Franklin Ohio Stock Appreciation Rights Plan is a unique program implemented by The Todd-AO Corporation, a renowned multimedia production and post-production company. This plan aims to reward employees based in Franklin, Ohio, by offering them stock appreciation rights (SARS) as an incentive for their hard work and dedication. The Franklin Ohio Stock Appreciation Rights Plan of The Todd-AO Corporation provides employees with the opportunity to receive additional compensation and participate in the company's growth. SARS are awarded to eligible employees, allowing them to benefit from the appreciation in the corporation's stock value over a predetermined period. This stock appreciation program serves as a powerful motivator, aligning the interests of employees with the success of the company. By granting employees the right to receive the increase in stock value, it encourages them to work towards the company's prosperity and better financial performance. The Franklin Ohio Stock Appreciation Rights Plan operates in compliance with applicable state and federal legislation, ensuring fairness and transparency. It sets clear guidelines for eligibility requirements, vesting schedules, exercise periods, and performance criteria, providing a structured framework for employees to participate in the program. Employees enrolled in the Franklin Ohio Stock Appreciation Rights Plan have the chance to benefit personally from the company's growth and success. As the stock value appreciates, participants can exercise their SARS and convert them into cash or stock, thus enjoying the increased value of their shares. This further strengthens their commitment and loyalty towards The Todd-AO Corporation. Within the realm of Franklin Ohio Stock Appreciation Rights Plan, different types may exist to meet the varying needs and objectives of employees. These variations can include performance-based SARS, time-based SARS, or a combination of both. Performance-based SARS may be tied to achieving predetermined goals set by the company, while time-based SARS may depend on the employee's length of service. By implementing the Franklin Ohio Stock Appreciation Rights Plan, The Todd-AO Corporation not only acknowledges the efforts of its employees but also nurtures a shared sense of ownership and pride within the company. This program serves as an attractive element in attracting and retaining top talent, motivating individuals to contribute their best towards the growth and success of the organization as a whole. In conclusion, the Franklin Ohio Stock Appreciation Rights Plan of The Todd-AO Corporation in Franklin, Ohio, is a valuable initiative that rewards employees for their dedication and commitment. Through SARS, employees have the opportunity to benefit from the appreciation in the company's stock value, fostering a strong bond between the employees and the corporation. Different types of SARS may exist within the plan, catering to diverse employee needs and fostering a culture of excellence and shared success.

Franklin Ohio Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

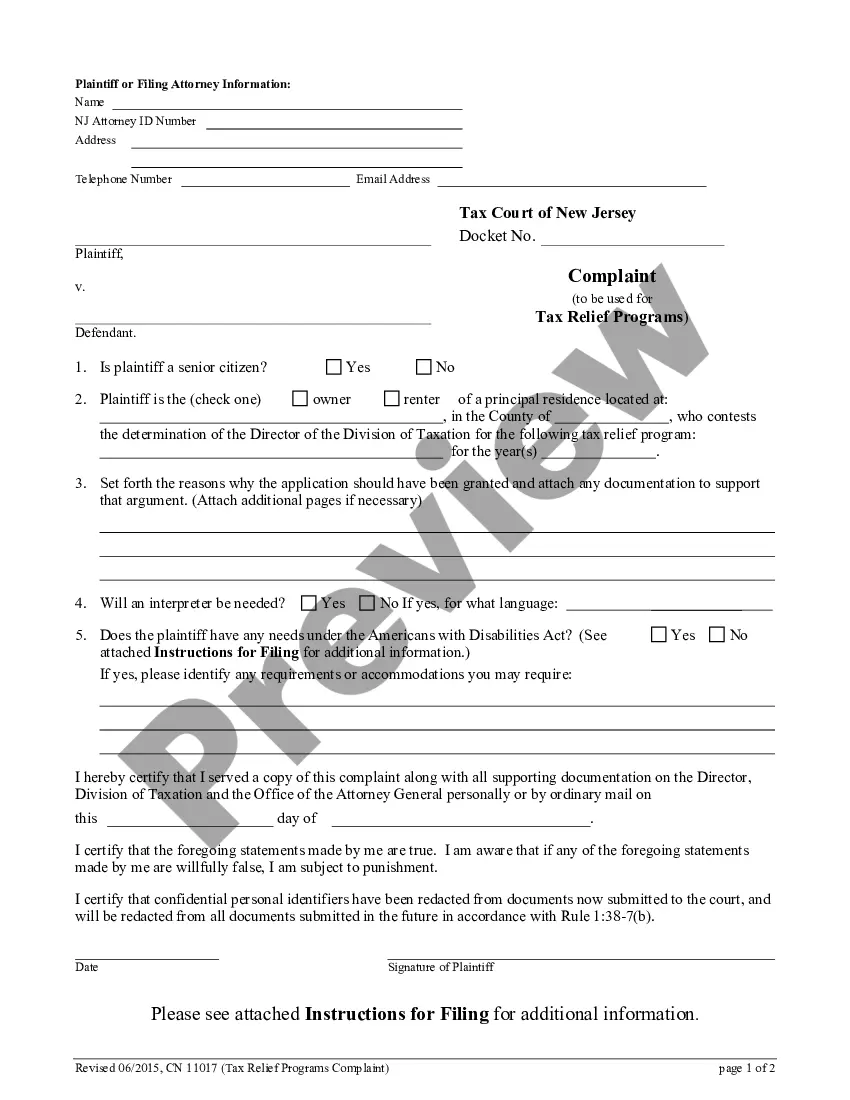

How to fill out Franklin Ohio Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Preparing legal paperwork can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Franklin Stock Appreciation Rights Plan of The Todd-AO Corporation, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Consequently, if you need the recent version of the Franklin Stock Appreciation Rights Plan of The Todd-AO Corporation, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Stock Appreciation Rights Plan of The Todd-AO Corporation:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Franklin Stock Appreciation Rights Plan of The Todd-AO Corporation and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Cash-settled transactions The expense for cash settled transactions is the cash paid by the company. As an example, share appreciation rights entitle employees to cash payments equal to the increase in the share price of a given number of the company's shares over a given period.

Taxation. Stock appreciation rights are treated as taxable income when you exercise them. If you receive shares of stock instead of cash, and then decide to sell those shares, you may owe capital gains tax on the appreciated value.

Stock appreciation rights are treated as taxable income when you exercise them. If you receive shares of stock instead of cash, and then decide to sell those shares, you may owe capital gains tax on the appreciated value.

Stock Appreciation Rights as Equity Sometimes employers choose to issue stock appreciation rights payments only in the form of stock. If this is the case, the rights are accounted for using an equity method. The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a preset period. Unlike stock options, SARs are often paid in cash and do not require the employee to own any asset or contract.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Stock options are often given at a discounted price by the employer. With stock options, you assume the full value of the shares. With SARs, your reward is based on any increases in the value of the shares.

Holding stock appreciation rights is not the same as holding shares of stock. Employees do not receive a share of equity when you award appreciation rights. You are free to set the bonus at any level you feel is appropriate. The bonus is usually paid in cash, but you can elect to award shares of stock instead.

What are the tax implications of stock appreciation rights? There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting.