Nassau, New York Share Appreciation Rights Plan is a compensation program designed to reward employees of companies based in Nassau, New York, for their contributions to the organization's success. The plan is often amended to suit the specific needs of the company and its employees, ensuring fairness and alignment with business objectives. A Share Appreciation Rights (SAR) plan grants eligible employees the opportunity to receive cash or stock-based rewards based on the appreciation of the company's shares over a predetermined time period. Employees can benefit from the plan without having to purchase or directly own company shares, making it an attractive incentive for both employers and employees. The key feature of the Nassau, New York Share Appreciation Rights Plan with amendment is its flexibility. It can be customized based on various factors such as the company's financial goals, market conditions, and employee preferences. The amendment may include changes to the plan's eligibility criteria, vesting schedule, payout terms, and performance metrics. Within the Nassau, New York region, there might be different types of Share Appreciation Rights Plans with amendments. Some commonly known types include: 1. Performance-based SAR Plan: This plan ties the reward payout to predefined performance targets, such as revenue growth, profitability, or market share. Employees are incentivized to work towards achieving these goals and are rewarded accordingly. 2. Time-based SAR Plan: In this type of plan, employees become eligible for SARS based on their tenure with the company. The longer an employee stays with the organization, the more SAR units they can accumulate, enhancing their potential earnings. 3. Stock Appreciation SAR Plan: This plan entitles employees to receive cash or stock-based rewards based on the increase in the company's stock price over a specified period. The reward is calculated by multiplying the appreciation in stock value by the number of SAR units vested. 4. Change of Control SAR Plan: This plan is triggered in the event of a merger, acquisition, or any significant change in the company's ownership structure. Employees receive SAR benefits if the change results in a higher stock price, compensating them for the potential dilution of their ownership. The NAS PP (National Association of Stock Plan Professionals) offers resources and guidance to companies looking to establish or amend their Share Appreciation Rights Plans in Nassau, New York. It is advisable for companies to consult legal, tax, and compensation professionals to ensure compliance with local regulations, maximize the benefits, and create a fair and attractive plan for employees.

Nassau New York Share Appreciation Rights Plan with amendment

Description

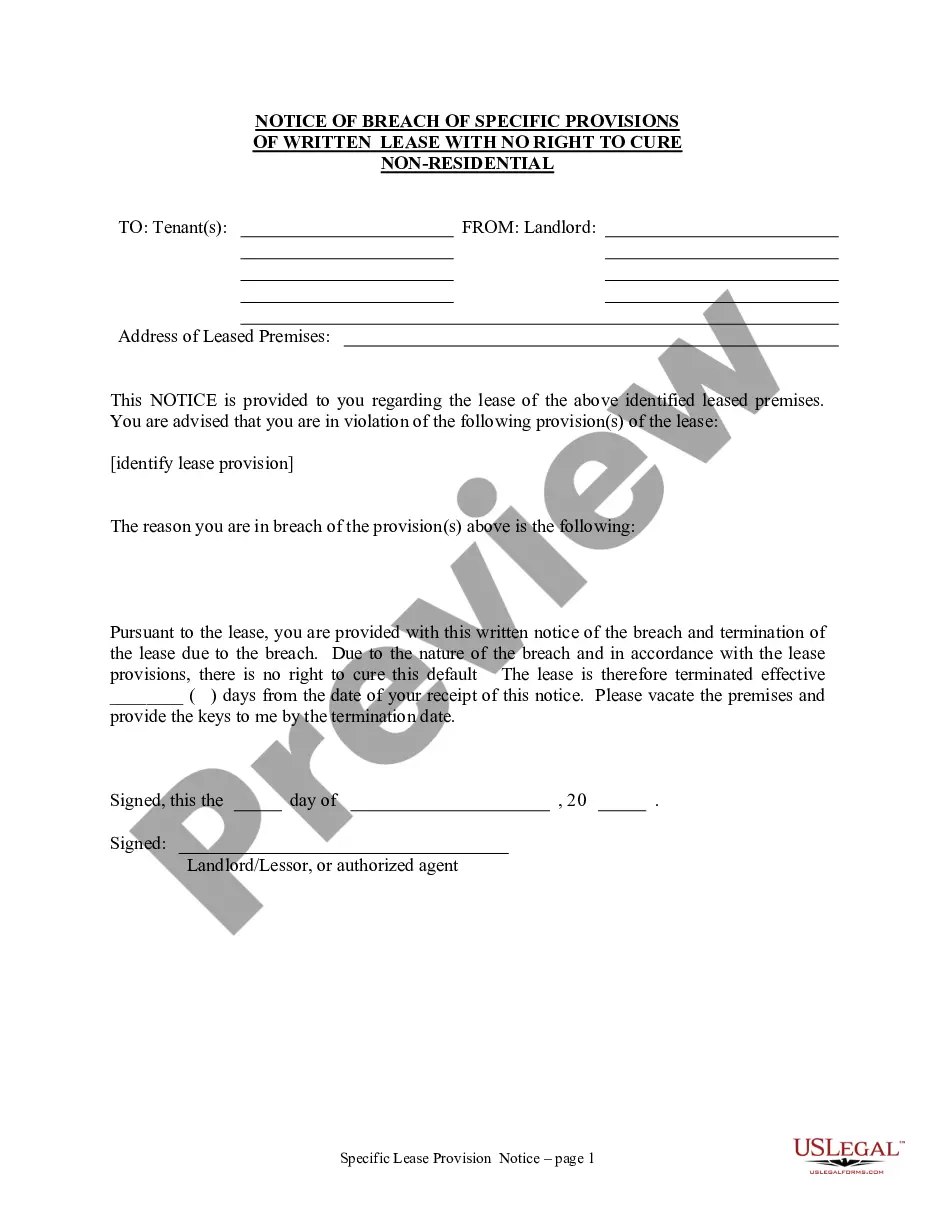

How to fill out Nassau New York Share Appreciation Rights Plan With Amendment?

