The Chicago Illinois Nonqualified Stock Option Plan offered by ASA Holdings, Inc. is a comprehensive employee benefit program designed to incentivize and reward employees through the granting of stock options. These stock options are a form of compensation that grant employees the right to purchase company stock at a predetermined price within a specified period. Under this plan, employees who receive nonqualified stock options have the opportunity to purchase company stock at a discounted price, known as the exercise price. The exercise price is typically set at a price lower than the market value of the stock at the time of grant, offering employees the potential for financial gain if the stock price increases over time. The Chicago Illinois Nonqualified Stock Option Plan operates within the legal framework established by the state of Illinois and the Internal Revenue Service (IRS). The plan is designed for employees who are not considered highly compensated or key employees, under the regulations set forth by the IRS. While there may not be different types of the Chicago Illinois Nonqualified Stock Option Plan offered by ASA Holdings, Inc., the plan may include additional features or provisions based on the company's specific policies and objectives. These could include: 1. Vesting Schedule: The plan may include a vesting schedule, which determines when employees are eligible to exercise their stock options. Vesting schedules can be time-based, where employees become vested in a certain percentage of their options over a period of time, or performance-based, where vesting is contingent upon achieving specified targets or goals. 2. Exercise Period: The plan will outline the exercise period during which employees can exercise their stock options. This period typically starts after the options have vested and may extend for a predetermined period, such as five or ten years, providing employees with ample time to exercise their options. 3. Tax Implications: The plan will clearly explain the tax implications associated with exercising stock options. Nonqualified stock options, unlike incentive stock options (SOS), are generally subject to ordinary income tax rates upon exercise. Employees should consult with a tax advisor to understand the tax consequences and potential strategies for optimizing their tax liabilities. 4. Transferability: The plan may specify whether stock options can be transferred to family members, charitable organizations, or other third parties. In some cases, the plan may restrict transferability entirely, limiting the options to the employee only. Overall, the Chicago Illinois Nonqualified Stock Option Plan of ASA Holdings, Inc. serves as a powerful tool to attract and retain talented employees by offering them the potential for ownership in the company. It aligns the interests of the employees with the long-term success of ASA Holdings, Inc., fostering a sense of commitment, loyalty, and motivation within the workforce.

Chicago Illinois Nonqualified Stock Option Plan of ASA Holdings, Inc.

Description

How to fill out Chicago Illinois Nonqualified Stock Option Plan Of ASA Holdings, Inc.?

