Allegheny Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc. is a compensation program offered to employees of ASA Holdings, Inc., a prominent company based in Allegheny, Pennsylvania. This plan provides employees with the opportunity to purchase company shares at a predetermined price, regardless of the current market value. The Allegheny Pennsylvania Nonqualified Stock Option Plan is designed to reward employees for their contribution to the company's growth and success. By granting stock options, ASA Holdings, Inc. aims to create a sense of ownership and motivate employees to work towards the company's long-term objectives. These stock options are nonqualified, meaning they do not meet certain requirements for favorable tax treatment, unlike incentive stock options. One of the key benefits of the Allegheny Pennsylvania Nonqualified Stock Option Plan is that employees have the flexibility to exercise their options at any time during a specified vesting period. This allows them to take advantage of potential increases in the company's stock price. The plan offers employees different types of stock options, specifically: 1. Employee Stock Option Grant: This is the most common type of nonqualified stock option granted to employees. It gives employees the right to purchase a specific number of company shares at a predetermined price within a specified time frame. 2. Director Stock Option Grant: This type of nonqualified stock option is specifically granted to members of the company's board of directors. It serves as an incentive to attract skilled and experienced individuals to contribute their expertise to the company. 3. Executive Stock Option Grant: Executives and high-ranking officials within ASA Holdings, Inc. are eligible for this type of stock option grant. These options often have higher strike prices and extended vesting periods to align with the executive's long-term commitment to the company's growth. 4. Stock Appreciation Right: In addition to stock options, the Allegheny Pennsylvania Nonqualified Stock Option Plan may also offer stock appreciation rights. With these rights, employees are entitled to receive the appreciation in the value of a specified number of company shares, without actually purchasing the shares. ASA Holdings, Inc.'s Allegheny Pennsylvania Nonqualified Stock Option Plan aims to align the interests of employees with the success of the company. By granting stock options, ASA Holdings, Inc. provides employees with a valuable incentive to contribute to the company's growth and overall success, while also fostering long-term loyalty and commitment.

Allegheny Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc.

Description

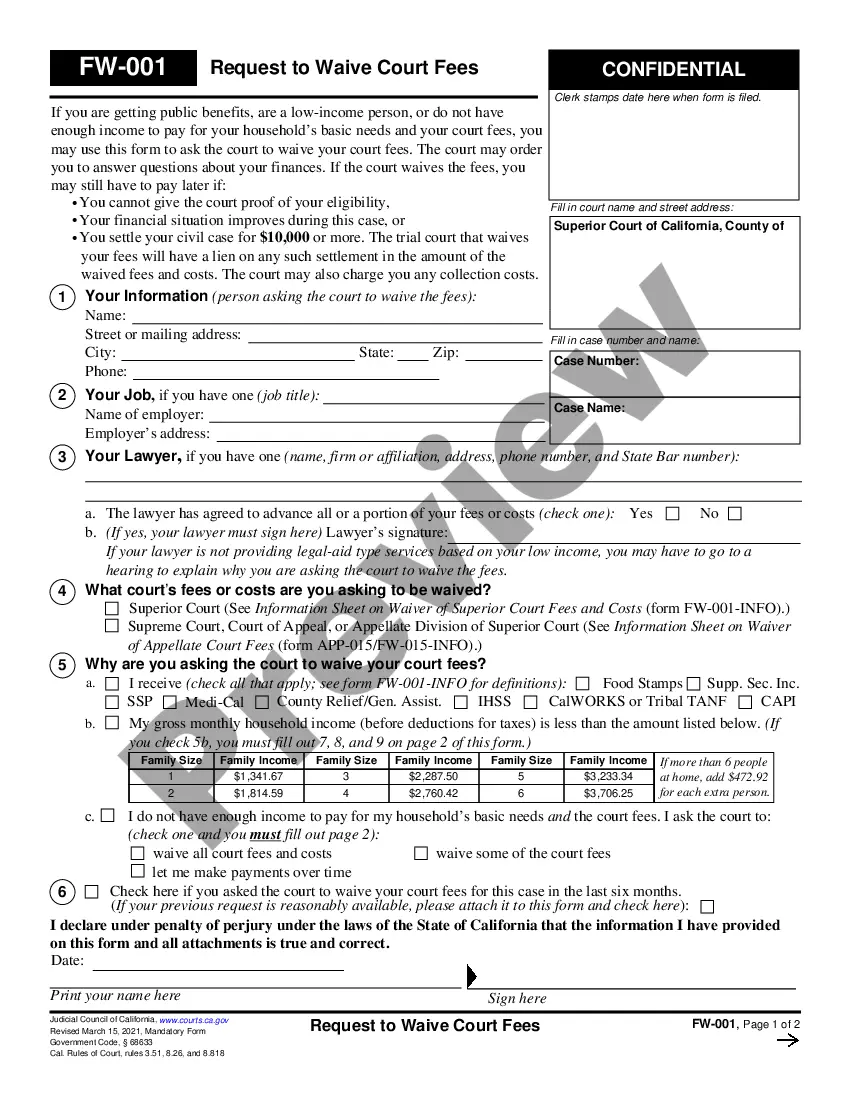

How to fill out Allegheny Pennsylvania Nonqualified Stock Option Plan Of ASA Holdings, Inc.?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Allegheny Nonqualified Stock Option Plan of ASA Holdings, Inc. is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to obtain the Allegheny Nonqualified Stock Option Plan of ASA Holdings, Inc.. Adhere to the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Nonqualified Stock Option Plan of ASA Holdings, Inc. in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Key Takeaways. Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

However you call them, there are two main differences between them. First, NSOs can be granted not only to employees but also to outside service providers, such as advisors, board directors or other consultants. ISOs can be issued to employees only.

Non-qualified stock options may be sold at any market price, either higher or lower than the grant price. While non-qualified stock options carry less favorable tax treatment for the holder than qualified stock options, they offer other benefits.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

Once you exercise your non-qualified stock option, the difference between the stock price and the strike price is taxed as ordinary income. This income is usually reported on your paystub. There are no tax consequences when you first receive your non-qualified stock option, only when you exercise your option.

There are two key differences who the stock can be issued to and the tax treatment. Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

A nonqualified stock option, also known as an NSO, is a form of employee compensation offered by employers wherein the option holder pays ordinary income tax on the profit made when they exercise the shares.