The King's New York Stock Option Plan is an employee benefit program offered by National Penn Ranchers, Inc. This plan is designed to incentivize and reward key employees of the company by providing them with the opportunity to purchase company stock at a predetermined price. The plan aims to align the interests of employees with those of the company and its shareholders, ultimately driving growth and enhancing shareholder value. Under the Kings New York Stock Option Plan, eligible employees are granted the right to purchase a specific number of shares of National Penn Ranchers, Inc. stock at a specified exercise price. These options typically have a predetermined vesting schedule, which means that employees must wait for a certain period of time before they can exercise their options and acquire the company stock. The options granted under the plan are usually subject to certain conditions, including continued employment or achievement of performance targets. This ensures that the plan remains effective in rewarding and retaining talented individuals who contribute to the company's success. The Kings New York Stock Option Plan may have different types, depending on the specific terms and features of each grant. Some common variations may include: 1. Non-Qualified Stock Options (Nests): These options do not qualify for special tax treatment and are typically granted to executives and other higher-level employees. Nests offer flexibility in terms of exercise price and exercise timing. 2. Incentive Stock Options (SOS): SOS are granted to employees and qualify for preferential tax treatment. To be eligible for SOS, employees must meet specific criteria as set by the Internal Revenue Service (IRS). SOS often come with a lower exercise price and can provide potential tax advantages to the employees upon exercise and sale of the acquired stock. 3. Restricted Stock Units (RSS): This type of equity grant represents a promise to deliver company stock to employees at a future date, based on specific vesting conditions. RSS do not involve an exercise price, but rather the employees receive the shares outright after satisfying the vesting requirements. 4. Performance-Based Stock Options: These options are granted based on the achievement of certain performance goals or targets set by the company. Such targets may include financial objectives, market share growth, or other predetermined metrics. Performance-based stock options provide an additional incentive for employees to contribute to the company's success in meeting specific objectives. It's important to note that the specific terms and details of the Kings New York Stock Option Plan of National Penn Ranchers, Inc. may vary, and employees should carefully review the plan documents and consult with a financial advisor or tax professional for a comprehensive understanding of their stock option benefits.

Kings New York Stock Option Plan of National Penn Bancshares, Inc.

Description

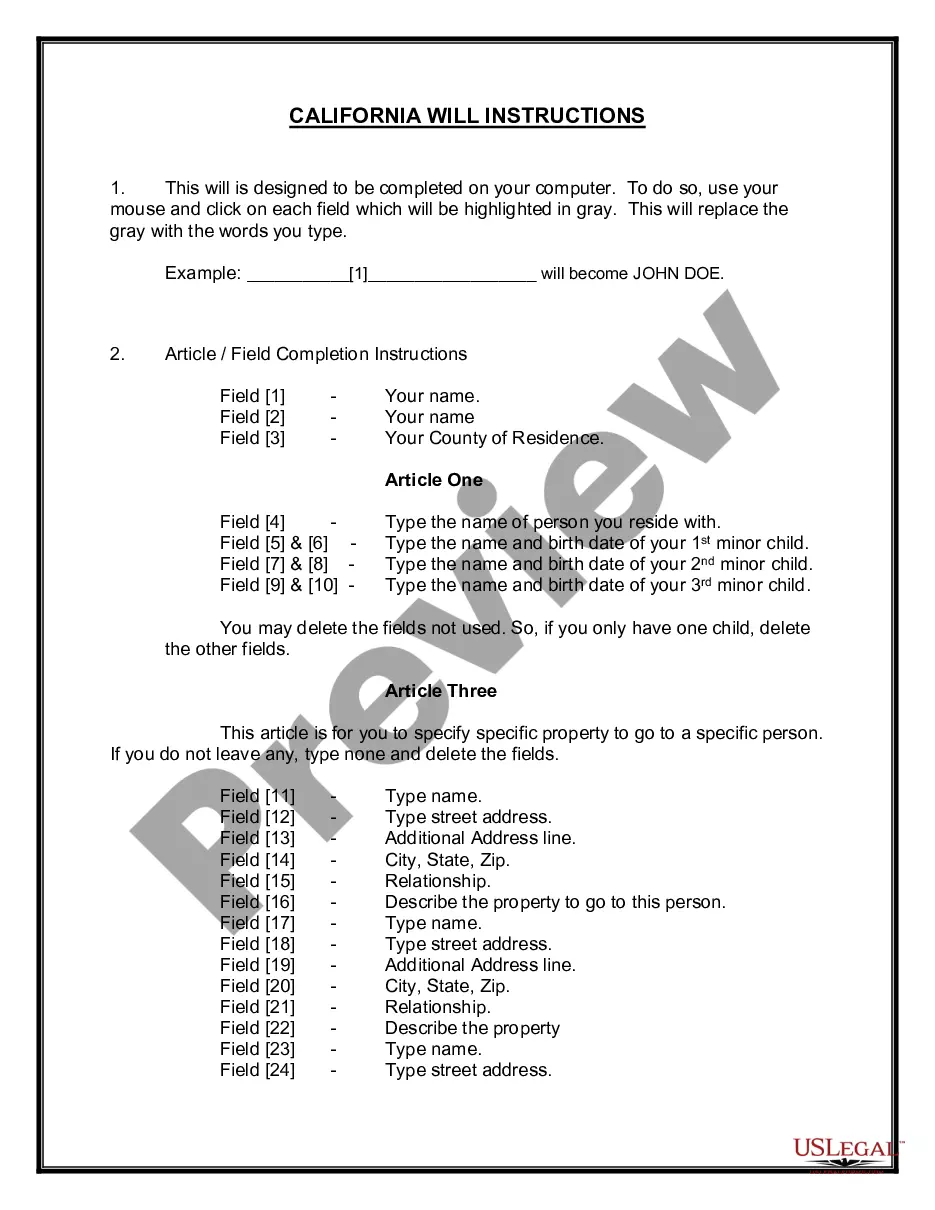

How to fill out Kings New York Stock Option Plan Of National Penn Bancshares, Inc.?

If you need to find a reliable legal paperwork provider to find the Kings Stock Option Plan of National Penn Bancshares, Inc., look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to get and execute various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Kings Stock Option Plan of National Penn Bancshares, Inc., either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Kings Stock Option Plan of National Penn Bancshares, Inc. template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first company, organize your advance care planning, create a real estate agreement, or execute the Kings Stock Option Plan of National Penn Bancshares, Inc. - all from the comfort of your home.

Join US Legal Forms now!