The Nassau New York Stock Appreciation Rights Plan is a compensation plan offered by The Todd-AO Corporation to its employees. This plan provides employees with the opportunity to earn additional compensation based on the appreciation of the company's stock price over a specific period of time. The Todd-AO Corporation is a prominent company based in Nassau, New York, known for its excellence in various sectors. They have implemented this stock appreciation rights plan as a way to reward their employees for their dedication and contribution towards the company's growth. Under the Nassau New York Stock Appreciation Rights Plan, eligible employees are granted a certain number of rights, which entitle them to receive a cash or stock bonus equal to the increase in the company's stock price during a specified vesting period. These rights are typically granted as an incentive to retain and motivate top talent within the organization. There are different types of stock appreciation rights plans offered by The Todd-AO Corporation, including: 1. Performance-Based Stock Appreciation Rights Plan: This plan sets specific performance goals that must be achieved by the company for employees to receive the stock appreciation rights. These goals are typically related to financial targets or other predetermined milestones. 2. Time-Based Stock Appreciation Rights Plan: This plan grants employees stock appreciation rights that vest over a specific period of time. The rights become exercisable gradually, allowing employees to benefit from the increase in stock price over the vesting period. 3. Cash-Settled Stock Appreciation Rights Plan: In this type of plan, employees receive a cash bonus equal to the appreciation in the company's stock price, rather than receiving actual shares. This provides employees with flexibility and liquidity as they can convert their rights into cash. It's important to note that the specific details of the Nassau New York Stock Appreciation Rights Plan may vary based on the employee's position, performance, and other factors. The Todd-AO Corporation strives to design these plans in a way that aligns the interests of its employees with the long-term success of the company.

Nassau New York Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

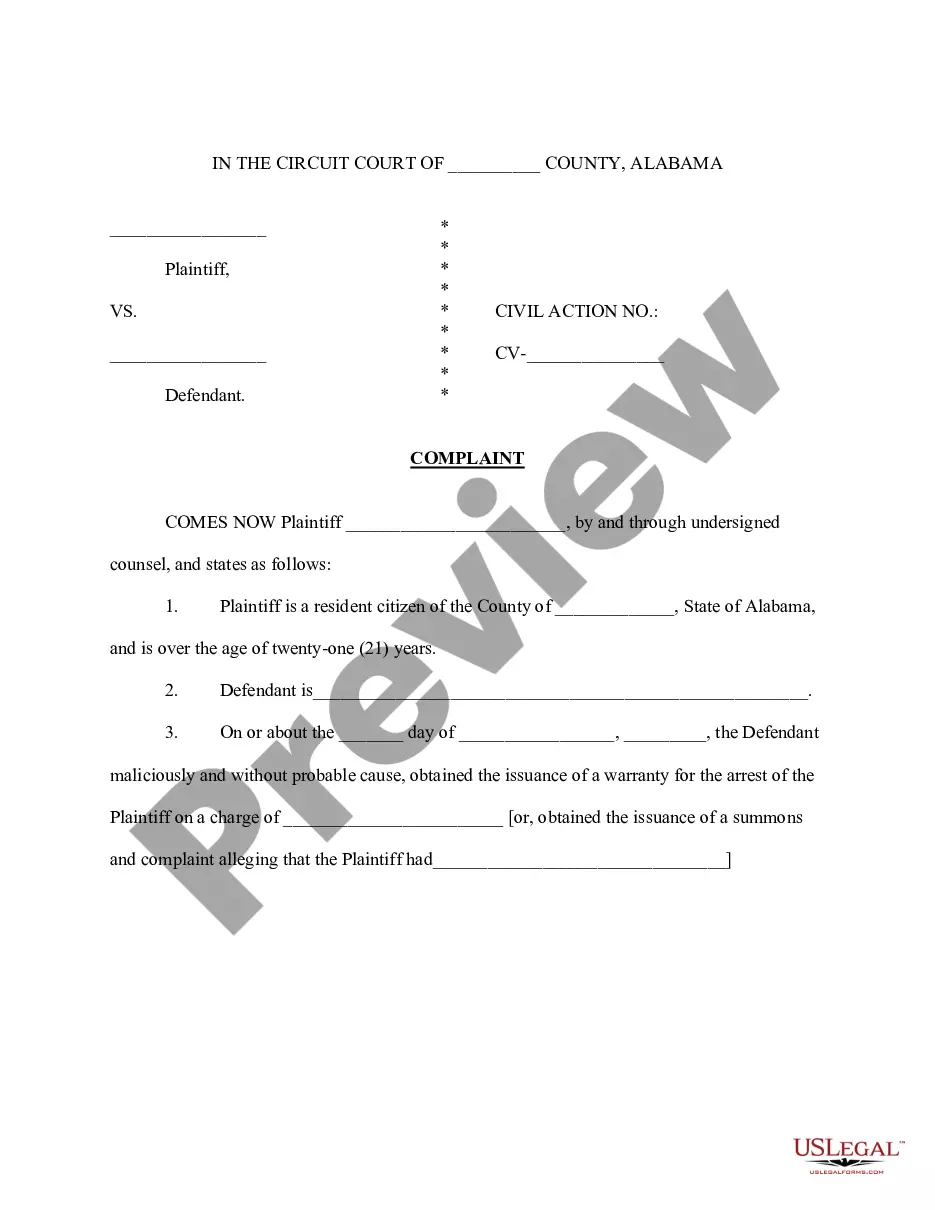

How to fill out Nassau New York Stock Appreciation Rights Plan Of The Todd-AO Corporation?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Nassau Stock Appreciation Rights Plan of The Todd-AO Corporation suiting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Aside from the Nassau Stock Appreciation Rights Plan of The Todd-AO Corporation, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Nassau Stock Appreciation Rights Plan of The Todd-AO Corporation:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Nassau Stock Appreciation Rights Plan of The Todd-AO Corporation.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

Stock appreciation rights are treated as taxable income when you exercise them. If you receive shares of stock instead of cash, and then decide to sell those shares, you may owe capital gains tax on the appreciated value.

Stock Appreciation Rights as Equity Sometimes employers choose to issue stock appreciation rights payments only in the form of stock. If this is the case, the rights are accounted for using an equity method. The rights are valued once, divided evenly over the vesting period and marked as rights paid in capital.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Stock Appreciation means an increase in the price or value of the Common Stock of the Corporation after the date of grant of an Award and during the Applicable Period with respect to the Corporation's Common Stock on stand alone basis, or on a basis relative to the performance of a specified peer group.

Stock options are often given at a discounted price by the employer. With stock options, you assume the full value of the shares. With SARs, your reward is based on any increases in the value of the shares.

settled share appreciation right entitles the holder to a payment, in shares, equal in value to the amount by which the underlying share has appreciated since the right was granted.

Stock appreciation rights offer the right to the cash equivalent of a stock's price gains over a predetermined time interval. Employers almost always pay this type of bonus in cash. However, the company may pay the employee bonus in shares. In most cases, employees can exercise SARs after they vest.