Title: Understanding Maricopa, Arizona's Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc. Introduction: Maricopa, Arizona, is a thriving city located in Pinal County, known for its Arizona State University campus, family-friendly neighborhoods, and a strong economy. This article delves into the details of the Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc., one of the leading financial institutions in the region. Description: 1. What is an Employee Stock Purchase Plan? An Employee Stock Purchase Plan (ESPN) is a powerful benefit offered by companies, allowing employees to buy company stock at a discounted price, generally through payroll deductions. The American Annuity Group, Inc., has gained approval for its ESPN in Maricopa, Arizona, ensuring additional financial incentives for its workforce. 2. Benefits of an ESPN: The American Annuity Group, Inc.'s ESPN provides several advantages for employees: — Financial Stability: Employees can invest in the company they work for, aligning their own financial goals with the organization's success. — Discounted Stock Purchase: Eligible employees can purchase company stocks at a price below the market value, enabling potential gains when the stock price appreciates. — Long-term InvestmentESPNPP encourages long-term investment strategies, fostering employee loyalty and commitment to the company's growth. — Tax Efficiency: CertaiESPNPs offer tax benefits, such as qualified or non-qualified plans, allowing employees to maximize their investment returns. 3. Maricopa, Arizona's Role: Maricopa, Arizona has played a significant role in approving The American Annuity Group, Inc.'s ESPN, supporting the city's economic growth and attracting top talent to the region. This approval reflects the city's commitment to facilitating thriving business environments and providing opportunities for financial prosperity. 4. Types of Employee Stock Purchase Plans: a) Qualified ESPN: This type of plan meets specific criteria outlined by the Internal Revenue Service (IRS), providing employees with favorable tax treatment such as potential tax-free gains. b) Non-Qualified ESPN: Non-qualified plans do not adhere to the IRS criteria, but they still offer valuable benefits to employees, such as the ability to purchase company stock at a discount. Conclusion: The Approval of Employee Stock Purchase Plan for The American Annuity Group, Inc., in Maricopa, Arizona, exemplifies the city's dedication to corporate growth and employee well-being. By providing opportunities for employees to invest in their company's success, The American Annuity Group, Inc. reinforces its commitment to building a strong, engaged workforce. As Maricopa continues to foster a supportive business environment, such initiatives will contribute to the city's overall economic prosperity.

Maricopa Arizona Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

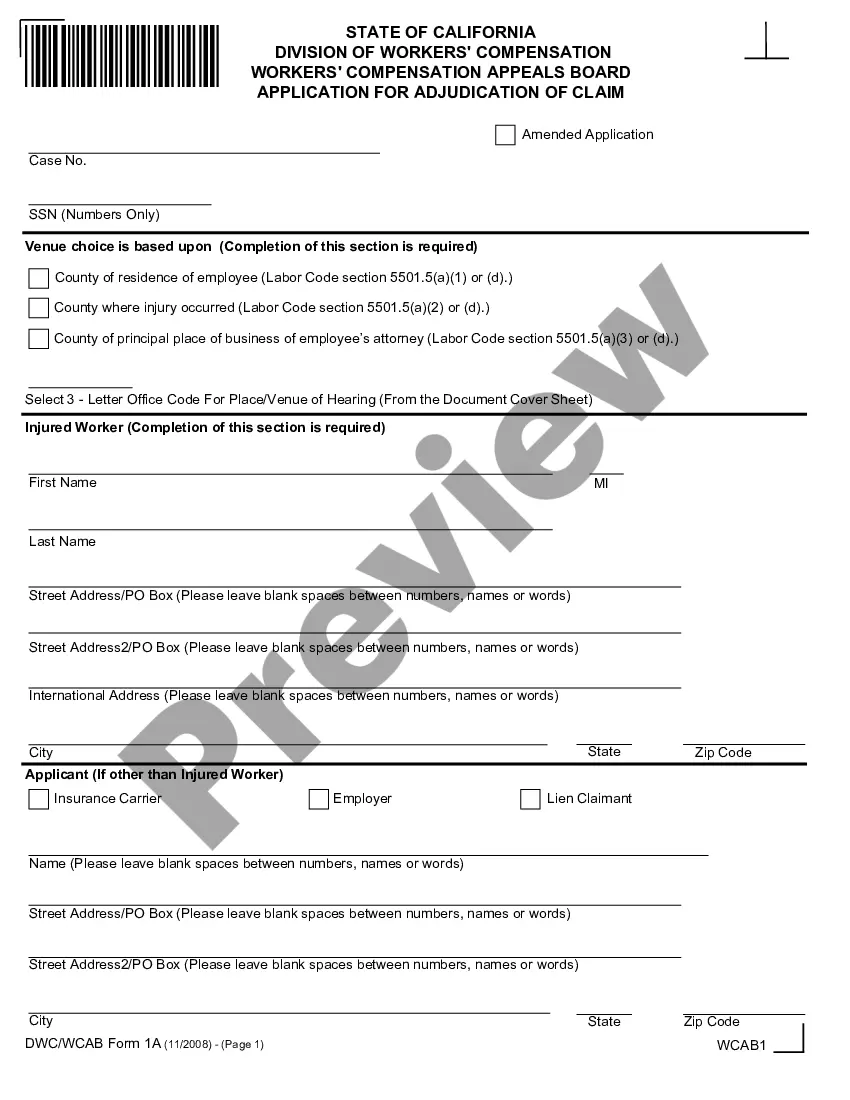

How to fill out Maricopa Arizona Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

Whether you intend to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Maricopa Approval of employee stock purchase plan for The American Annuity Group, Inc. is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Maricopa Approval of employee stock purchase plan for The American Annuity Group, Inc.. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Approval of employee stock purchase plan for The American Annuity Group, Inc. in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!