Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan is a strategic compensation program implemented by American Annuity Group, Inc. It is designed to reward and incentivize the directors of the company for their contributions and successes in driving the company's growth and financial performance. The Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan offers directors the opportunity to receive additional compensation in the form of stock appreciation rights (SARS). SARS is a type of stock option plan that provide directors with the right to receive cash or company stock equal to the appreciation in the company's stock price, over a predetermined period of time. These stock appreciation rights can be a valuable component of a director's total compensation package, as they provide a direct link between the company's performance and the director's personal financial gain. By aligning the interests of the directors with those of the shareholders, the plan aims to motivate the directors to make decisions that will enhance long-term shareholder value. There are different types of Philadelphia Pennsylvania Directors Stock Appreciation Rights Plans that can be tailored to suit the needs and goals of American Annuity Group, Inc. The specific details of each plan can vary, but generally, they include provisions related to vesting periods, exercise periods, and the calculation of the stock price appreciation. Vesting periods determine when directors become eligible to exercise their stock appreciation rights. It may be structured in a way that a certain percentage of SARS become exercisable each year or after reaching specific performance milestones. This encourages directors to remain with the company and actively contribute to its growth over time. Exercise periods define the duration within which directors can exercise their SARS. Companies often provide a limited window of opportunity for directors to exercise their rights, ensuring that they actively monitor and remain engaged in the company's performance during the specified timeframe. The calculation of the stock price appreciation is a crucial element of the Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan. It may be based on the increase in the company's stock price over a specific period or linked to the broader stock market's performance. In conclusion, the Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a compensation program that awards directors with stock appreciation rights, allowing them to receive additional compensation based on the company's stock price appreciation. It promotes the alignment of shareholder and director interests and provides a powerful incentive for directors to contribute to the long-term success of the company.

Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Philadelphia Pennsylvania Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Philadelphia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. without professional help.

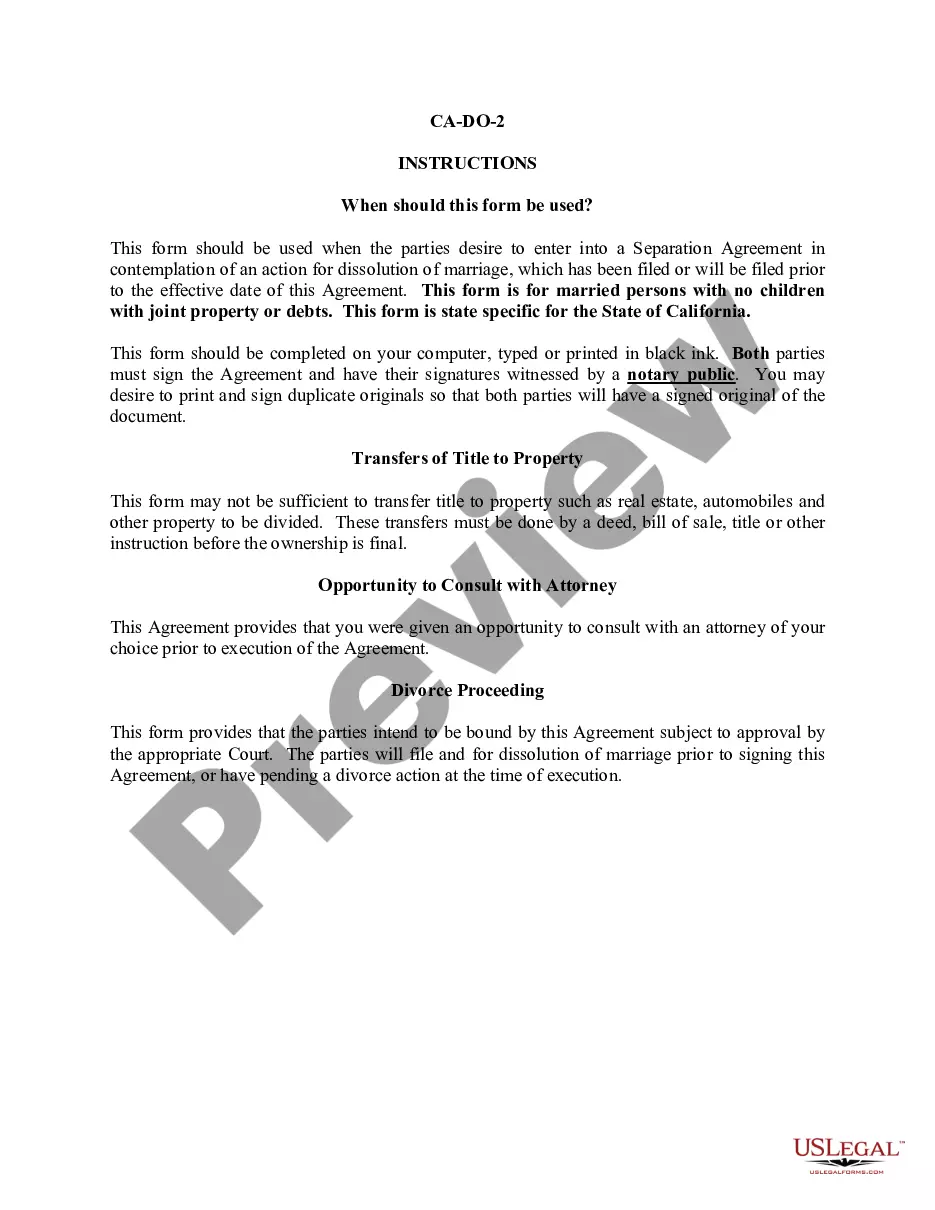

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Philadelphia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Philadelphia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an exercise price or grant price over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

The primary benefit of stock appreciation rights is that employees can receive proceeds from stock price increases without having to buy stock.

Stock options are often given at a discounted price by the employer. With stock options, you assume the full value of the shares. With SARs, your reward is based on any increases in the value of the shares.

What Are Stock Appreciation Rights? Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. SARs are profitable for employees when the company's stock price rises, which makes them similar to employee stock options (ESOs).

Stock Appreciation Rights Are Not Securities. Claim that exercise of cash appreciation of Stock Appreciation Rights involved insider trading and securities fraud rejected for lack of evidence of fraud and because the Rights are not securities.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a preset period. Unlike stock options, SARs are often paid in cash and do not require the employee to own any asset or contract.

Stock Appreciation Rights as Equity Sometimes employers choose to issue stock appreciation rights payments only in the form of stock. If this is the case, the rights are accounted for using an equity method. The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital.

Taxation. Stock appreciation rights are treated as taxable income when you exercise them. If you receive shares of stock instead of cash, and then decide to sell those shares, you may owe capital gains tax on the appreciated value.

Holding stock appreciation rights is not the same as holding shares of stock. Employees do not receive a share of equity when you award appreciation rights. You are free to set the bonus at any level you feel is appropriate. The bonus is usually paid in cash, but you can elect to award shares of stock instead.