The Kings New York Directors Stock Appreciation Rights Plan is a key component of the American Annuity Group, Inc.'s compensation package for its directors based in New York. This plan allows the directors to receive appreciation in the company's stock value without having to actually purchase the stock. The Kings New York Directors Stock Appreciation Rights Plan provides the directors with the opportunity to benefit from any increase in American Annuity Group, Inc.'s stock price over a specified period of time. Instead of receiving actual stock shares, the directors are granted stock appreciation rights (SARS), which are the right to receive the appreciation in the company's stock value. Under this plan, the directors are typically granted a certain number of SARS that are subject to vesting requirements. Vesting is usually based on the director's continued service with the company over a predetermined period. Once the SARS have vested, the directors have the right to exercise them and receive the appreciation in the stock's value. The Kings New York Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. offers directors an attractive incentive to align their interests with the company's shareholders. By tying the value of their compensation directly to the company's stock performance, directors have an increased motivation to drive the company's success and enhance shareholder value. It is important to note that there may be different variations or types of the Kings New York Directors Stock Appreciation Rights Plan within American Annuity Group, Inc., tailored to specific director roles or levels of responsibility. These variations may include different vesting schedules, exercise periods, or other conditions that align with the individual director's contributions to the company. In summary, the Kings New York Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a compensation plan that grants directors the right to receive the appreciation in the company's stock value over time. This aligns the interests of directors with the company and its shareholders, fostering a collective drive for success and shareholder value creation.

Kings New York Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Kings New York Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Kings Directors Stock Appreciation Rights Plan of American Annuity Group, Inc., you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Kings Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.:

- Look through the page and verify there is a sample for your region.

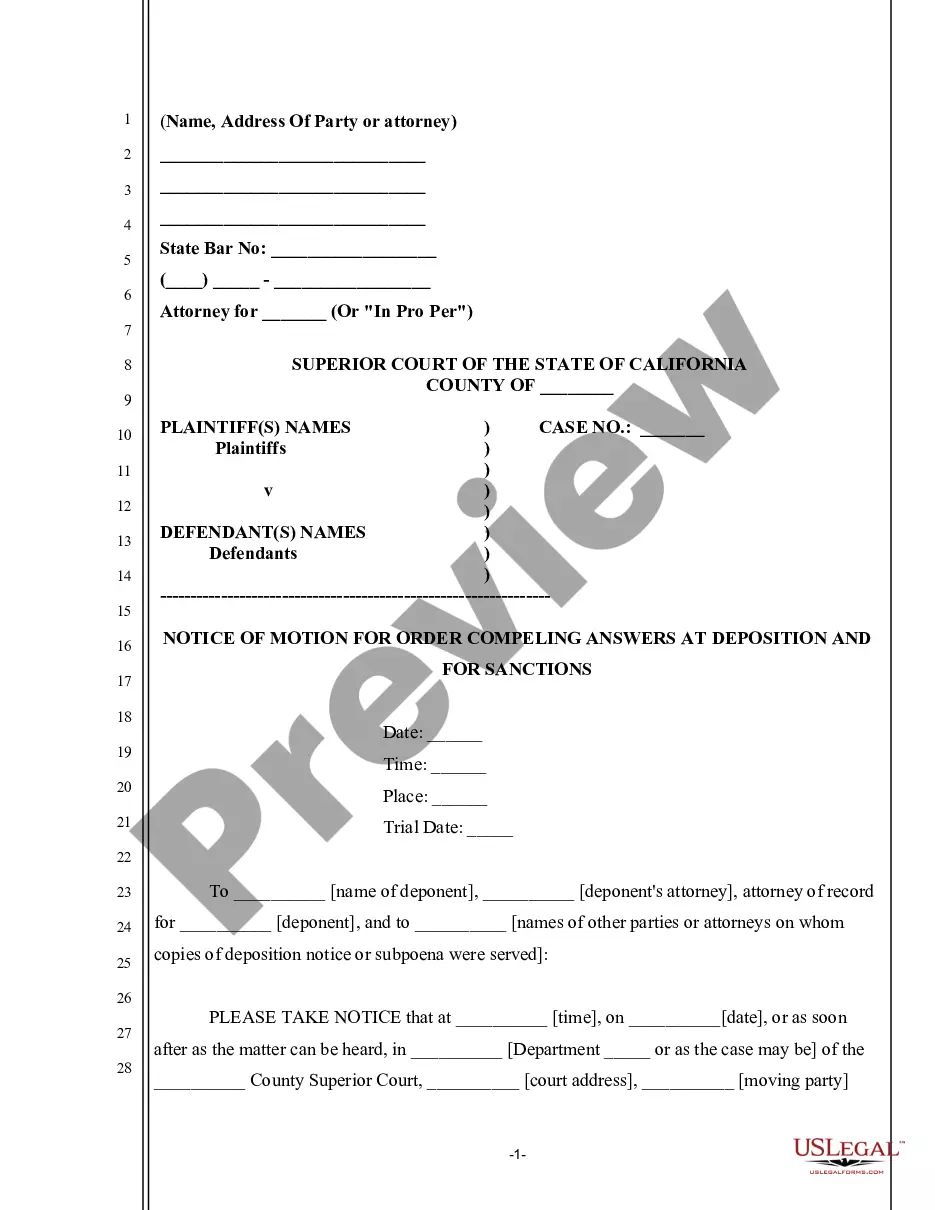

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Kings Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!