Palm Beach Florida Stock Option Plan of National Penn Bancshares, Inc.

Description

How to fill out Palm Beach Florida Stock Option Plan Of National Penn Bancshares, Inc.?

Preparing papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Palm Beach Stock Option Plan of National Penn Bancshares, Inc. without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Palm Beach Stock Option Plan of National Penn Bancshares, Inc. by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Palm Beach Stock Option Plan of National Penn Bancshares, Inc.:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value.

What is ESOP? Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

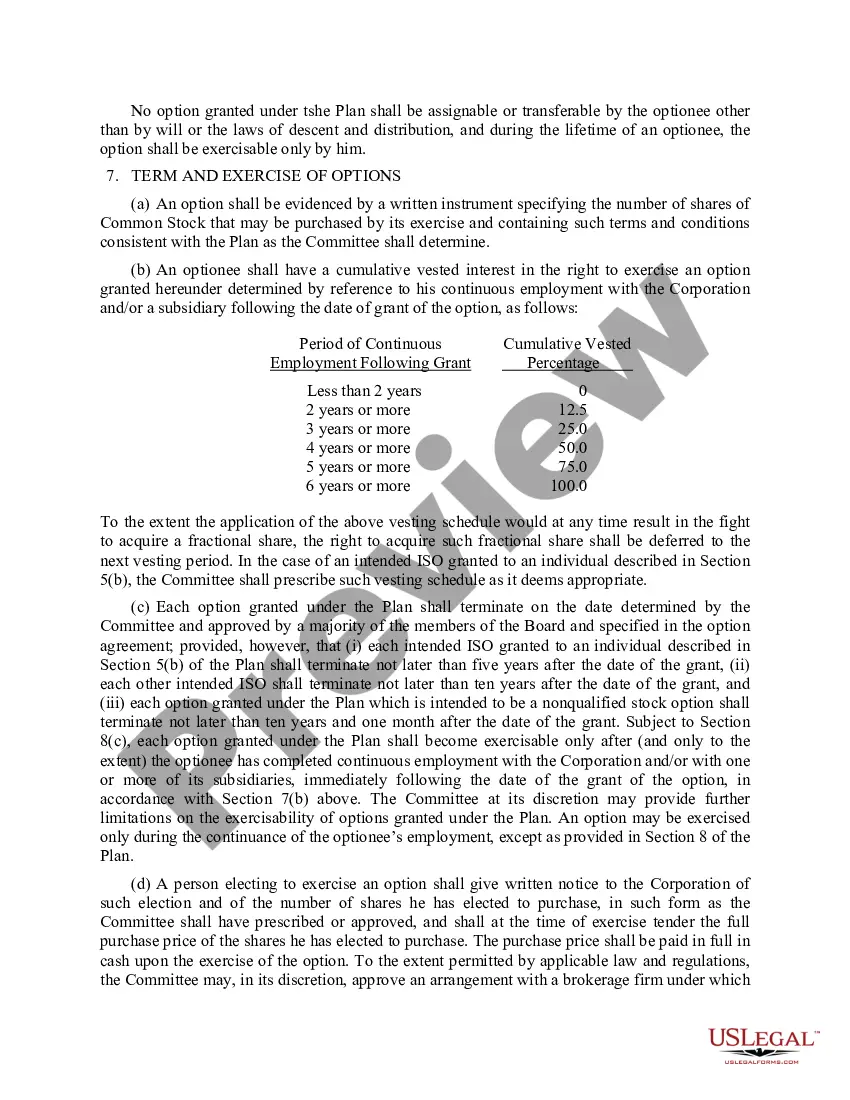

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

An employee stock option is a plan that means you have the option to buy shares of the company's stock at a certain price for a given period of time. In doing so, it could increase how much money you bring in from your job.

ESOPs offer serious tax and investment benefits. Since ESOPs are tax-exempt trusts, profits earned by the company stay with the employees ? and that's only the beginning. An S-corporation that is 100% employee-owned doesn't pay taxes, which instantly translates to higher profit.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Are ESPPs good investments? These plans can be great investments if used correctly. Purchasing stock at a discount is certainly a valuable tool for accumulating wealth, but comes with investment risks you should consider. An ESPP plan with a 15% discount effectively yields an immediate 17.6% return on investment.

Interesting Questions

More info

National City Bank's name had been changed to PNC Bank on Monday, April 18th, 2009. The merger is complete, and all accounts are subject to the new name. This page is archived. Please visit for additional information. We apologize for the inconvenience, but the following information is in effect. As always, we welcome your suggestions. The Bank of America® ATM network provides banking services for a selection of financial institutions. All banks and savings accounts are subject to the Bank of America Corporation's own terms and conditions of service; these are available on any bank's website. Bank of America® is a unit of the Bank of America Corporation. Bank of America is responsible for the management, investment, credit, insurance and other activities and liabilities of Bank of America Financial Services (Boats), its deposit insurance company. BFA also manages the investment and other businesses of BFA Capital Management, LLC.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.