San Jose California Stock Appreciation Rights Plan of The Todd-AO Corporation San Jose, California, is the home of The Todd-AO Corporation, a prominent company that offers a Stock Appreciation Rights Plan (SARS) as part of its comprehensive employee compensation package. With its unique features and benefits, the San Jose California Stock Appreciation Rights Plan aims to motivate and reward employees while fostering a sense of ownership and commitment to the company's growth. Let's delve into the details of this plan and explore any potential variations it may offer: 1. Purpose and Description: The San Jose California Stock Appreciation Rights Plan of The Todd-AO Corporation focuses on providing employees with financial incentives based on the appreciation of the company's stock value over a specified period. It grants eligible employees the right to receive cash or stock bonuses equal to the appreciation in the Todd-AO Corporation's stock price. 2. Eligibility Criteria: To participate in the San Jose California Stock Appreciation Rights Plan, employees often need to meet certain criteria, such as employment duration, position, or level within the organization. The plan aims to include a broad spectrum of employees, aligning their interests with the company's success. 3. Stock Appreciation Calculation: The calculation of stock appreciation is typically tied to the increase in the Todd-AO Corporation's stock price over a predetermined measurement period. This period could be months, years, or a combination of both. Employees benefit from the plan by receiving cash or stock equivalent to the appreciation. 4. Vesting and Exercise Period: The vesting period refers to the duration an employee must remain with the company before becoming eligible to exercise their rights. It ensures that employees are motivated to stay and contribute to the long-term success of The Todd-AO Corporation. Once vested, employees can exercise their stock appreciation rights within a specified period to receive their granted benefits. 5. Cash vs. Stock Bonuses: The San Jose California Stock Appreciation Rights Plan may offer the choice between cash or stock bonuses. Cash bonuses allow employees to receive the appreciation value as a cash payout, while stock bonuses grant them additional company shares. This flexibility caters to individual preferences, investment strategies, and tax considerations. 6. Performance-based vs. Time-based Plans: Within the realm of San Jose California Stock Appreciation Rights Plans, there may be two main variations — performance-based and time-based plans. A performance-based plan typically ties stock appreciation to the achievement of specific performance goals, such as revenue targets or market share growth. On the other hand, a time-based plan grants appreciation rights solely based on the passage of time, incentivizing long-term loyalty. 7. Tax Implications: The San Jose California Stock Appreciation Rights Plan may have tax implications for both the company and employees. Companies should consult with tax experts to ensure compliance with applicable laws and regulations related to employee taxation. Employees may need professional advice regarding tax implications and strategies when exercising and managing their stock appreciation benefits. In conclusion, The Todd-AO Corporation's San Jose California Stock Appreciation Rights Plan symbolizes the company's commitment to rewarding employees for their contributions and dedication. This plan empowers employees by providing an opportunity to share in the company's success and aligns their interests with the long-term growth of the business. Whether it's through cash or stock bonuses, time-based or performance-based plans, the San Jose California Stock Appreciation Rights Plan serves as a valuable tool for fostering a motivated and engaged workforce.

