San Diego, California, is a vibrant city located on the west coast of the United States. Known for its temperate climate, stunning beaches, and diverse culture, San Diego is a popular destination for tourists and residents alike. One notable financial incentive offered by some companies in San Diego is the Share Appreciation Rights Plan (SHARP), which includes an amendment to enhance its effectiveness and benefits. A Share Appreciation Rights Plan is a type of compensation plan typically offered to employees as a form of long-term incentive. Under this plan, employees are granted a specific number of share appreciation rights or SARS. These rights allow employees to receive cash compensation based on the increase in the company's stock price over a predetermined period. The amendment to the San Diego California Share Appreciation Rights Plan aims to make the plan more attractive and beneficial for employees. It may include changes such as: 1. Performance-based criteria: With the amendment, the SARS' vesting or payout may be tied to specific performance targets, ensuring that employees' rewards are directly linked to the company's success. 2. Extended vesting period: The amendment may extend the time period over which the SARS vest, encouraging long-term commitment and investment in the company's growth. 3. Additional cash bonus options: To further motivate employees, the amendment might introduce cash bonus opportunities alongside the SARS, providing even more financial incentives for outstanding performance. 4. Flexible payout options: The amendment may allow employees to choose between cash or stock as their preferred form of compensation, granting them the freedom to align their benefits with their personal financial goals. Different types of Share Appreciation Rights Plans exist based on various factors, such as: 1. Performance-based SARS: These plans tie the SARS' payout or vesting to specific performance goals or milestones achieved by the company or the employee. 2. Time-based SARS: This type of plan determines the SARS' vesting solely based on the length of time an employee remains with the company. It offers a gradual accumulation of rights over a predetermined period. 3. Equity-based SARS: In this plan, the SARS are granted in conjunction with company stock options, giving employees the opportunity to participate in the company's equity gains. In conclusion, the San Diego California Share Appreciation Rights Plan with an amendment aims to provide a more attractive and beneficial compensation package for employees. The amendment introduces changes such as performance-based criteria, extended vesting periods, additional cash bonus options, and flexible payout choices. It is worth noting that there are different types of Share Appreciation Rights Plans, including performance-based, time-based, and equity-based plans, each tailored to the specific needs and goals of the company and its employees.

San Diego California Share Appreciation Rights Plan with amendment

Description

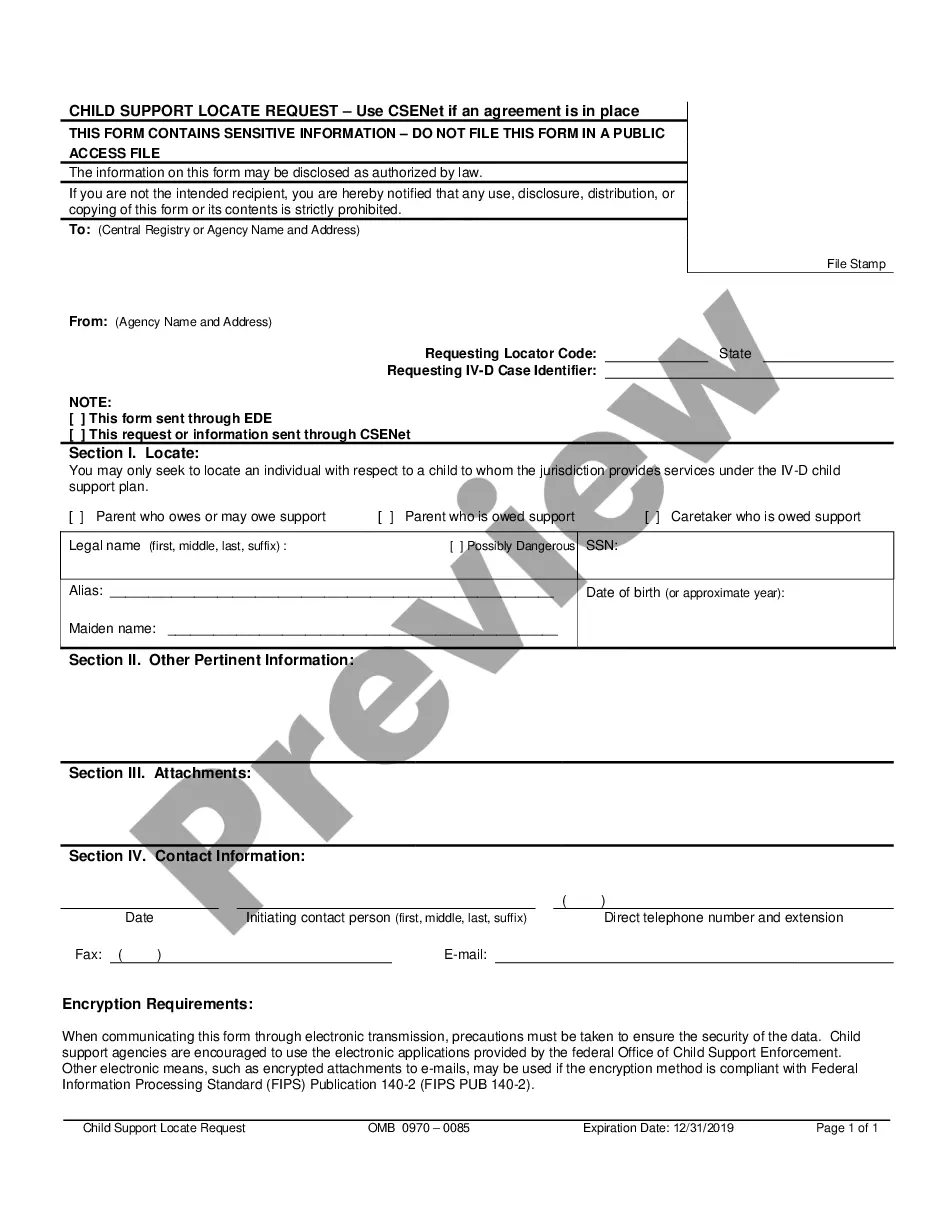

How to fill out San Diego California Share Appreciation Rights Plan With Amendment?

If you need to get a reliable legal form supplier to obtain the San Diego Share Appreciation Rights Plan with amendment, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it simple to locate and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse San Diego Share Appreciation Rights Plan with amendment, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the San Diego Share Appreciation Rights Plan with amendment template and take a look at the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first company, organize your advance care planning, create a real estate agreement, or execute the San Diego Share Appreciation Rights Plan with amendment - all from the convenience of your home.

Sign up for US Legal Forms now!