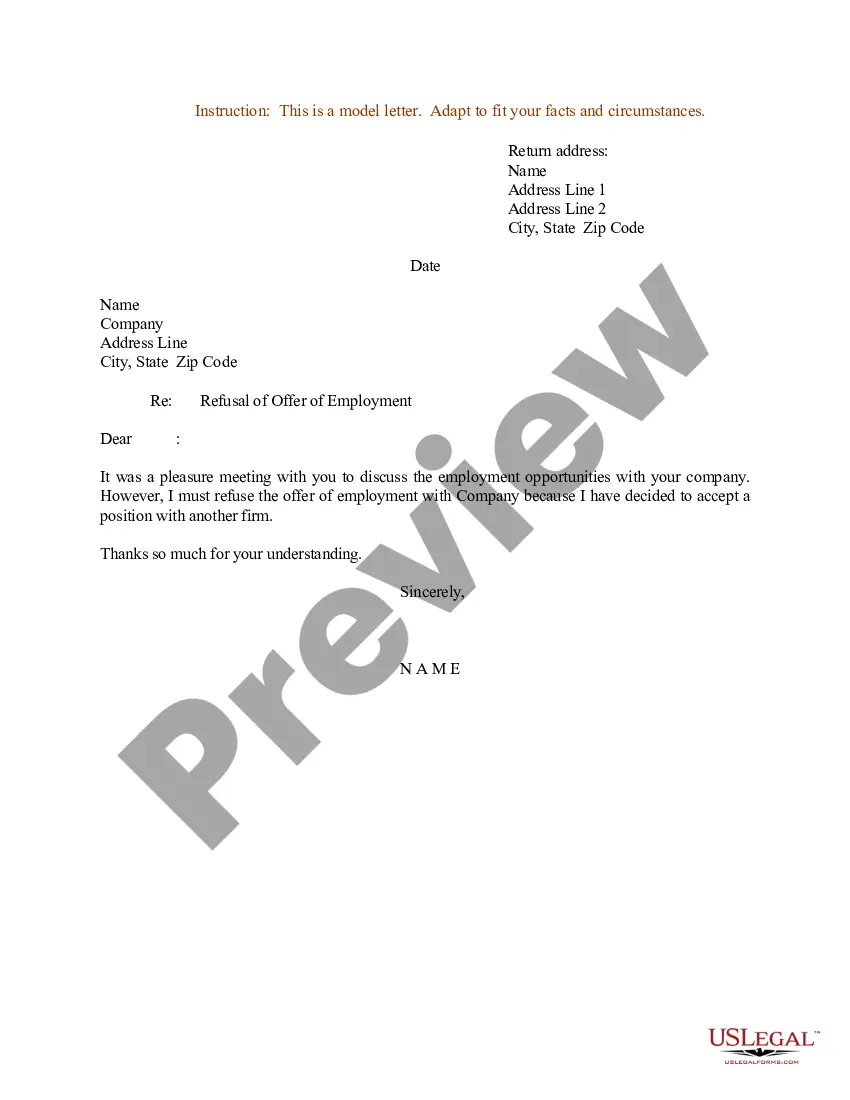

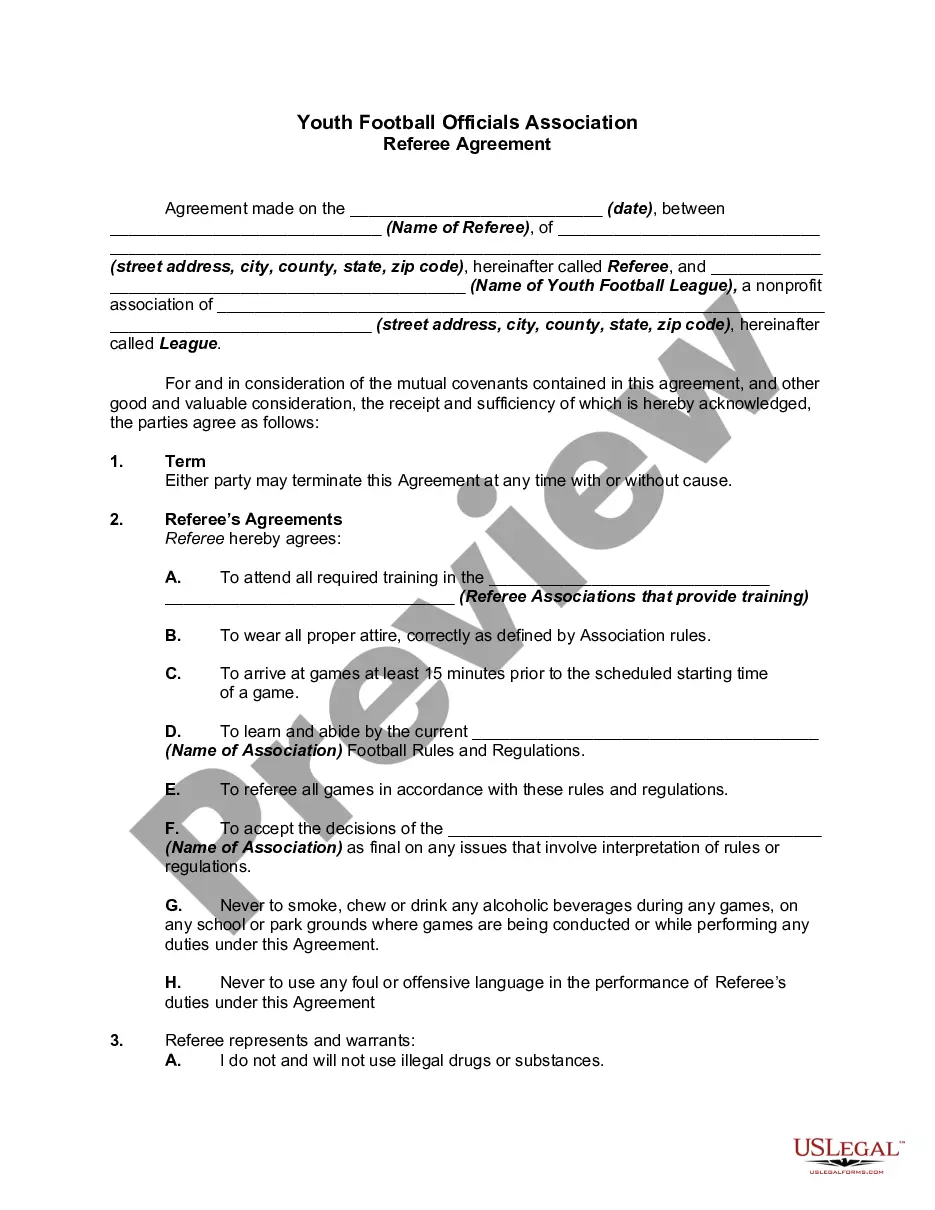

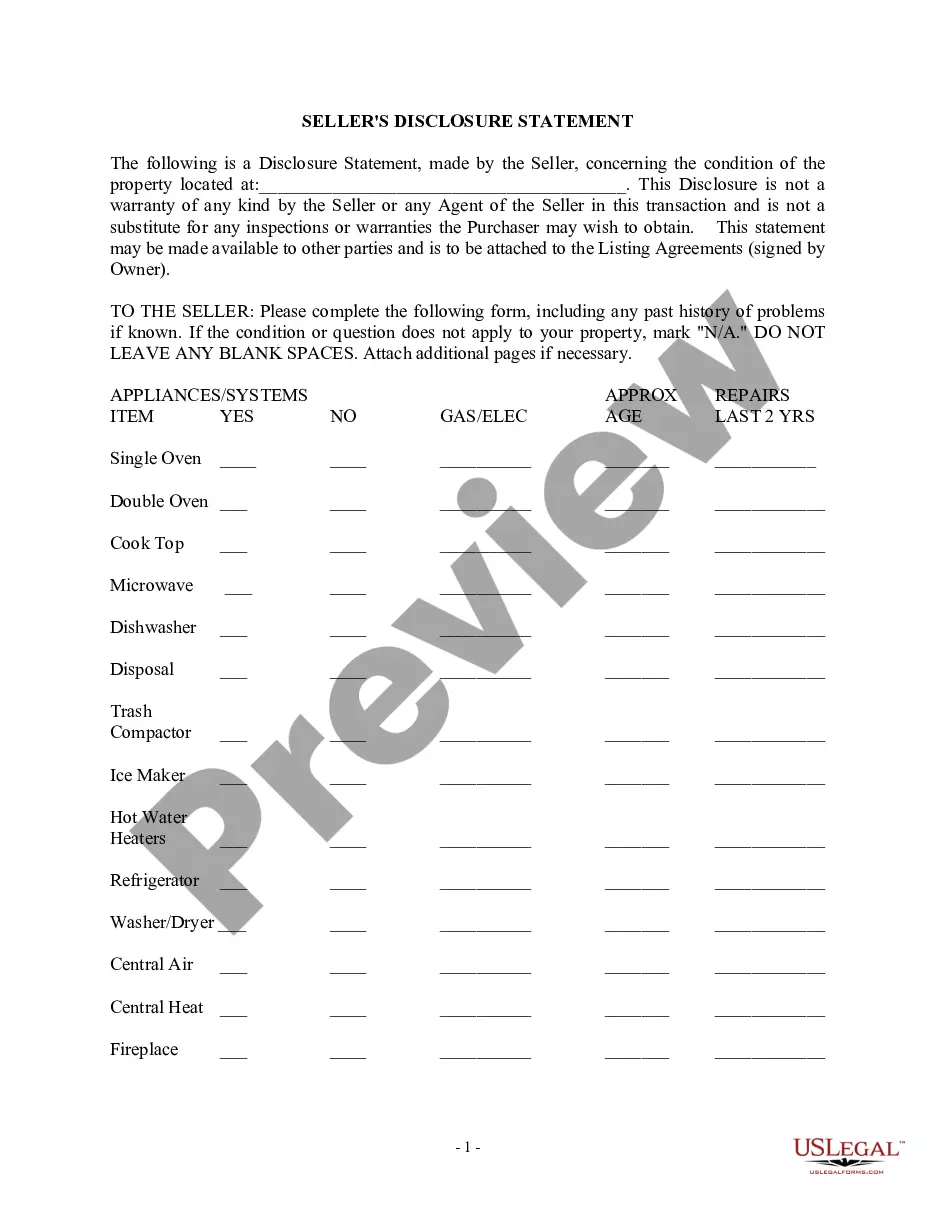

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Chicago Nonqualified Stock Option Plan of ASA Holdings, Inc..

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Chicago Nonqualified Stock Option Plan of ASA Holdings, Inc. will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Chicago Nonqualified Stock Option Plan of ASA Holdings, Inc.:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Chicago Nonqualified Stock Option Plan of ASA Holdings, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!