The Chicago Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a compensation program designed specifically for directors of the company. It provides an opportunity for directors to benefit from the appreciation in the company's stock value over time. This plan is carefully crafted to align the interests of directors with those of the company and its shareholders. By offering stock appreciation rights (SARS), directors are granted the right to receive the increase in the company's stock price between the grant date and the exercise date. This allows directors to share in the company's success and financial growth. The Directors Stock Appreciation Rights Plan offers several advantages. Firstly, it serves as an incentive for directors to actively contribute to the company's growth and success. By providing a direct link between their efforts and the company's stock price, directors are motivated to make decisions that enhance shareholder value. Furthermore, the plan helps attract and retain top talent on the board of directors. In today's competitive marketplace, it is crucial to have skilled and experienced individuals guiding the company's strategic direction. The stock appreciation rights plan can be a powerful tool in attracting high-caliber directors who are looking for financial incentives tied to the company's performance. The Chicago Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. may have different variations or types, specific to the needs and goals of the company. One type could be a performance-based SAR plan, wherein directors are granted SARS based on specific performance metrics that the company aims to achieve. Another type could be a time-based SAR plan, wherein directors are granted SARS after a certain period of service on the board. It should be noted that the specifics of the plan can vary from company to company, and it is important for directors to thoroughly review and understand the terms and conditions of their specific plan. By leveraging the Chicago Illinois Directors Stock Appreciation Rights Plan, American Annuity Group, Inc. aims to foster a strong, performance-driven board of directors that actively contributes to the company's long-term success while providing attractive incentives for its directors.

Chicago Illinois Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Chicago Illinois Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Chicago Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the current version of the Chicago Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Chicago Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.:

- Glance through the page and verify there is a sample for your region.

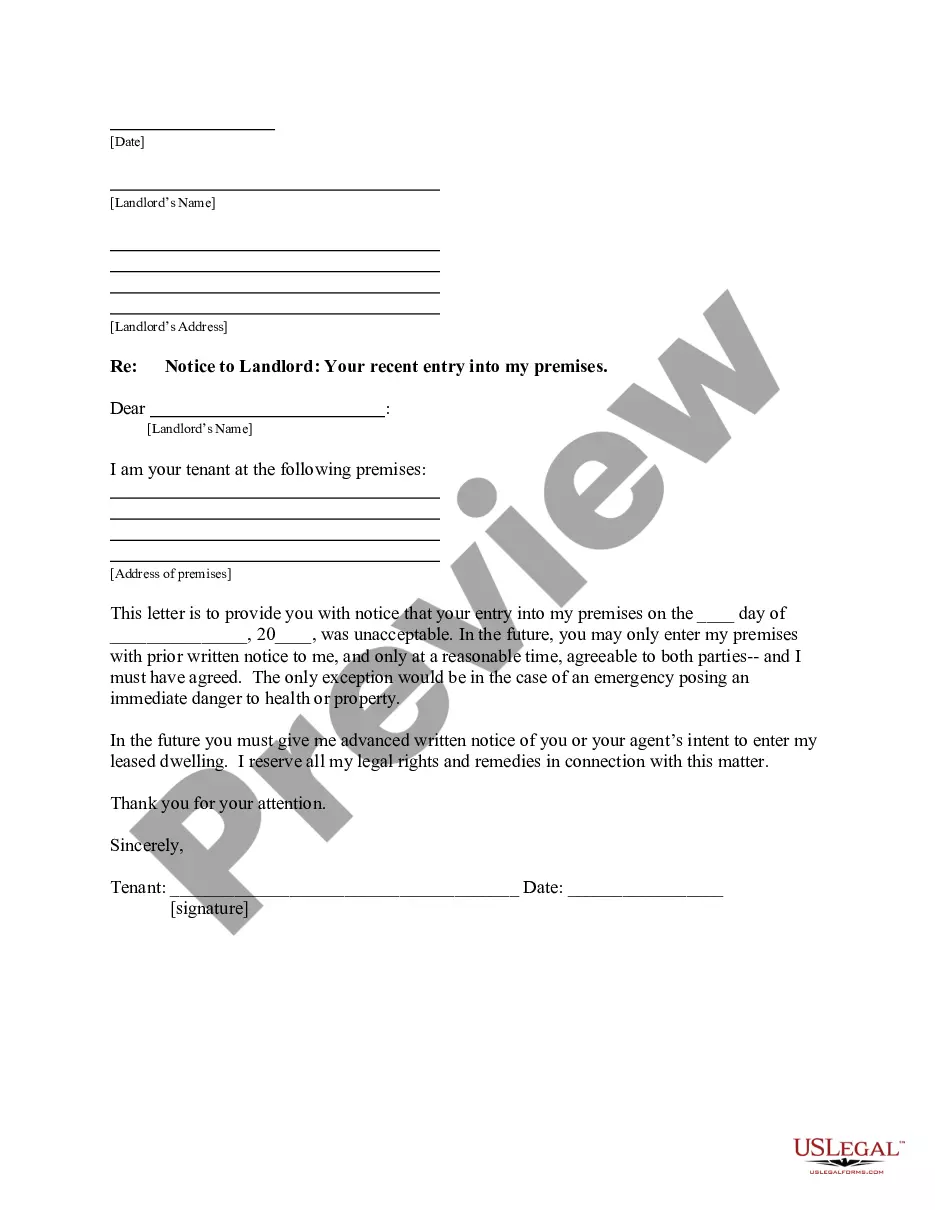

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Chicago Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!