Intercargo Corp. is a renowned company based in Palm Beach, Florida, offering its employees the opportunity to participate in their comprehensive Nonqualified and Incentive Stock Option Plan. This Plan serves as a valuable tool for employee retention and incentivization, allowing eligible individuals to acquire company stock at a predetermined price. The Palm Beach Florida Nonqualified and Incentive Stock Option Plan is designed to provide flexibility and benefits to employees as part of their overall compensation package. It is a highly attractive feature for employees seeking long-term growth potential and financial rewards. Participants in this Plan gain the advantage of purchasing company stock, which can potentially appreciate in value over time. The Nonqualified Stock Option Plan grants employees the right to purchase a set number of company shares at a specific price, commonly referred to as the "strike price." This option usually has no tax advantages and is typically available to employees regardless of their position or level within the organization. The Nonqualified Stock Option Plan caters to a broad range of employees, providing them an opportunity to own a stake in the company's success. On the other hand, the Incentive Stock Option Plan is typically offered to key employees, executives, and management personnel, providing more favorable tax treatment compared to the Nonqualified Stock Option Plan. Incentive stock options are subject to specific criteria, such as a maximum value limit and a requirement for the employee to hold the purchased shares for a specified holding period. Intercargo Corp.'s Palm Beach Florida Nonqualified and Incentive Stock Option Plan is a valuable component of their employee compensation strategy. It aims to attract top talent, motivate and retain existing employees, and align their interests with the long-term success of the company. By offering these stock options, the company signifies its commitment to rewarding outstanding performance and fostering a culture of shared ownership.

Palm Beach Florida Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

How to fill out Palm Beach Florida Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

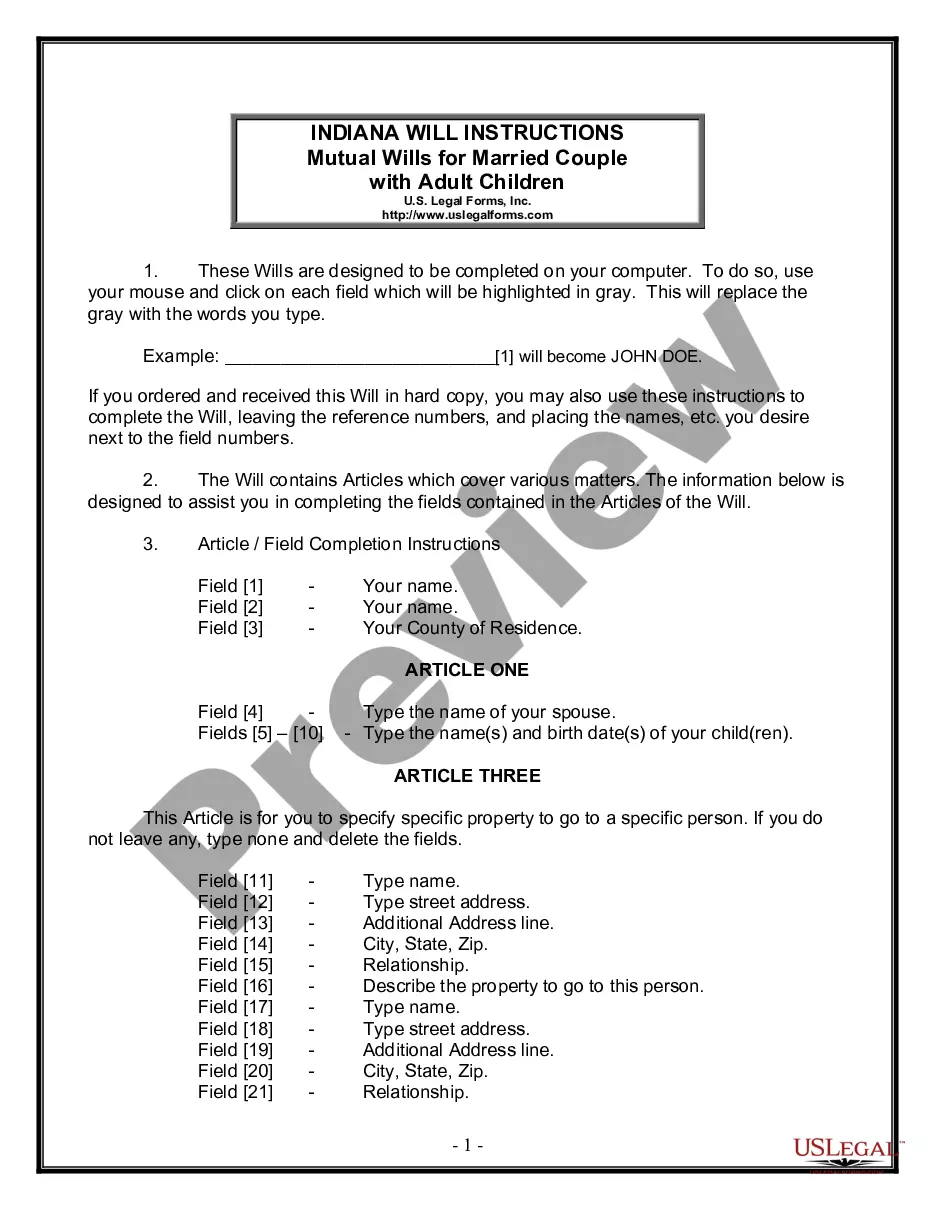

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to create some of them from the ground up, including Palm Beach Nonqualified and Incentive Stock Option Plan of Intercargo Corp., with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with document completion simple.

Here's how you can locate and download Palm Beach Nonqualified and Incentive Stock Option Plan of Intercargo Corp..

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some records.

- Check the similar forms or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Palm Beach Nonqualified and Incentive Stock Option Plan of Intercargo Corp..

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Palm Beach Nonqualified and Incentive Stock Option Plan of Intercargo Corp., log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to cope with an extremely complicated situation, we recommend using the services of a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

What are non-qualified stock options? Non-qualified stock options are stock options that do not receive favorable tax treatment when exercised but do provide additional flexibility for the issuing company. Gains from non-qualified stock options are taxed as normal income.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Non-qualified stock options (NSOs) are taxed as ordinary income. Generally, ISO stock is awarded only to top management and highly-valued employees. ISOs also are called statutory or qualified stock options.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Your employer is not required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.

A qualified stock option is a type of company share option granted exclusively to employees. It confers an income tax benefit when exercised. Qualified stock options are also referred to as 'incentive stock options' or 'incentive share options. '

Tax Treatment of Non-Qualified Stock Options Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Incentive stock options are statutory (qualified) and differ from nonstatutory (nonqualified) stock options, or NSOs, in a few key ways: Eligibility. ISOs are issued only to employees, whereas NSOs can be granted to outside service providers like advisors, board directors or other consultants.

What is the difference between incentive stock options and non-qualified stock options? Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs.

What is the difference between incentive stock options and non-qualified stock options? Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs.