Plan of Helene Curtis Industries, Inc. aims to motivate and retain talented employees by providing them with a valuable financial incentive tied to the company's performance and stock value appreciation. It encourages employees to contribute towards the company's growth, fostering a sense of ownership and loyalty. By offering different types of SARS, Helene Curtis Industries, Inc. ensures flexibility to meet the needs of diverse employees and the company's strategic objectives.

Santa Clara California Stock Appreciation Right Plan of Helene Curtis Industries, Inc.

Description

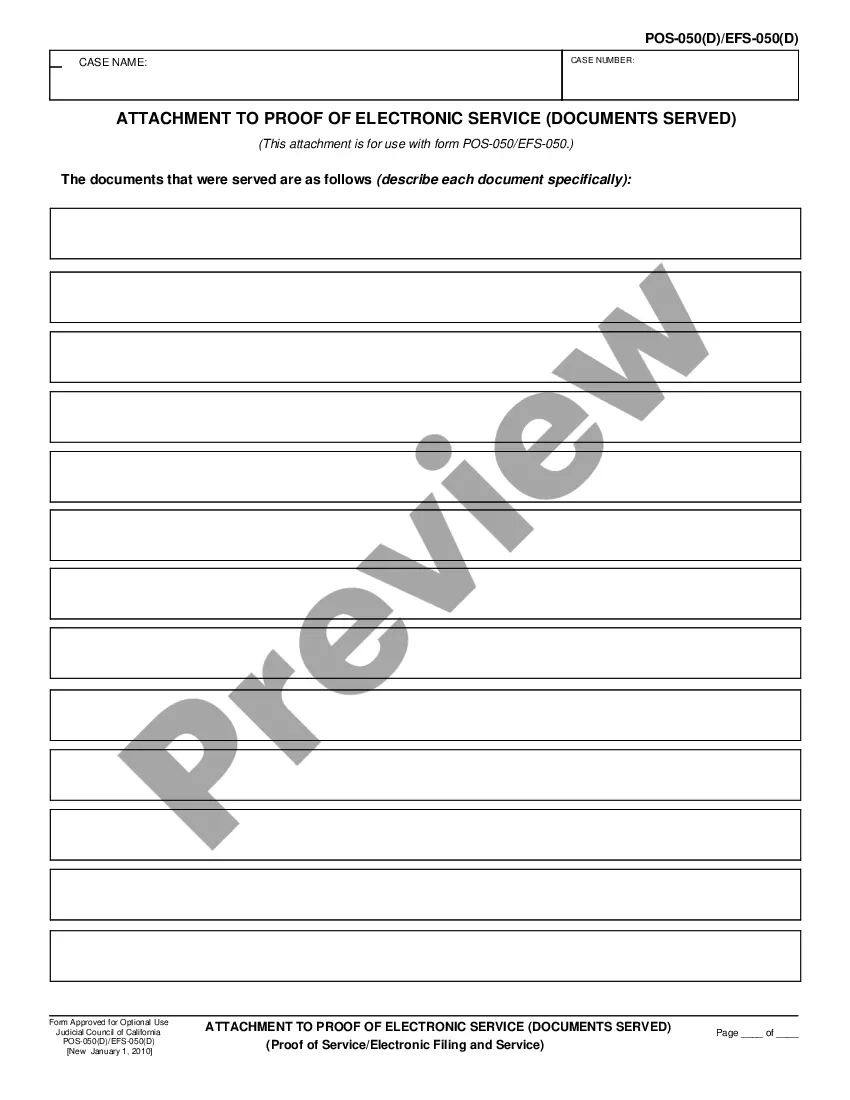

How to fill out Santa Clara California Stock Appreciation Right Plan Of Helene Curtis Industries, Inc.?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from scratch, including Santa Clara Stock Appreciation Right Plan of Helene Curtis Industries, Inc., with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks associated with document completion straightforward.

Here's how to locate and download Santa Clara Stock Appreciation Right Plan of Helene Curtis Industries, Inc..

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the similar forms or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Santa Clara Stock Appreciation Right Plan of Helene Curtis Industries, Inc..

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Santa Clara Stock Appreciation Right Plan of Helene Curtis Industries, Inc., log in to your account, and download it. Of course, our website can’t take the place of a lawyer entirely. If you need to cope with an exceptionally complicated situation, we advise using the services of an attorney to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!