The Queens New York Directors Stock Appreciation Rights Plan is a comprehensive compensation program offered by American Annuity Group, Inc. to its directors based in the Queens area of New York. This plan enables directors to receive additional compensation tied to the appreciation in the company's stock value over a specific period. Under this plan, directors are granted Stock Appreciation Rights (SARS), which are similar to stock options but with no purchase price. SARS give directors the right to receive a cash payment equal to the appreciation in the company's stock price over a predetermined period. This provides directors with an opportunity to benefit from the company's growth and financial success. The Queens New York Directors Stock Appreciation Rights Plan offers several types of SARS, including: 1. Performance-based SARS: This SARS is granted based on the achievement of specific performance goals set by the company. The performance goals may include financial targets, market share growth, or other relevant metrics. Directors are rewarded with cash payments if the company meets or exceeds these goals. 2. Time-based SARS: This SARS is granted to directors based on their tenure and service to the company. Directors typically receive a certain number of SARS that vest over a specified period. Once vested, directors can exercise their SARS and receive cash payments based on the stock's appreciation. 3. Combination SARS: This type of SAR combines both performance-based and time-based elements. Directors receive a portion of SARS based on performance goals and another portion based on their tenure with the company. This provides a balanced approach to reward directors for their efforts and the overall growth of the company. It is important to note that the Queens New York Directors Stock Appreciation Rights Plan is designed to align the interests of directors with the company's success. By offering directors the opportunity to benefit directly from the appreciation of the company's stock, it incentivizes them to make decisions that enhance shareholder value and promote the long-term growth and profitability of American Annuity Group, Inc. The plan also promotes retention and attracts top talent to the board of directors by offering an additional form of compensation beyond regular director fees. This helps ensure a strong and experienced leadership team, driving the company's growth and success in the ever-competitive financial industry. In conclusion, the Queens New York Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. is a thoughtfully designed compensation program that provides directors with stock-based incentives to drive the company's growth, aligning their interests with those of the shareholders. Through various types of SARS, directors are rewarded for their performance, tenure, or a combination of both. This plan aims to attract and retain top talent while fostering a culture of accountability and shareholder value.

Queens New York Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Queens New York Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Queens Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Queens Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Queens Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!

