Travis Texas Nonqualified and Incentive Stock Option Plan of Intercargo Corp. is an employee benefit program that provides eligible employees of Intercargo Corp., a leading company in the transportation industry, with the opportunity to acquire company stock options. These options offer valuable financial incentives and are designed to recognize and reward exceptional employee performance. The Travis Texas Nonqualified and Incentive Stock Option Plan offer two distinct types of stock options: 1. Nonqualified Stock Options (Nests): The Nonqualified Stock Option Plan allows eligible employees to purchase company stocks at a predetermined price, referred to as the exercise price. These options provide employees with flexibility, as they can be exercised at any time within a specified timeframe. Nests are typically subject to income tax upon exercise, allowing employees to benefit from potential stock price appreciation. 2. Incentive Stock Options (SOS): The Incentive Stock Option Plan provides eligible employees with stock options that offer certain tax advantages. Under this plan, employees have the opportunity to purchase company stock at a predetermined price, known as the strike price. SOS are subject to specific guidelines and must comply with various regulatory requirements. If the employee meets certain holding requirements, the gains from the exercise of SOS may be treated as long-term capital gains instead of ordinary income upon sale. Intercargo Corp.'s Travis Texas Nonqualified and Incentive Stock Option Plan aims to align the interests of employees with the growth and success of the company. By providing stock options, Intercargo Corp. encourages employees to contribute to the company's long-term goals, foster a sense of ownership, and incentivize them to perform at their best. Participation in the Travis Texas Nonqualified and Incentive Stock Option Plan is typically based on factors such as job level, performance, and tenure with the company. Eligible employees receive detailed information regarding the terms and conditions of the plan, including the vesting schedule and exercise periods. It is important for employees to carefully evaluate their financial objectives, tax implications, and potential risks when considering the exercise of stock options under the Travis Texas Nonqualified and Incentive Stock Option Plan. Seeking advice from financial and tax professionals can help employees make informed decisions aligned with their individual circumstances. Overall, the Travis Texas Nonqualified and Incentive Stock Option Plan of Intercargo Corp. provides valuable opportunities for eligible employees to accumulate and benefit from the growth of Intercargo Corp.'s stock, enhancing their financial well-being and fostering a sense of ownership in the company's success.

Travis Texas Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

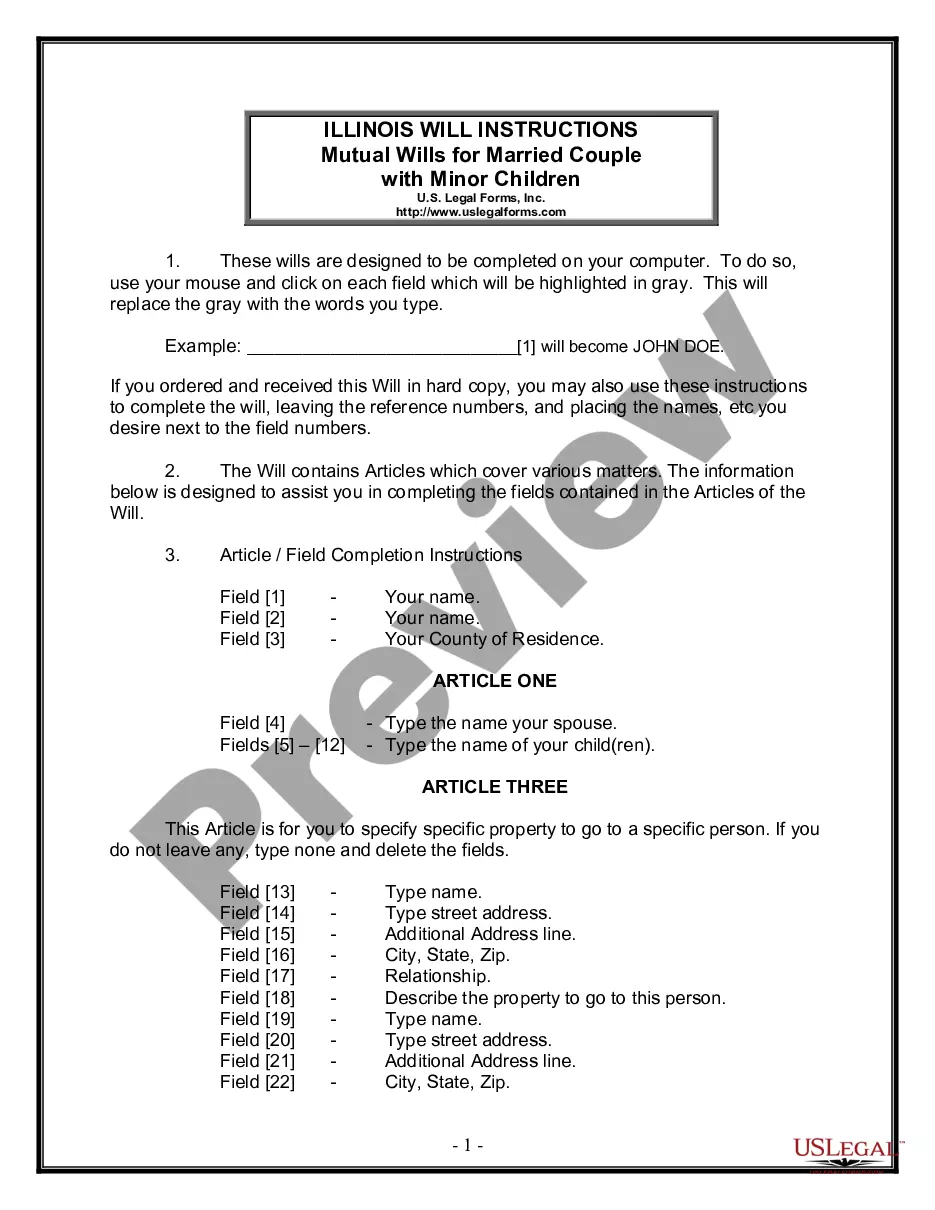

How to fill out Travis Texas Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Travis Nonqualified and Incentive Stock Option Plan of Intercargo Corp..

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Travis Nonqualified and Incentive Stock Option Plan of Intercargo Corp. will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Travis Nonqualified and Incentive Stock Option Plan of Intercargo Corp.:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Travis Nonqualified and Incentive Stock Option Plan of Intercargo Corp. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Incentive stock options (ISOs), are a type of employee stock option that can be granted only to employees and confer a U.S. tax benefit. ISOs are also sometimes referred to as statutory stock options by the IRS. ISOs have a strike price, which is the price a holder must pay to purchase one share of the stock.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

The core elements of an Employee Stock Option Plan include: Definitions, Option Commitment Certificate, Grant of Options, Conditions of Options, Vesting, and Exercise of Option, Termination of Participation, Payment.

There are two key types of employee stock options: incentive stock options, or ISOs, and nonqualified stock options, called NSOs. That distinction has a big impact on the tax treatment, which in turn may affect the strategy you employ with the options.

Stock acquired from exercising a non-qualified stock option is treated as any other investment property when sold. The employee's basis is the amount paid for the stock, plus any amount included in income upon exercising the option.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.

When you exercise Incentive Stock Options, you buy the stock at a pre-established price, which could be well below actual market value. The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option.

Incentive stock options are one type of deferred compensation used to motivate and retain key employees. Since you need to hold on to your ISOs for a period of time, the only way to capitalize on these benefits is to stay with your firm for the long haul.

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.