San Jose California Stock Appreciation Rights Plan of The Todd-AO Corporation

Description

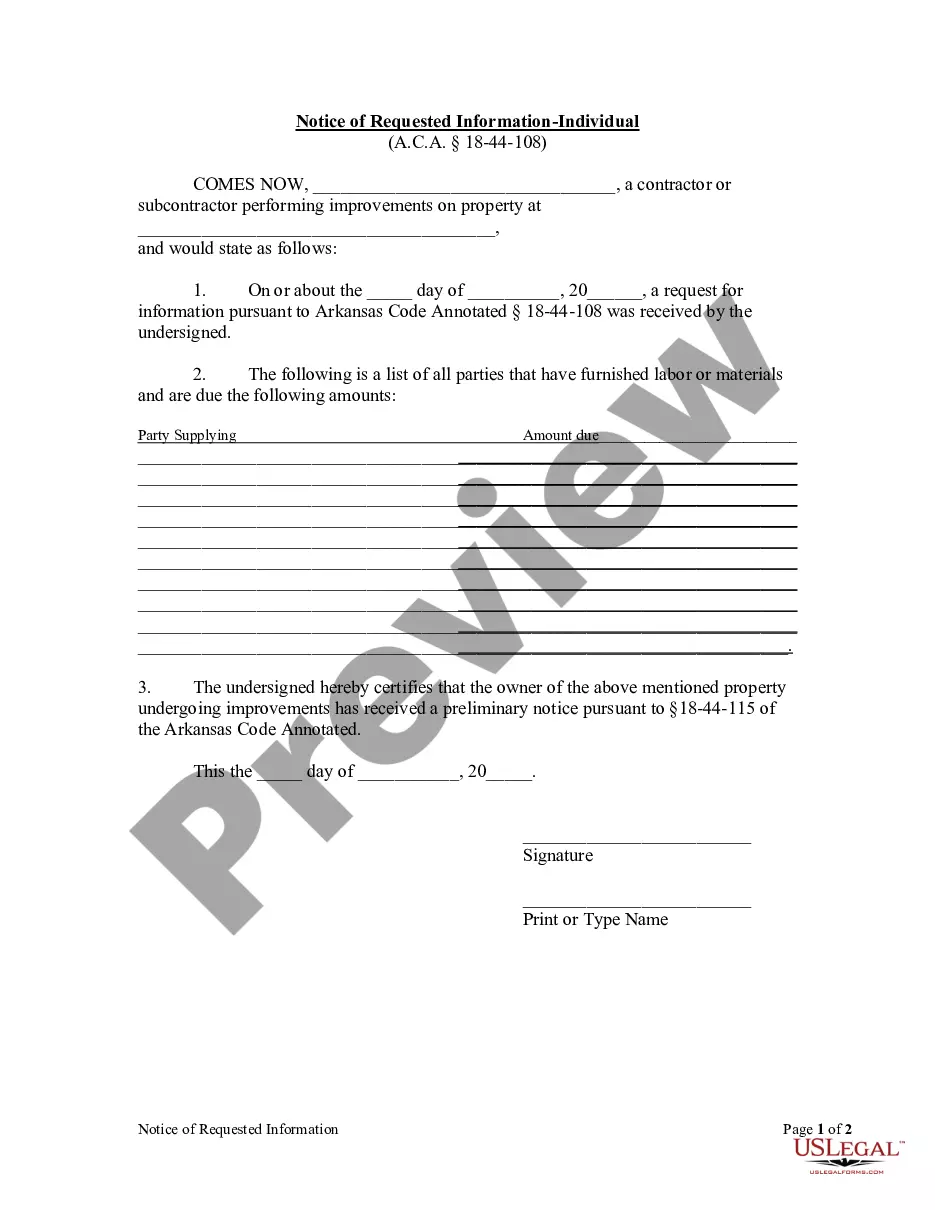

How to fill out San Jose California Stock Appreciation Rights Plan Of The Todd-AO Corporation?

Draftwing forms, like San Jose Stock Appreciation Rights Plan of The Todd-AO Corporation, to manage your legal matters is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for different scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Jose Stock Appreciation Rights Plan of The Todd-AO Corporation form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before downloading San Jose Stock Appreciation Rights Plan of The Todd-AO Corporation:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the San Jose Stock Appreciation Rights Plan of The Todd-AO Corporation isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

The production was the only musical directed by Fred Zinnemann. Oklahoma! was the first feature film photographed in the Todd-AO 70 mm widescreen process (and was simultaneously filmed in CinemaScope 35mm)....Oklahoma! (1955 film) Oklahoma The Corn StateRunning time145 minutesCountryUnited StatesLanguageEnglishBudget$6.8 million13 more rows

Todd-AO IndustryPost-production, broadcast media, motion pictures, televisionFounded1953HeadquartersHollywood, California, United StatesOwnerTodd SoundeluxWebsitewww.todd-ao.com1 more row

Todd-AO is the perfected film process that give you - the audience - a sense of participation in the action, the feeling of presence in every scene.

While CinemaScope, already in use since 1953, used standard 35-millimeter cameras equipped with a special anamorphic lens, Todd-AO required an entirely new set of special 70mm cameras and projectors.

In the Todd-AO version, the titles appear against a black background; then, the black background fades out to reveal two rows of giant cornstalks, through which the camera tracks, until it finds Gordon MacRae singing "Oh, What a Beautiful Mornin".