Title: Cook Illinois Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. Keywords: Cook Illinois, Approval, Employee Stock Purchase Plan, The American Annuity Group, Inc. Introduction: The Cook Illinois Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. signifies a significant milestone in the company's commitment to fostering employee participation and ownership. This detailed description will provide an overview of the employee stock purchase plan, emphasizing the benefits and types available. 1. Comprehensive Employee Stock Purchase Plan: The Cook Illinois Approval of Employee Stock Purchase Plan allows employees of The American Annuity Group, Inc. to purchase company stock at a discounted price, providing them with an opportunity to invest in their future and align their interests with the company's success. This all-encompassing plan encourages employees to become shareholders and reap the rewards of the company's growth. 2. Stock Purchase Options: a) Traditional Stock Purchase Plan: Under this plan, employees are given the option to buy company stocks at a discounted rate (usually below the market price) through regular payroll deductions. These contributions accumulate over a defined period and are then used to purchase the stocks at a predetermined date. b) Qualified Stock Purchase Plan: This plan enables eligible employees to purchase shares at a discounted rate. However, unlike the Traditional Stock Purchase Plan, there are specific tax advantages associated with owning the shares for a qualifying period. This program encourages long-term investment and loyalty among employees. 3. Advantages of the Employee Stock Purchase Plan: a) Financial Benefits: By participating in the Cook Illinois Approved Employee Stock Purchase Plan, employees gain the potential for financial growth through capital appreciation as the company performs well. Furthermore, the discounted stock purchase provides an immediate advantage, allowing employees to acquire more shares for their investment. b) Employee Ownership: The stock purchase plan allows employees to become owners of the company, fostering a sense of ownership and pride in their work. This, in turn, leads to heightened employee engagement, productivity, and loyalty towards The American Annuity Group, Inc. c) Tax Benefits: Some Employee Stock Purchase Plans offer tax advantages, such as Qualifying Dispositions or favorable capital gains treatment. Employees should consult tax professionals for further details on specific tax benefits. Conclusion: The Cook Illinois Approval of Employee Stock Purchase Plan highlights The American Annuity Group, Inc.'s commitment to providing its employees with an opportunity to invest in the company's success and share in its growth. The plan offers multiple stock purchase options, providing employees with flexibility, financial benefits, and the chance to become stakeholders in the company's future. By fostering employee ownership, The American Annuity Group, Inc. sets a positive precedent for employee engagement and long-term loyalty.

Cook Illinois Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

How to fill out Cook Illinois Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

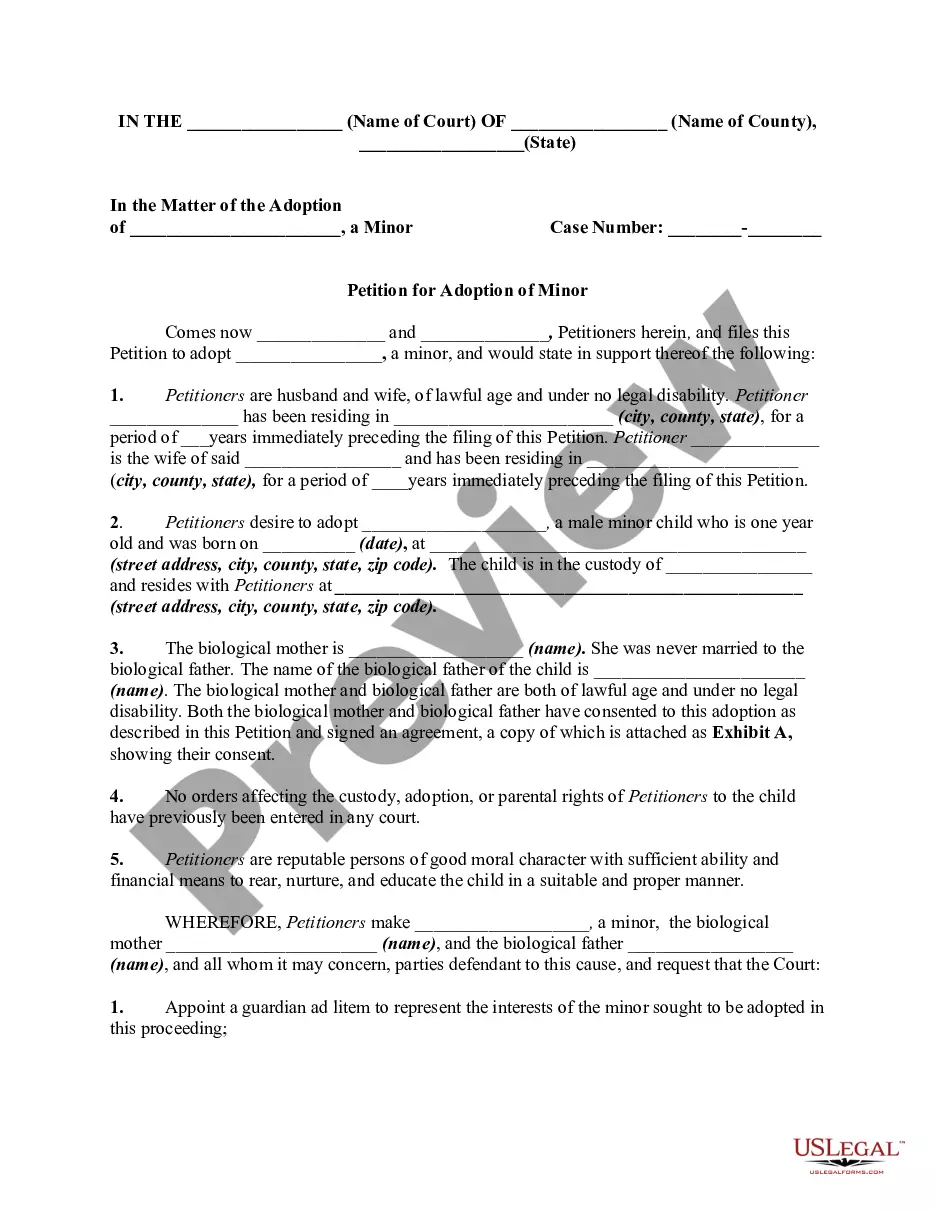

Preparing legal documentation can be burdensome. In addition, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Cook Approval of employee stock purchase plan for The American Annuity Group, Inc., it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the latest version of the Cook Approval of employee stock purchase plan for The American Annuity Group, Inc., you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Approval of employee stock purchase plan for The American Annuity Group, Inc.:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Cook Approval of employee stock purchase plan for The American Annuity Group, Inc. and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

Your employer will send you Form 3922, Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c), if you purchased ESPP stock during the tax year. If you didn't sell any ESPP stock, don't enter anything from your 3922.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

An ESPP allows you to purchase company stock at a discounted price, often between 5-15% off the fair market value. For example, if the fair market value on the applicable date is $10 per share, and your plan offers a 15% discount, you can purchase those shares for $8.50 per share.

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

A. An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company's stock, usually at a discount of up to 15%.

The current Instructions for Forms 3921 and 3922. To get or to order these instructions, go to .

Shares involved in qualifying dispositions are traditionally acquired through an employee stock purchase plan (ESPP), or through an incentive stock option (ISO). ESPPs and ISOs are used by companies to attract and retain talented personnel.

With qualified Section 423 employee stock purchase plans, you are not taxed at the time the shares are purchased, only when you sell. Depending on whether the shares were held for the required holding period, a portion of your gain may be taxed as capital gains or as ordinary income.

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.