Harris Texas Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

How to fill out Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Do you require to swiftly establish a legally-binding Harris Stock Appreciation Rights Plan for The Todd-AO Corporation or potentially any other document to oversee your personal or business affairs? You can opt for one of the two alternatives: reach out to an expert to compose a legal document for you or create it completely on your own. The promising news is, there's a third option - US Legal Forms. It will assist you in obtaining well-structured legal papers without incurring excessive costs for legal assistance.

US Legal Forms offers an extensive collection of over 85,000 state-compliant form templates, including the Harris Stock Appreciation Rights Plan for The Todd-AO Corporation and various form packages. We provide templates for a wide range of life situations: from divorce documents to real estate forms. We have been in the industry for more than 25 years and have earned a robust reputation among our clientele. Here's how you can join them and secure the required document without unnecessary issues.

- First and foremost, diligently confirm if the Harris Stock Appreciation Rights Plan for The Todd-AO Corporation aligns with your state's or county's regulations.

- If the form has a description, ensure to verify its intended purpose.

- Initiate the search again if the form isn’t what you were expecting by utilizing the search bar at the top.

- Choose the plan that is most suitable for your requirements and proceed to payment.

- Select the file format you wish to receive your form in and download it.

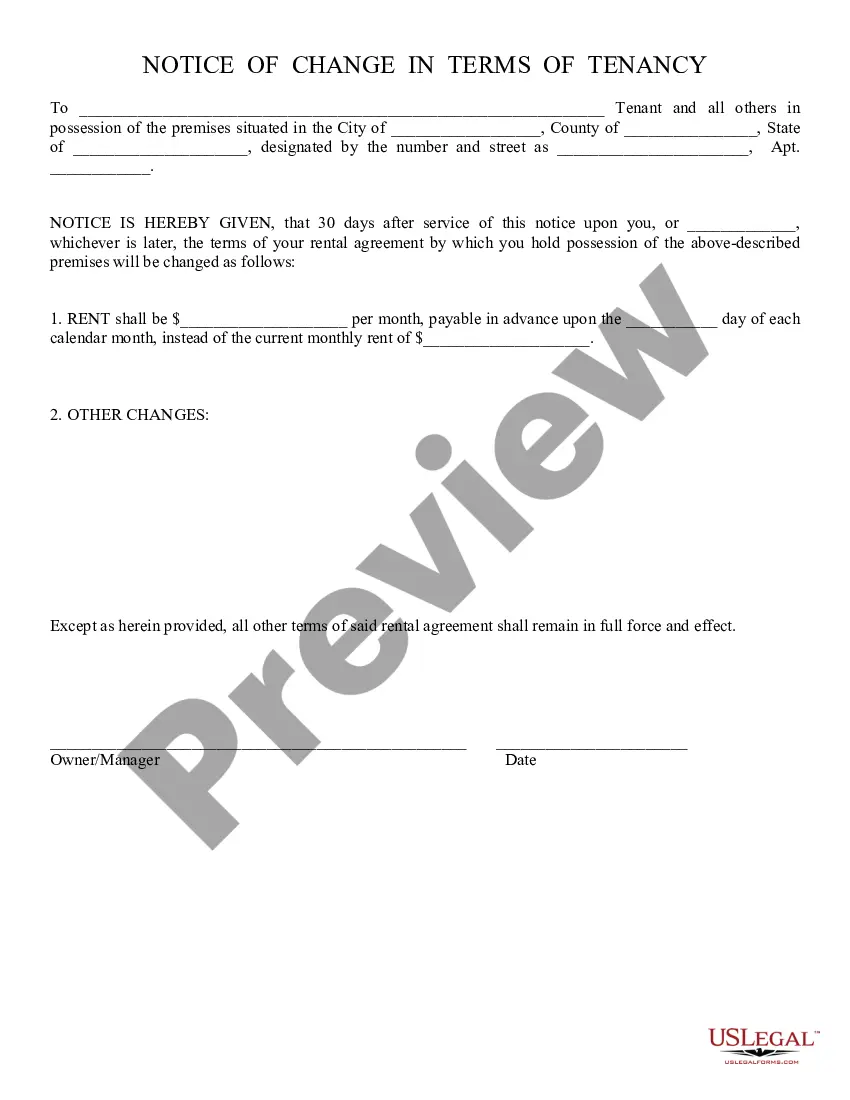

- Print it, fill it out, and sign where indicated.

Form popularity

FAQ

Typically, a vested SAR may be exercised, in whole or in part, at any time during the period commencing on the date of vesting and ending on the SAR's expiration date. Upon exercise, an SAR may be paid in cash (e.g., cash-settled SAR) or stock (e.g., stock-settled SAR) or a combination of the two.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

Stock Appreciation Rights and its Nuances AdvantagesDisadvantagesSaves employees from having to buy stock optionsLack of additional cash infusion when employees buy stockLesser compliance required as compared to ESOPs and ESPPsFunds are required to finance rights being exercised which may cause liquidity issues2 more rows

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an exercise price or grant price over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

Stock Appreciation Rights Overview Instead, employees are simply entitled to the difference between the exercise price and the market value of the stock. For example, an employee with a stock appreciation right exercise price of $15 for one stock could exercise his rights when the stock price is $20 and reap $5.

Stock appreciation rights are a type of incentive plan based on your stock's value. Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is exercised.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

The primary benefit of stock appreciation rights is that employees can receive proceeds from stock price increases without having to buy stock.

Stock options are often given at a discounted price by the employer. With stock options, you assume the full value of the shares. With SARs, your reward is based on any increases in the value of the shares.