Form popularity

FAQ

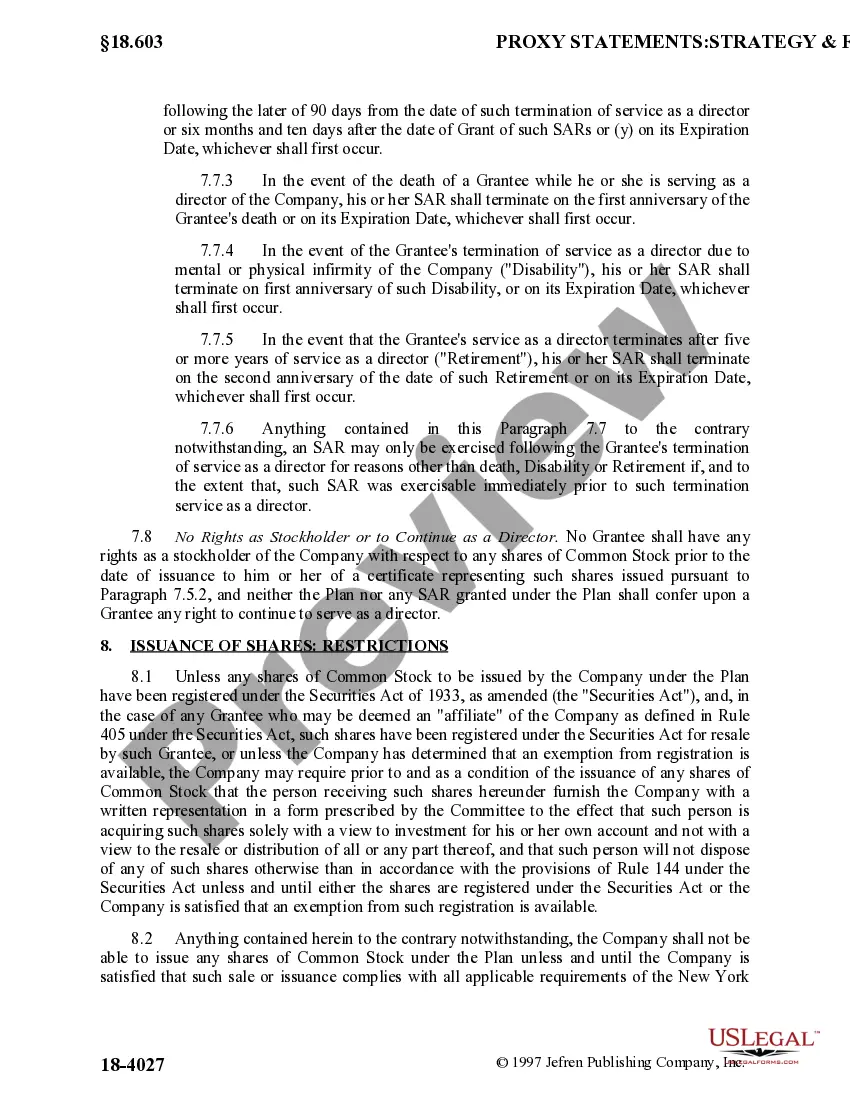

Phantom stock plans and stock appreciation rights (SARs) are two types of stock plans that don't really use stock at all but still reward employees with compensation that is tied to the company's stock performance.

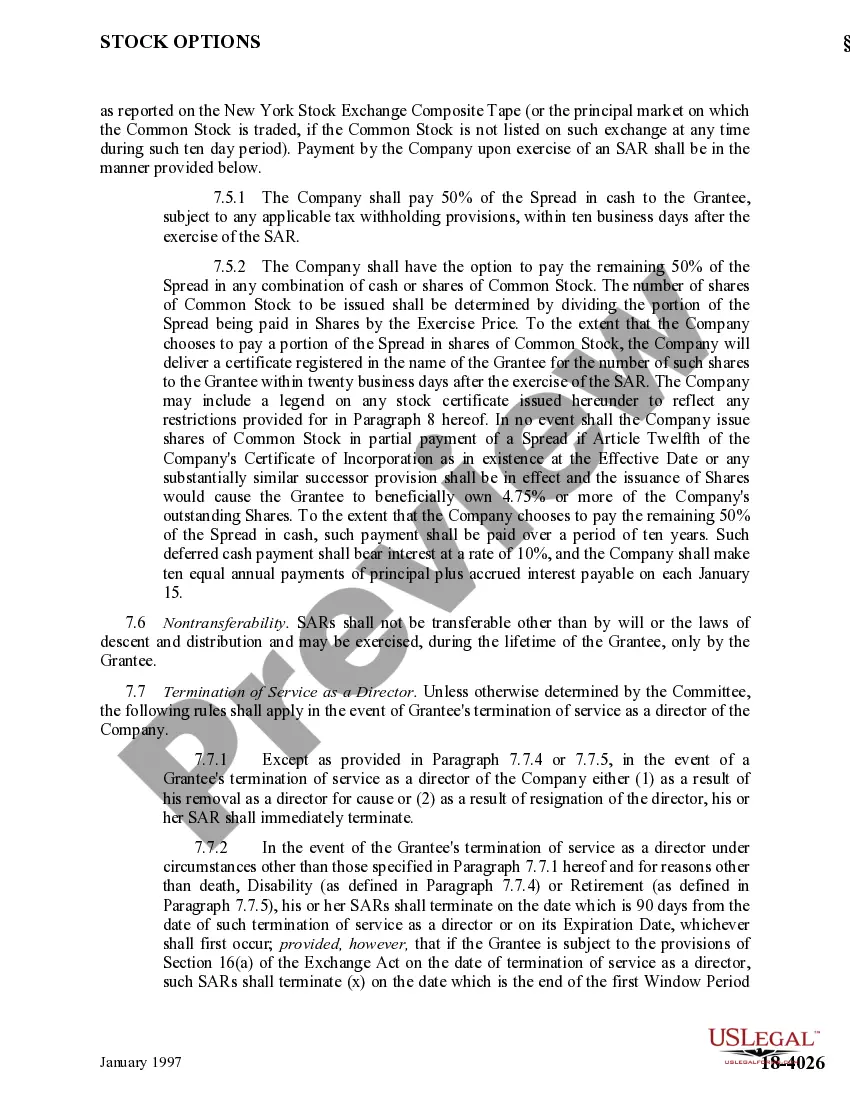

Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration. The proceeds will be paid either in cash, shares, or a combination of cash and shares depending on the rules of an employee's plan.

Stock appreciation rights are treated as taxable income when you exercise them. If you receive shares of stock instead of cash, and then decide to sell those shares, you may owe capital gains tax on the appreciated value.

Stock appreciation rights are NOT deferred compensation subject to the special timing rule under IRC §3121(v)(2).

What are the tax implications of stock appreciation rights? There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting.

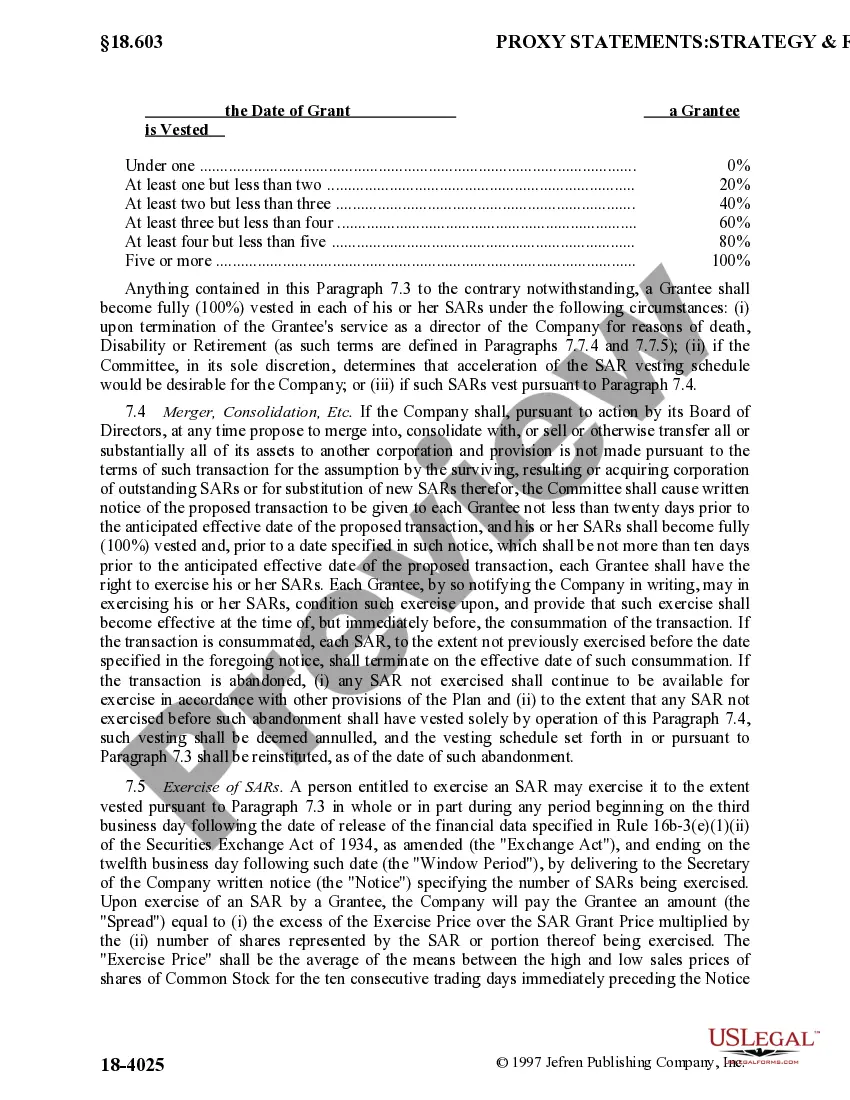

Vesting: Similar to stock options, SARs often have a vesting period (i.e. vesting means ownership, a waiting period before gaining the award ownership) and expiration date. Once a SAR vests, employees can exercise (purchase) it anytime before its expiration date.

Stock Appreciation Rights as Equity Sometimes employers choose to issue stock appreciation rights payments only in the form of stock. If this is the case, the rights are accounted for using an equity method. The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital.

Ownership. With stock appreciation rights, you don't need to buy shares of stock to benefit from an increase in the stock's value. Employee stock options, on the other hand, require you to exercise your right to purchase company stock in order to benefit from any increase in value.

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise. 2 Most employers will also withhold supplemental federal income tax.

Deferred compensation is an addition to an employee's regular compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. There are many forms of deferred compensation, including retirement plans, pension plans, and stock-option plans.