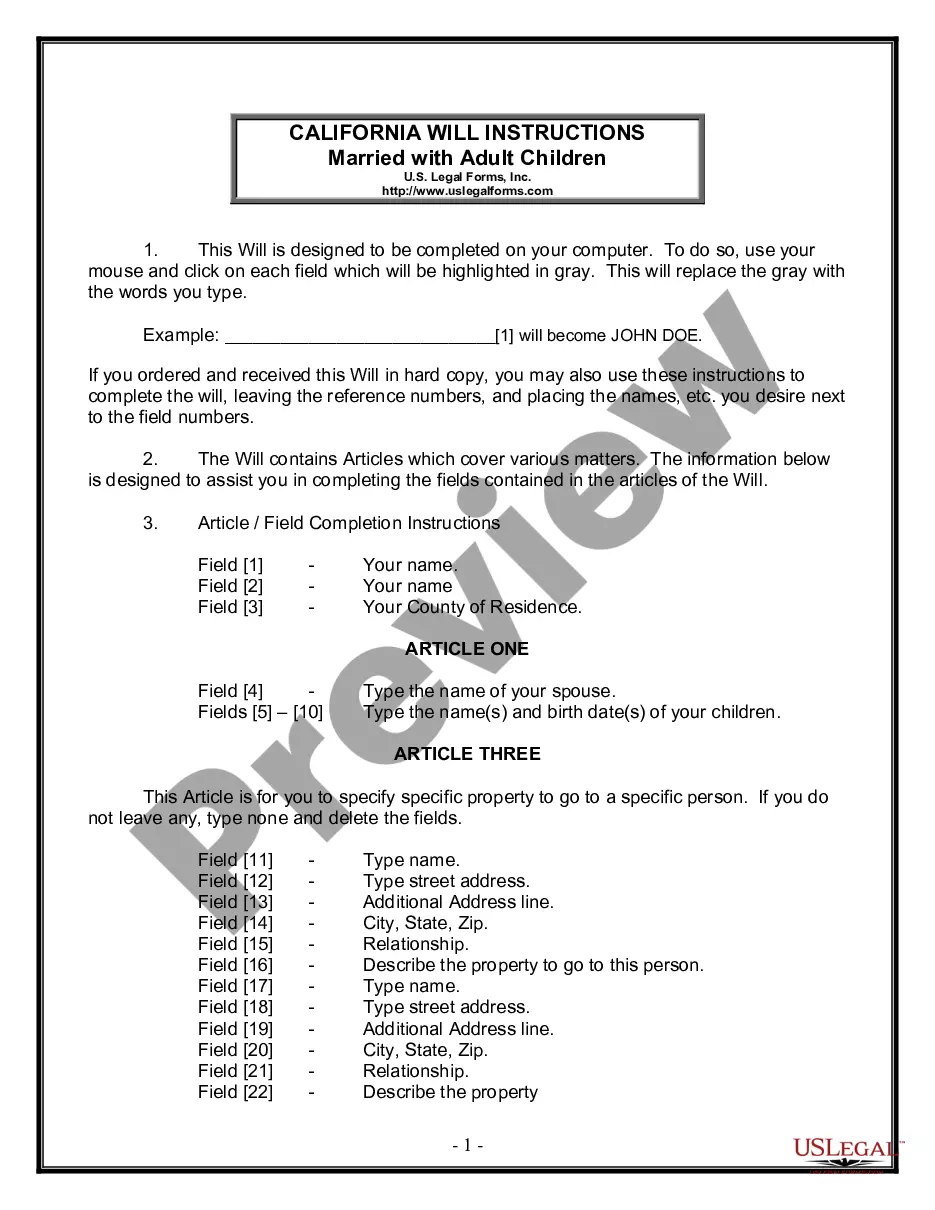

If you need to get a reliable legal form provider to get the Nassau Share Appreciation Rights Plan with amendment, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to locate and complete various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Nassau Share Appreciation Rights Plan with amendment, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Nassau Share Appreciation Rights Plan with amendment template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Nassau Share Appreciation Rights Plan with amendment - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an exercise price or grant price over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

Transferability. The Stock Appreciation Rights shall not be transferable by Employee otherwise than by Employee's will or by the laws of descent and distribution. During the lifetime of Employee, the Stock Appreciation Rights shall be exercisable only by Employee or his authorized legal representative.

How do Stock Appreciation Rights (SARs) work? The holder of SARs is typically granted a specified number of shares of company stock, which are set aside in a trust or escrow account. At the end of the vesting period, if the stock price has increased, the holder receives cash or stock equal to the appreciation in value.

settled share appreciation right entitles the holder to a payment, in shares, equal in value to the amount by which the underlying share has appreciated since the right was granted.

Holding stock appreciation rights is not the same as holding shares of stock. Employees do not receive a share of equity when you award appreciation rights. You are free to set the bonus at any level you feel is appropriate. The bonus is usually paid in cash, but you can elect to award shares of stock instead.

Understanding Stock Appreciation Rights Stock appreciation rights offer the right to the cash equivalent of a stock's price gains over a predetermined time interval. Employers almost always pay this type of bonus in cash. However, the company may pay the employee bonus in shares.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Stock appreciation rights are a type of incentive plan based on your stock's value. Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is exercised.